The US Disrupter

Our pro-US equities stance helped the performance of our portfolios through Q4 2024 and into January 2025. At this point, coincidentally just after the Inauguration of President Trump, our proprietary asset allocation model signaled some caution. We thus cut weights in US shares significantly in the last week of January, rotating both into US-denominated government bonds and into the Czech and European bourses. In doing so, we were able to book some of the gains made in equities through 2024 and diversify away some of the potential risks appearing. The first month of the second-term Trump Presidency has thrown up a lot of questions for investors, some of which may not be answered quickly or conventionally.

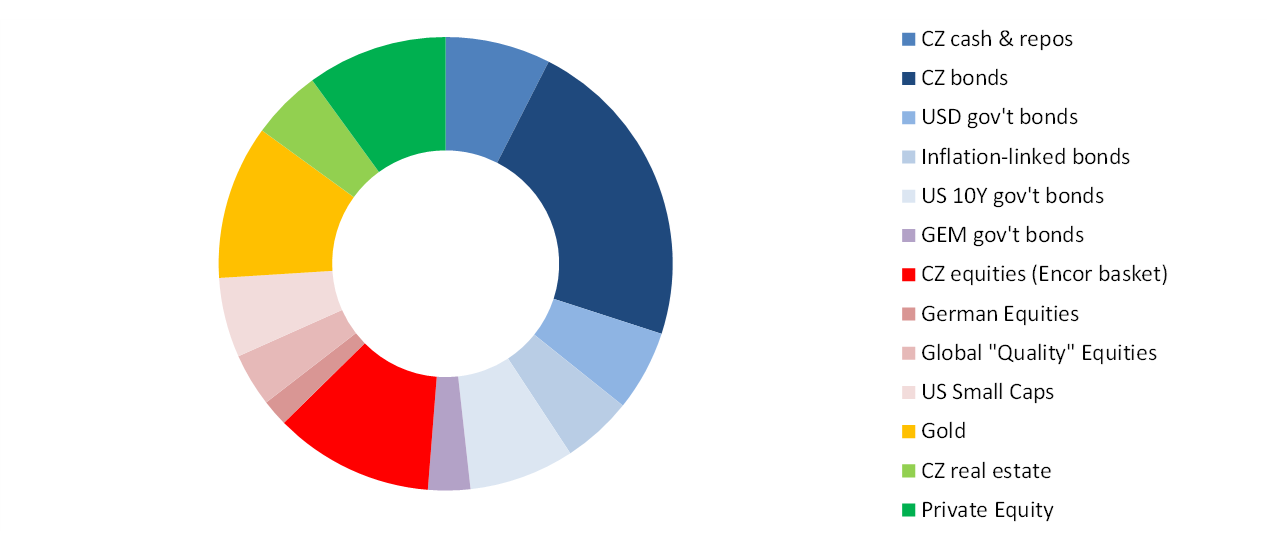

Allocation for a typical moderate risk client into Q1 2025*

Source: EnCor Wealth Management proprietary asset allocation model.

See disclosures at the bottom of this text. * Weights as of end January.

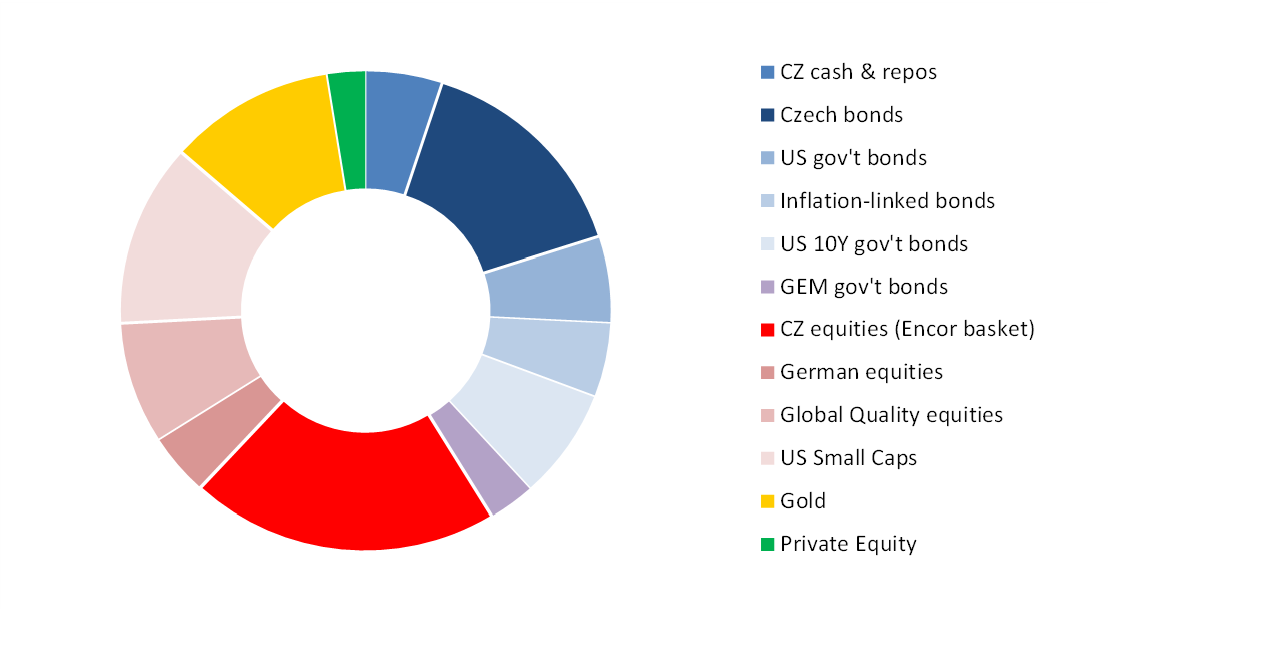

Allocation of our “Rustovy” Dynamic OPF – Q1 2025*

Source: EnCor Wealth Management proprietary asset allocation model.

See disclosures at the bottom of this text. * Weights as of end January.

Liquidity, sentiment and some growth signals from the Q1 update of our model all suggested some caution towards riskier assets. Accordingly, we removed around a quarter of our positions in equities in our mandates and funds, replacing the weightings with US-dollar denominated bonds. Some uncertainty is since starting to be priced into markets, resulting in US government bond prices rallying even in the face of stronger-than-expected inflation readings. US equities sit at very rich valuations, thus pricing in a high-growth scenario and making them somewhat vulnerable to a correction phase.

Commentators and investors face a dilemma when considering the impact of the new US Administration. On the one hand, it has demonstrated its low-tax, market-friendly credentials by asking Congress to extend the raft of personal income tax rate cuts that the first Trump Presidency famously passed in 2017. And efforts to rein in the huge US fiscal deficit via spending cuts through the instrument of Elon Musk’s Department of Government Efficiency (“DOGE”) should ultimately please bond investors. But the extent of “disruption”, not just from DOGE but the de-globalising threat (and reality in the case of China at the time of writing) of increased tariffs on the US economy may yet be under-estimated. High government spending, including on health programmes, helped the US economy to grow much faster than its peers in the past couple of years. Replacing this with private sector demand is a laudable long-term aim from a capitalist perspective but the short-term effects of this and the other mentioned moves could be weaker consumer spending, a dearth of government investment and a cautious capital expenditure (“CAPEX”) approach from the private sector. A period of “soft” GDP growth may well ensue. This, the markets may just be waking up to.

Our portfolios tilt towards Czech and European equities this quarter, with well over half of our share weights in this geography. A chance of an end to the awful Russia-Ukraine war may have bolstered sentiment but the cutting of interest rates both by the CNB and the ECB over the last 20 months has created easier financial conditions. Expectations for Czech and Eurozone GDP growth are very low and a huge potential fiscal stimulus from military spending (reaching up to 3% of EU GDP) could well act as a trigger to kick-start European economic activity via manufacturing and investment. The probability of much-increased expenditure on rearmament appears much higher after the German election results this last week.

A full, slightly larger weight in gold also bears out the more cautious positioning our portfolios have adopted for Q1. The disruptive actions of the new US Administration have thrown geopolitical, inflation and de-globalisation risks into sharper focus. In this environment, a more balanced approach is warranted, one which also includes capturing yield from dollar government bonds and from higher-quality equity ETFs and Czech shares. “Disrupters” breed disruption and market volatility.

Disclaimer: This article does not constitute an investment advice, or a recommendation to buy or sell a specific security. Please contact us at welcome@encorwealth.com if you would like to consult on your individual situation.

Author: Mark Robinson