The new show in town

The stabilization of global asset markets over the last quarter signals the beginning of investors understanding the new macroeconomic rules and conditions for interacting with the world’s largest economy, the US. Several globally-significant equity markets hit fresh all-time highs in local currency terms, though adverse foreign exchange movements pared down gains significantly for Koruna-terms investors. Our proprietary EnCor asset allocation model absorbed the signals of this stabilization, raising weighings of equities for Q3 towards neutral, trimming down weightings in bonds and cash. The “new show” that is the Trump Administration targets both strong GDP growth and a rebalancing of the US economy. For now, markets believe that both aims are mutally plausible.

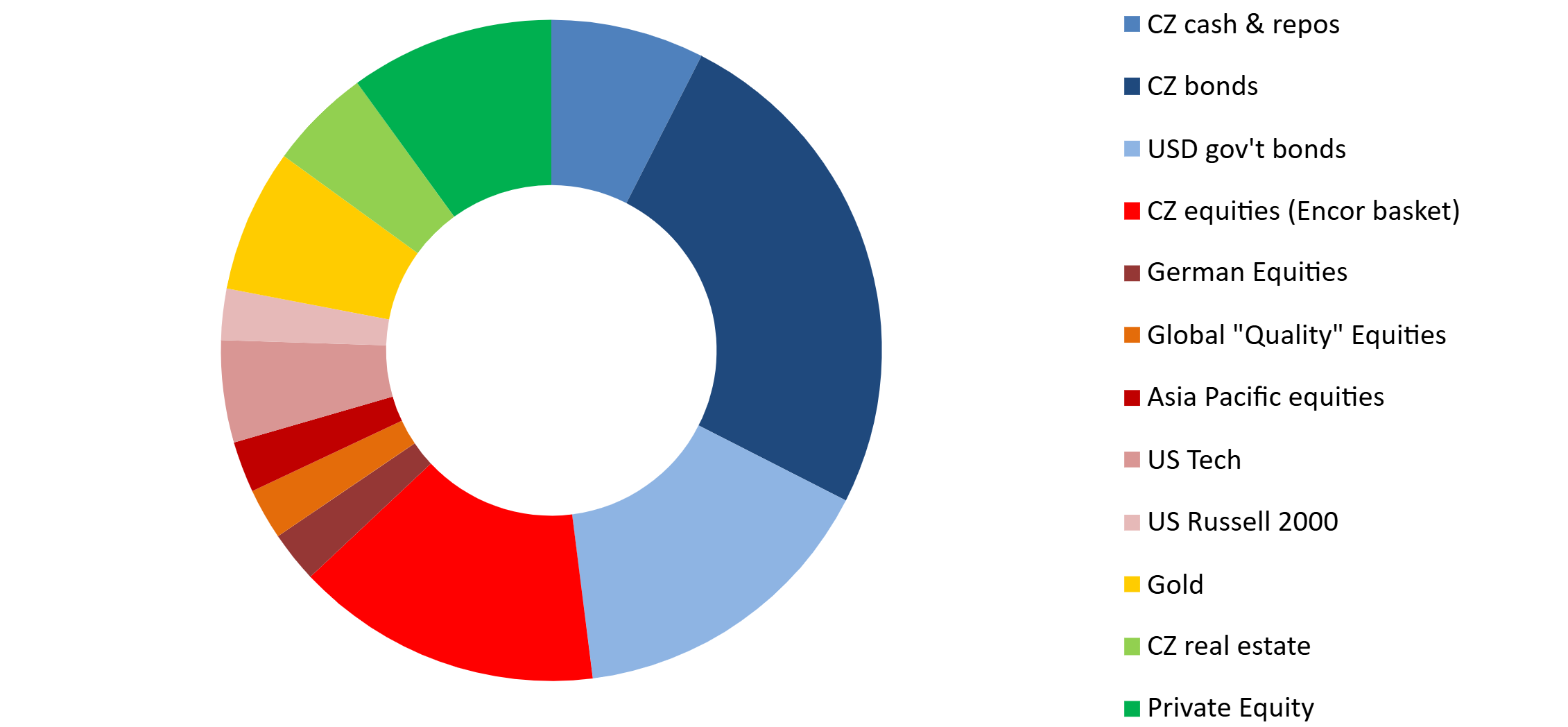

Allocation for a typical moderate risk client into Q3 2025*

Source: EnCor Wealth Management proprietary asset allocation model.

See disclosures at the bottom of this text. * Weights as of end July.

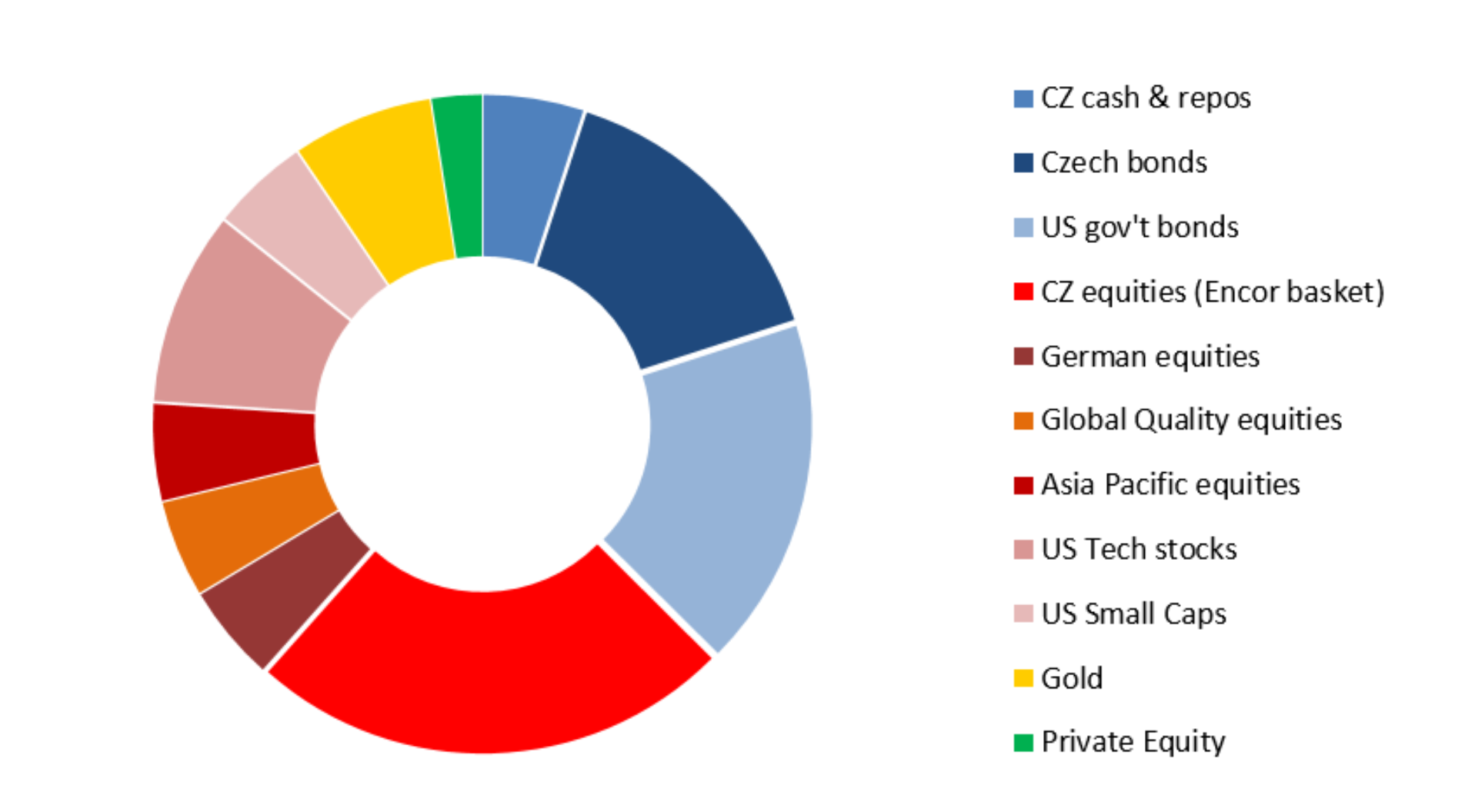

Allocation of our “Rustovy” Dynamic OPF – Q3 2025*

Source: EnCor Wealth Management proprietary asset allocation model.

See disclosures at the bottom of this text. * Weights as of end July.

Liquidity, credit sentiment and growth signals from the Q3 update of our model indicated an improvement from the troubled first three months of the new Trump Administration. As a result, we added significantly to our positions in equities. Around half or more of our exposure to the asset class, depending on the mandate, is in Czech shares. Our portfolios have already benefited in 2025 from the 27% koruna-terms return (excluding dividends) of the Czech PX Index to the end of July. A recovering Czech economy and healthy prospects for local corporate profits and ongoing payouts to shareholders are both underpinning market sentiment. Investors await October’s parliamentary elections and a possible reduction of geopolitical risk if peace indeed comes to Ukraine. Our portfolios additionally retain their positions in German (up 18% year-to-date in CZK terms) and European markets (up 6%).

US shares, despite also hitting fresh all-time highs for US dollar investors, were still actually -5% down in Koruna terms during calendar 2025 at the end of July. Our model takes advantage, increasing weights to the world’s largest equity market for this quarter. The dollar has lost nearly 12% of its value versus the Koruna this year, depressing returns for all USD-denominated bond asset classes as well. This weakness of the “greenback” means that, presently, it is currency markets that have priced in the economic effect of higher US tariffs on imported goods. The Trump Administration has negotiated or set “permanent” tariff levels for almost all trading partners, with the notable exception of China. And the weaker dollar makes imports more expensive for US consumers by itself, helping to reduce the trade imbalance. The passing by Congress of Trump’s signature fiscal package, the “Big Beautiful Bill” at the beginning of July buoyed risky asset sentiment, as it primes US GDP growth by extending major tax cuts. At the same time, the Bill’s provisions are set to increase the country’s huge government budget deficit yet further.

Thus, the Trump Administration seeks to shrink the US’s trade imbalance but is doing almost nothing about the fiscal deficit, aside from the marginal but massively-publicised “DOGE” initiatives. Holders of US government bonds (and Elon Musk himself) are rightly questioning this situation and are doubting, absent a change of policy-making at the presently-independent US Federal Reserve, that measures of “core” inflation will allow for policy interest rate cuts. Our model signals to hold only very short-maturity US fixed income exposures in the near run, while retaining our hefty positions in Czech corporate bonds.

Overall, our asset allocation for Q3 remains on the cautious side of neutral. Markets are still assessing the techniques and moves of the Trump Administration, the new show in town. The tariff uncertainty has, for now, settled down. But inflation uncertainty has not gone away and a higher “cost of capital” for companies and investors globally looks like a fair assumption to make when pricing in future macro developments. Our portfolios retain a position in gold, which often acts as an insurance policy in such situations. The (reality) show must go on.

Disclaimer: This article does not constitute an investment advice, or a recommendation to buy or sell a specific security. Please contact us at welcome@encorwealth.com if you would like to consult on your individual situation.

Author: Mark Robinson