About us

When we left Raiffeisenbank, our friends began to approach us for advice how to best invest their money. We discovered that their banks or “advisors” just wanted to feather their nests at the expense of our friends’ investment returns. We knew, however, that there are fair investment products available, they were just not offered by anyone. That’s how the Encor Wealth idea came to life.

Together with Mark, we developed a mathematical model that allocates client’s money to different asset classes. For each asset class we select the best products in the market, monitor the risks and flush out hidden fees. Along with our clients we plan their financial future and adjust their investment portfolios. Sometimes we talk about their own business strategies or a future exit. When we solve all these questions, we play golf or go to theatre together. We are committed by this trust.

Founders of EnCor Wealth Management

About us

When we left Raiffeisenbank, our friends began to approach us for advice how to best invest their money. We discovered that their banks or “advisors” just wanted to feather their nests at the expense of our friends’ investment returns. We knew, however, that there are fair investment products available, they were just not offered by anyone. That’s how the EnCor Wealth idea came to life.

Together with Mark, we developed a mathematical model that allocates client’s money to different asset classes. For each asset class we select the best products in the market, monitor the risks and flush out hidden fees. Along with our clients we plan their financial future and adjust their investment portfolios. Sometimes we talk about their own business strategies or a future exit. When we solve all these questions, we play golf or go to theatre together. We are committed by this trust.

Founders of Encor Wealth Management

Our services

We provide complex asset management services to protect hard-earned money of our clients from inflation and other market risks, to manage and grow their assets in a professional manner, and to help them fulfil their goals and dreams. Our services include:

► Long-term financial planning

► Investment strategy and asset allocation

► Design and management of investment portfolio

► Free capital allocation

► Strategic investments’ analysis

► Access to top-tier investment products

Our services

We provide complex asset management services to protect hard-earned money of our clients from inflation and other market risks, to manage and grow their assets in a professional manner, and to help them fulfil their goals and dreams. Our services include:

► Long-term financial planning

► Investment strategy and asset allocation

► Design and management of investment portfolio

► Free capital allocation

► Strategic investments’ analysis

► Access to top-tier investment products

Why with us

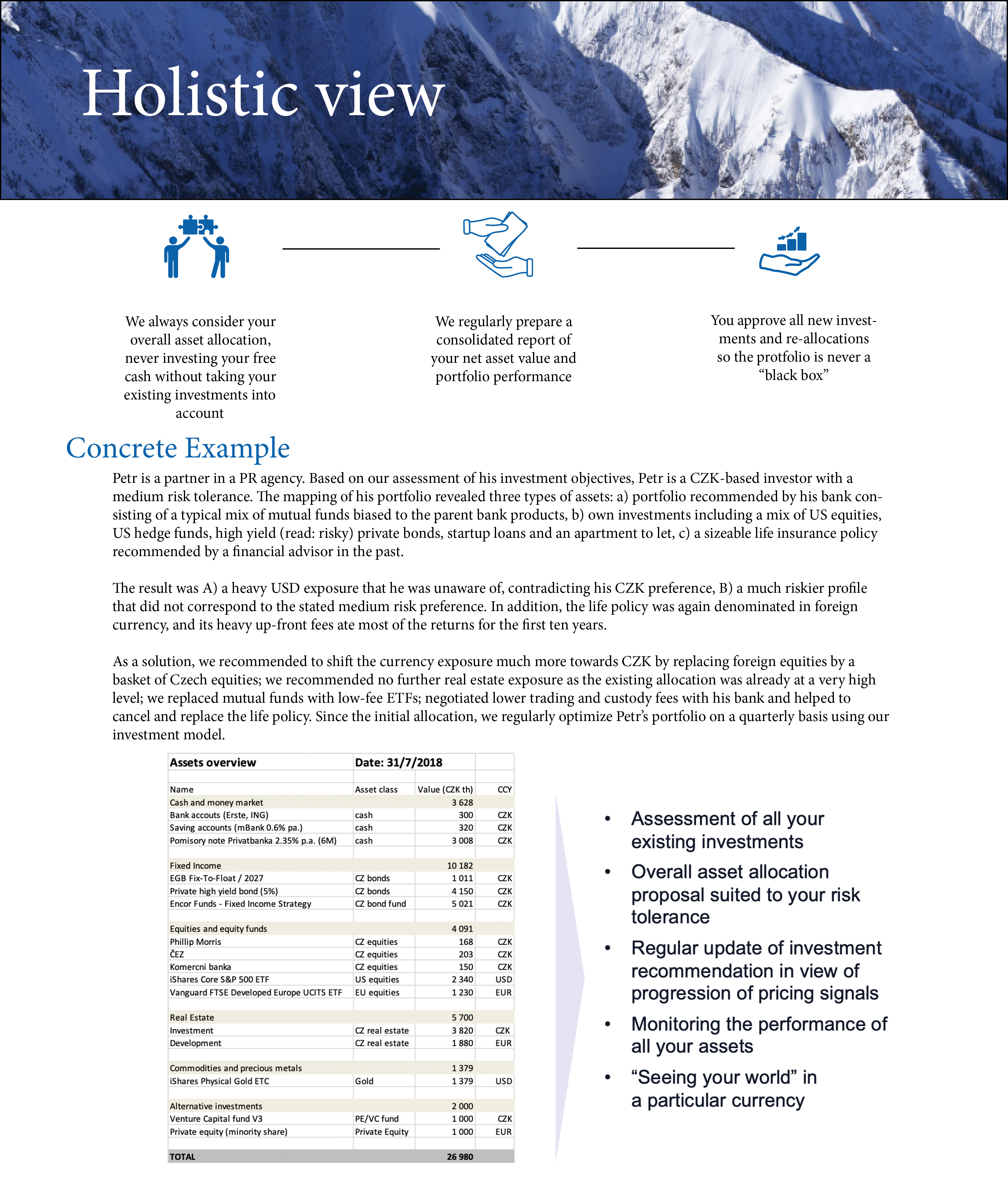

Holistic view

We take all your assets into consideration to properly manage your portfolio risks and returns.

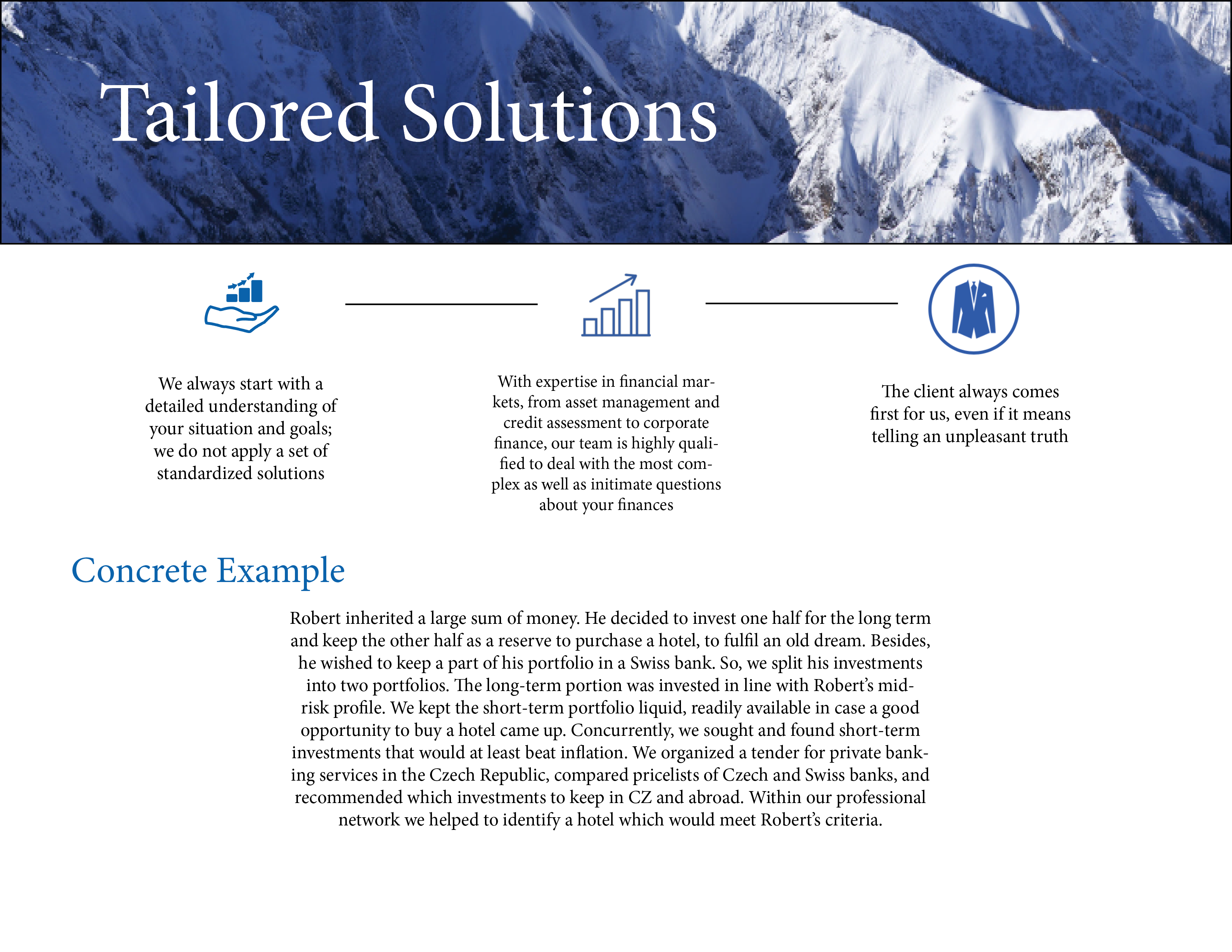

Tailored solutions

Listening to your individual situation before designing a tailor‑made recommendation.

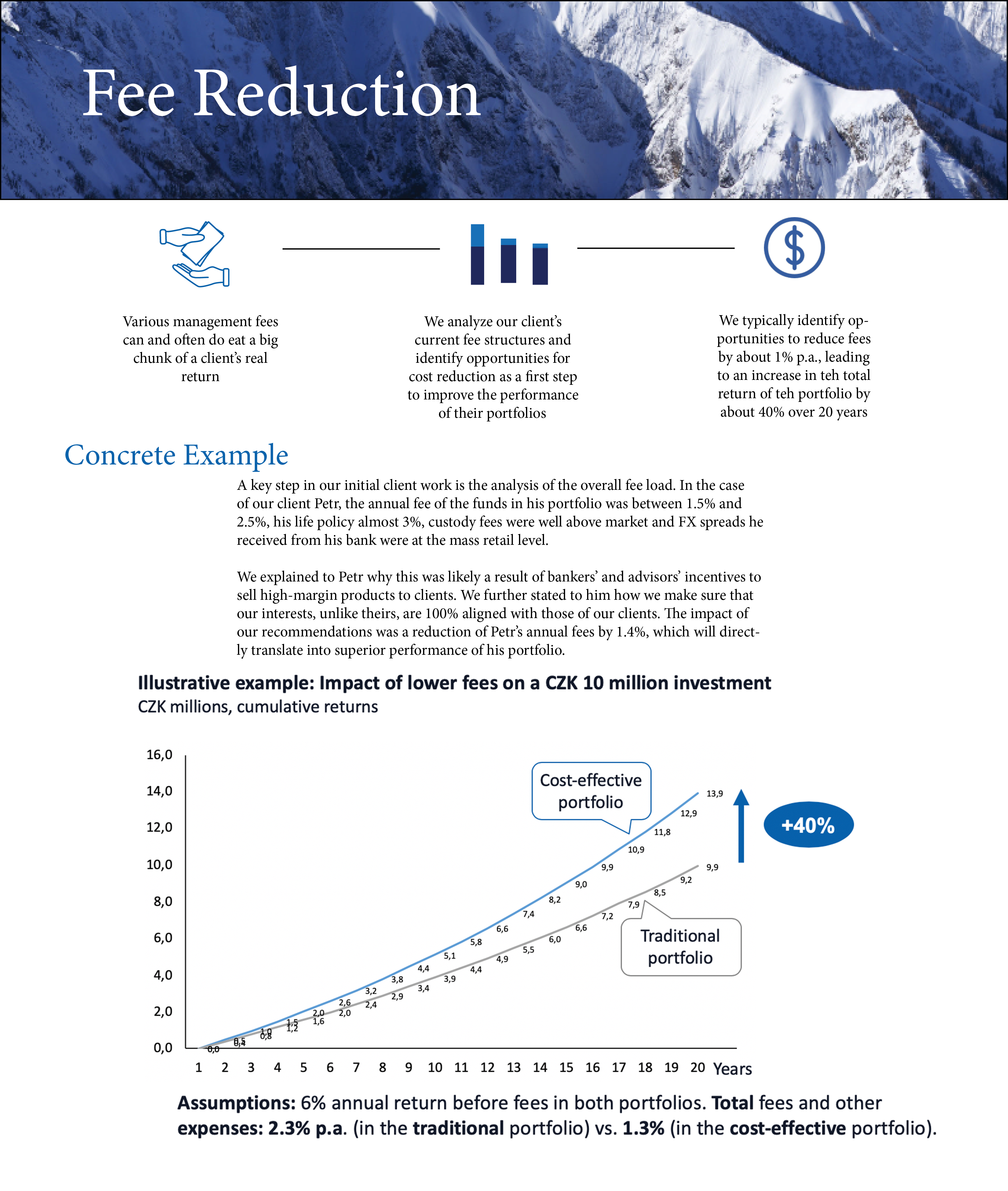

Fee reduction

Aligned incentives, transparent pricing and sharp focus on fees increase your net returns.

High performance

Multi-asset investment strategies building on our strong track record and a proprietary analytical model.

Insights

EnCor Navigator: allocation of assets in Q1 2026

Rotation away from the “greenback”

The prices of riskier assets outside of US Tech equities continued to rise in the final months of 2025 and through January 2026. The observed trends over the past 12-18 months, […]

EnCor Navigator: allocation of assets in Q4 2025

Pump-primed world economy

The recovery of risky assets from April’s severe drawdown has sent several equity markets around the world and the precious metals to continued record highs over the summer and autumn period. A fuller […]

EnCor Navigator: allocation of assets in Q3 2025

The new show in town

The stabilization of global asset markets over the last quarter signals the beginning of investors understanding the new macroeconomic rules and conditions for interacting with the world’s largest economy, the US. […]

Insights

EnCor Navigator: allocation of assets in Q1 2026

Rotation away from the “greenback”

The prices of riskier assets outside of US Tech equities continued to rise in the final months of 2025 and through January 2026. The observed trends over the past 12-18 months, […]