Rotation away from the “greenback”

The prices of riskier assets outside of US Tech equities continued to rise in the final months of 2025 and through January 2026. The observed trends over the past 12-18 months, including a weaker dollar, interest rate cuts and continued stimulus from governments running wide fiscal deficits gave fuel to most equity markets and commodity prices to climb towards fresh all-time highs. Our proprietary EnCor asset allocation model largely maintained weights in those riskier assets for Q1 2026, while seeking to diversify within both the Equities and Commodities asset arenas.

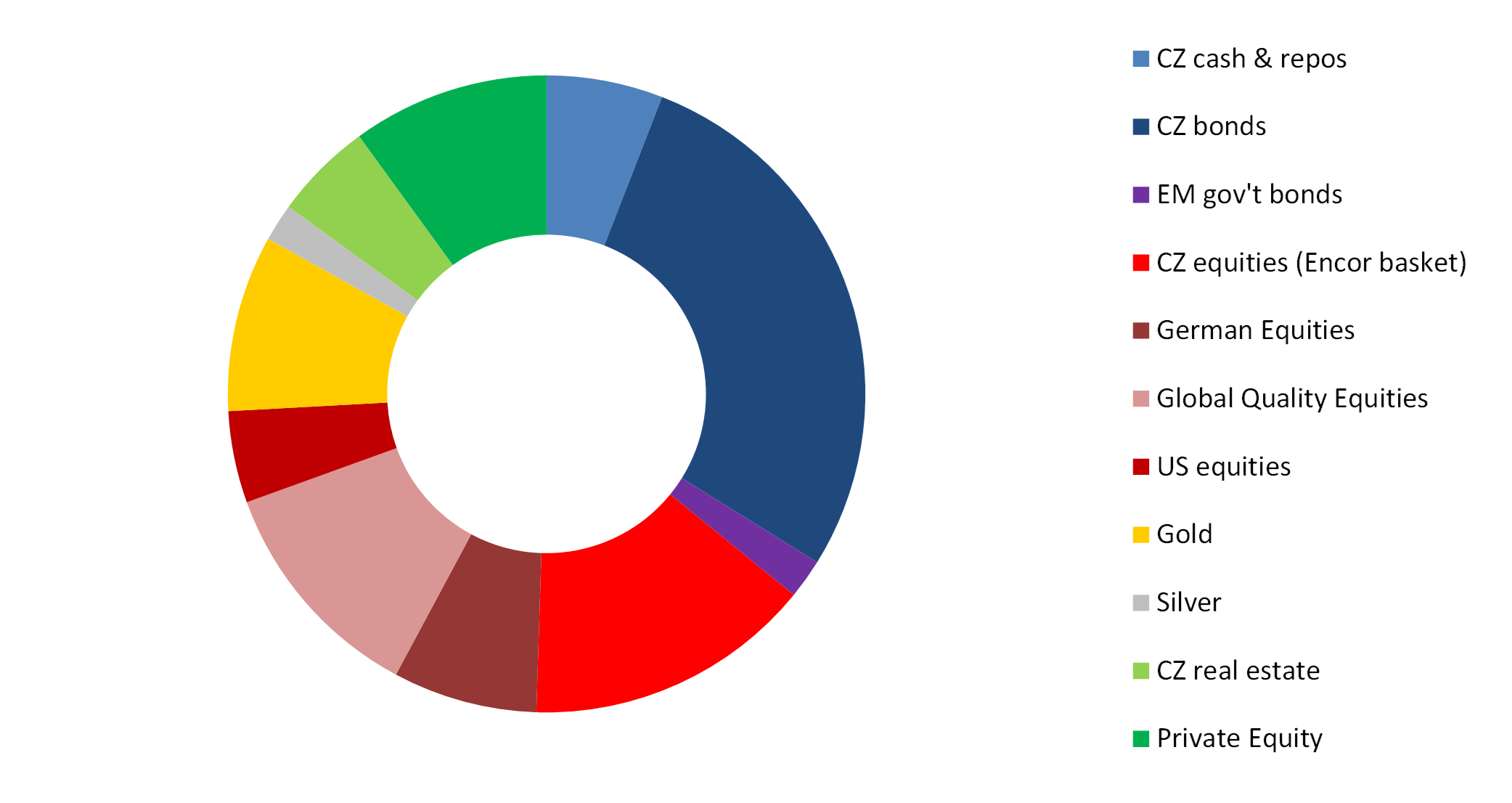

Allocation for a typical moderate risk client into Q1 2026*

Source: EnCor Wealth Management proprietary asset allocation model.

See disclosures at the bottom of this text. * Weights as of end January.

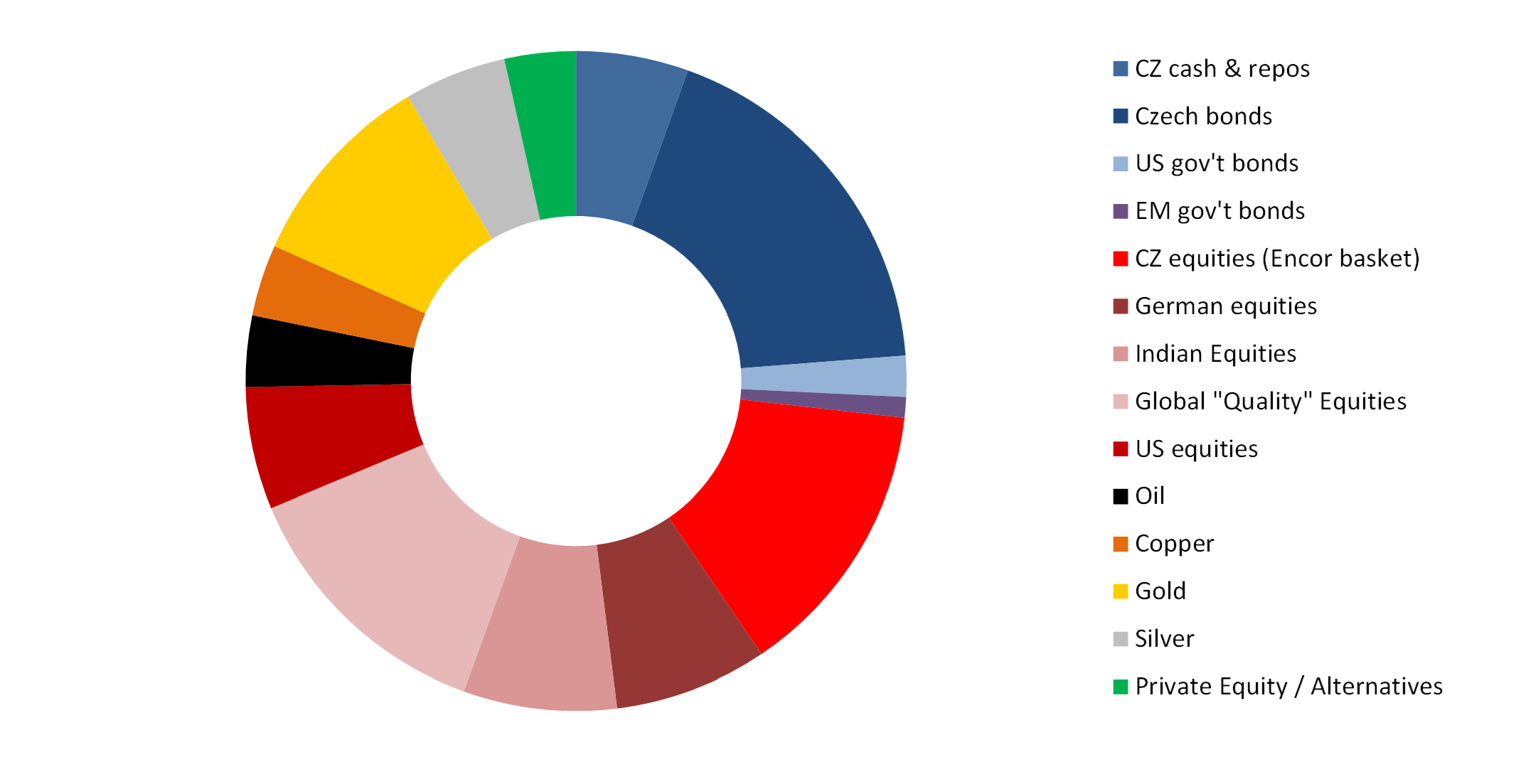

Allocation of our “Rustovy” Dynamic OPF – Q1 2026*

Source: EnCor Wealth Management proprietary asset allocation model.

See disclosures at the bottom of this text. * Weights as of end January.

The Q1 update of our asset allocation model shows positive signals on economic growth in the coming year in Emerging Markets and in Asia, as well as Central Bank total asset indicators indicating that liquidity is being fed into the global economy. Some leading indicators of US economic growth are softening. Our portfolios thus diversified away from US equities for this quarter. Valuations of US Tech and “AI” stocks remain at very high levels, while the growth dynamic in the heavyweight and heavily-owned software sector may be under threat.

In the Equities space, we took fresh positions in “Global High-Quality” ETFs, while also adding to positions in the German market. “High-Quality” companies are those with well-developed business models, generating high returns on capital employed and paying out decent levels of dividends when measured by yield. We largely maintained weights in Czech equities, which have similar characteristics to those global peers. The dividend yield of the Czech bourse still sits close to 5% even after 2025’s stellar market performance. In our higher-risk portfolios, we added fresh positions in India, the UK, European shares and Swiss Defensive stocks.

Commodities were among the strongest performers among asset classes in the last quarter and this has continued so far in 2026. Precious metals saw continued buying from financial investors, Central Banks (in the case of gold) and industrial players (in the case of silver). Prices of both of these stores of value saw significant volatility at the end of January, as physical shortages started to affect investor positioning and sentiment in the paper proxy markets. Oil prices rose in reaction to geopolitical events, including the forced reduction of supply from Russia while relative supply scarcity saw copper prices hit all-time highs. Our higher-risk portfolios now hold positions in all four of these key commodities.

What these equity and commodity asset classes have in common is that they tend to out-perform when the US dollar is weakening. Our asset allocation model has clearly positioned for further moderate slippage in the value of the “greenback” versus both major peers and real assets (such as the precious metals). Why might the dollar slip further? The probability of more international policy “flip-flops” to-and-from extreme positions by President Trump is a risk factor in itself. This is also “encouraging” the ongoing slow reduction of the dollar as the chief global reserve currency. The US fiscal deficit looks to be sustaining at a very wide level, something that currency markets usually fear. And for good reason, because the likely “solution” to funding that deficit is for interest rate cuts to be executed and “money-printing” or Quantitative Easing being applied in size. Which means more dollars in circulation and if there is more of something, its value should fall. And, as mentioned, some leading indicators of growth in the US are softening. As a result our US equity exposure is pared down. And we own almost no US government bonds in our portfolios, preferring mainly Czech Koruna fixed-income exposures.

Our asset allocation for Q1, with large weights in commodities and non-US equities, reflects the probability of accelerating global liquidity, a weaker US dollar and a recovery in international growth. These asset classes may be “under-owned”, compared to US assets, by investors. Our portfolio positions in Czech cash, Czech corporate bonds and gold, as before, provide diversification and stabilising characteristics for our clients in what remains a volatile geopolitical and valuation environment.

Disclaimer: This article does not constitute an investment advice, or a recommendation to buy or sell a specific security. Please contact us at welcome@encorwealth.com if you would like to consult on your individual situation.

Author: Mark Robinson (10 February 2026)