Pump-primed world economy

The recovery of risky assets from April’s severe drawdown has sent several equity markets around the world and the precious metals to continued record highs over the summer and autumn period. A fuller understanding of US tariff policy has seen the US Dollar stablise after its draw-down in the first half of the year. That weaker dollar, interest rate cuts over the last 18 months and continued stimulus from governments running wide fiscal deficits have set the conditions for further rallies in riskier assets. Our proprietary EnCor asset allocation model increased weights in those riskier assets for Q4 2025, again trimming down weights in US government bonds.

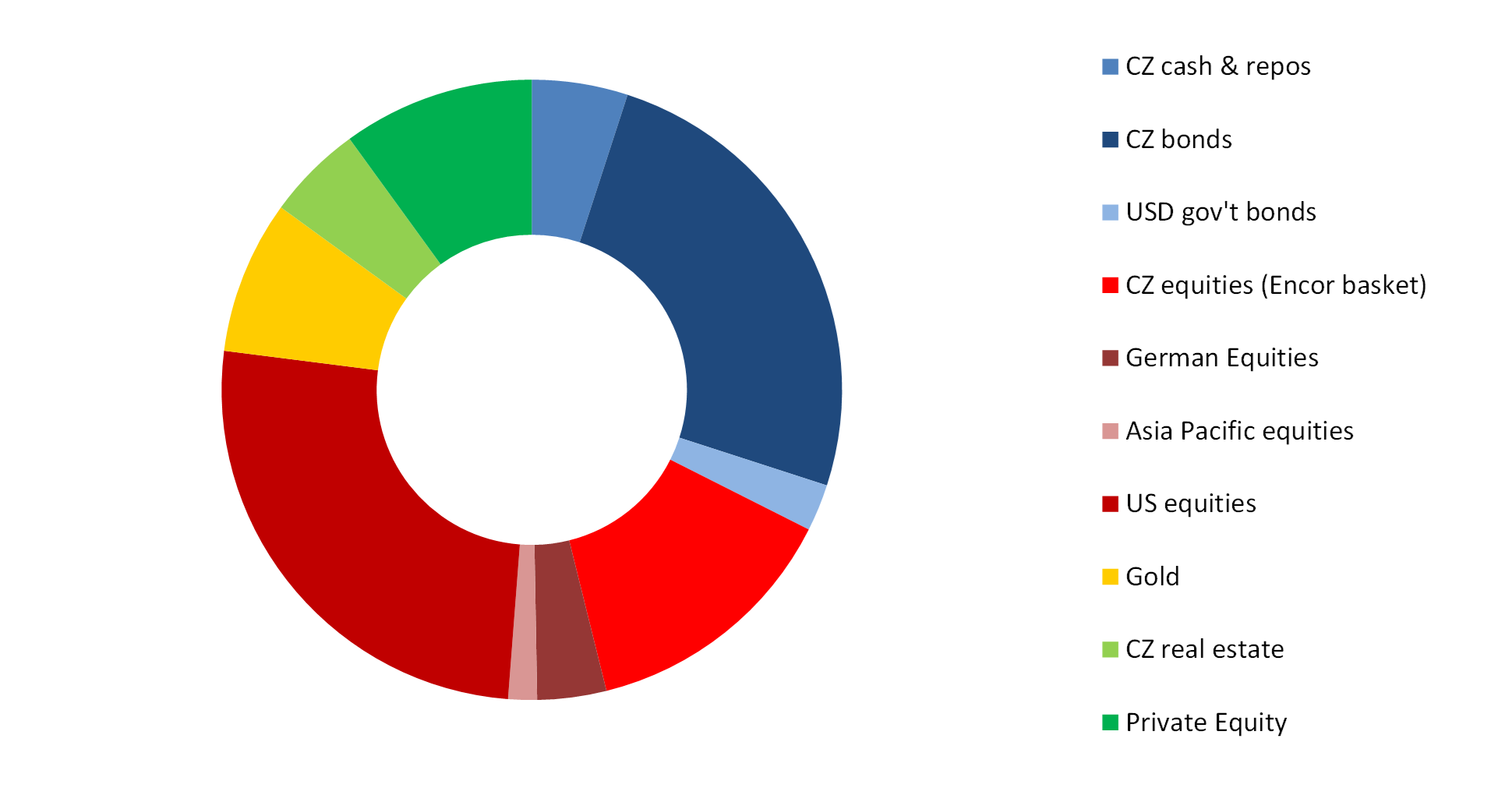

Allocation for a typical moderate risk client into Q4 2025*

Source: EnCor Wealth Management proprietary asset allocation model.

See disclosures at the bottom of this text. * Weights as of end October.

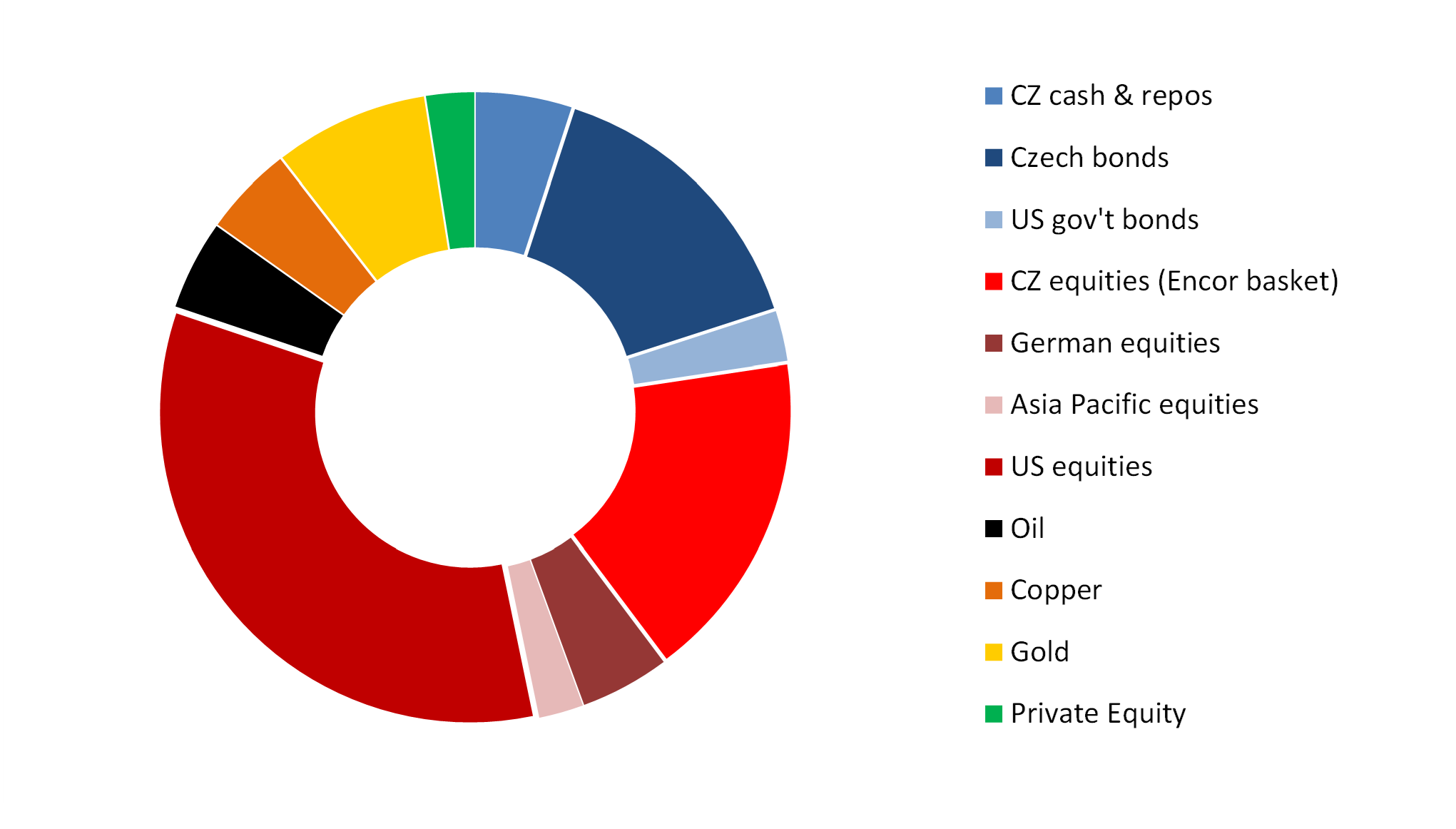

Allocation of our “Rustovy” Dynamic OPF – Q4 2025*

Source: EnCor Wealth Management proprietary asset allocation model.

See disclosures at the bottom of this text. * Weights as of end October.

The Q4 update of our asset allocation model shows positive signals on economic growth in the coming year in various geographies, as well as Central Bank liquidity indicators stabilizing. Rallies in the Australian dollar versus USD and the USD versus the Japanese Yen point also to improving market sentiment. As well as the rotation from equities to bonds, our higher-risk mandates including the EnCor “Rustovy” Dynamic OPF see fresh weightings in cyclical commodities oil and copper. These are high-conviction positions that have not featured since summer 2024 in the case of copper and mid-2022 for oil.

The other major rotation in our portfolios this quarter is towards US equities, largely out of other equity classes. US bourses make up the bulk (well over 60%) of global equity market capitalization and will be at least this proportion of our overall exposure to stock markets for this quarter. US company earnings are growing at a healthy 13% year-on-year rate, according to data provider FactSet, while the latest estimate for third quarter GDP growth from the Atlanta Fed’s GDPnow model is 4.2% year-over-year. This is a very solid earnings base for the stock market. It remains to be seen how the US government shutdown, now ended, will affect fourth-quarter output. Most economic activity in America is outside of the government sphere.

Our model signals for Q4 to reduce more defensive, higher dividend-paying Czech and global “high-quality” companies in favour of the US. In addition, we remove the out-performing positions in the US Tech (due partly to the AI theme) and US Small Cap arenas, in favour of a “plain vanilla” diversified exposure to the US S&P 500 Index. There is ample profit to be taking also in the case of the Czech market. So far in 2025, the Czech index has rallied an impressive 50%, including dividends while the total return of US equities is in fact flat overall in CZK terms this year: the strength of the Koruna versus the USD has wiped out the 14% local-terms rally in the key US bourse.

Worries over the US government shutdown and the future path in general of fiscal policy in the world’s largest economy and elsewhere, including China and France, has contributed to the very strong rally in precious metals seen in Q3 (and before). Our portfolios retain their holdings in gold for this coming quarter. There remains little sign that governments are going to rein in their spending, thus implying that Central Banks will have to accommodate increased money supply and retail investors deal with inflation: this pushes up the nominal price of precious metals denominated in fiat currencies (most obviously in US Dollars). Many Central Banks around the world remain determined to continue the medium-term build-up of their gold reserves, again wanting to diversify away from holdings of G10 fiat currencies, including the weaker Dollar.

Our asset allocation for Q4, with large weights in equities and fresh positions in cyclical commodities, reflects the probability of an accelerating global economy. Investors have moved beyond the impact of H1 2025’s US tariffs and see the resulting weaker US dollar as providing some liquidity for markets and greater scope for international economic activity. Our portfolio positions in Czech cash, Czech corporate bonds and gold, as before, provide diversification and stabilising characteristics for our clients in this environment.

Disclaimer: This article does not constitute an investment advice, or a recommendation to buy or sell a specific security. Please contact us at welcome@encorwealth.com if you would like to consult on your individual situation.

Author: Mark Robinson