Conditions stabilizing in the near term, allowing some risk-taking

Liquidity and sentiment conditions in financial markets are calmer in Q1 2023 than they were during a stormy 2022, allowing greater risk-taking in portfolios. Our proprietary EnCor Asset Management Asset Allocation model, created by Mark Robinson, adds to the moderate increase in risk positions we implemented in Q4 by cutting defensive cash and gold weightings in Q1 2023 and adding mainly to equities.

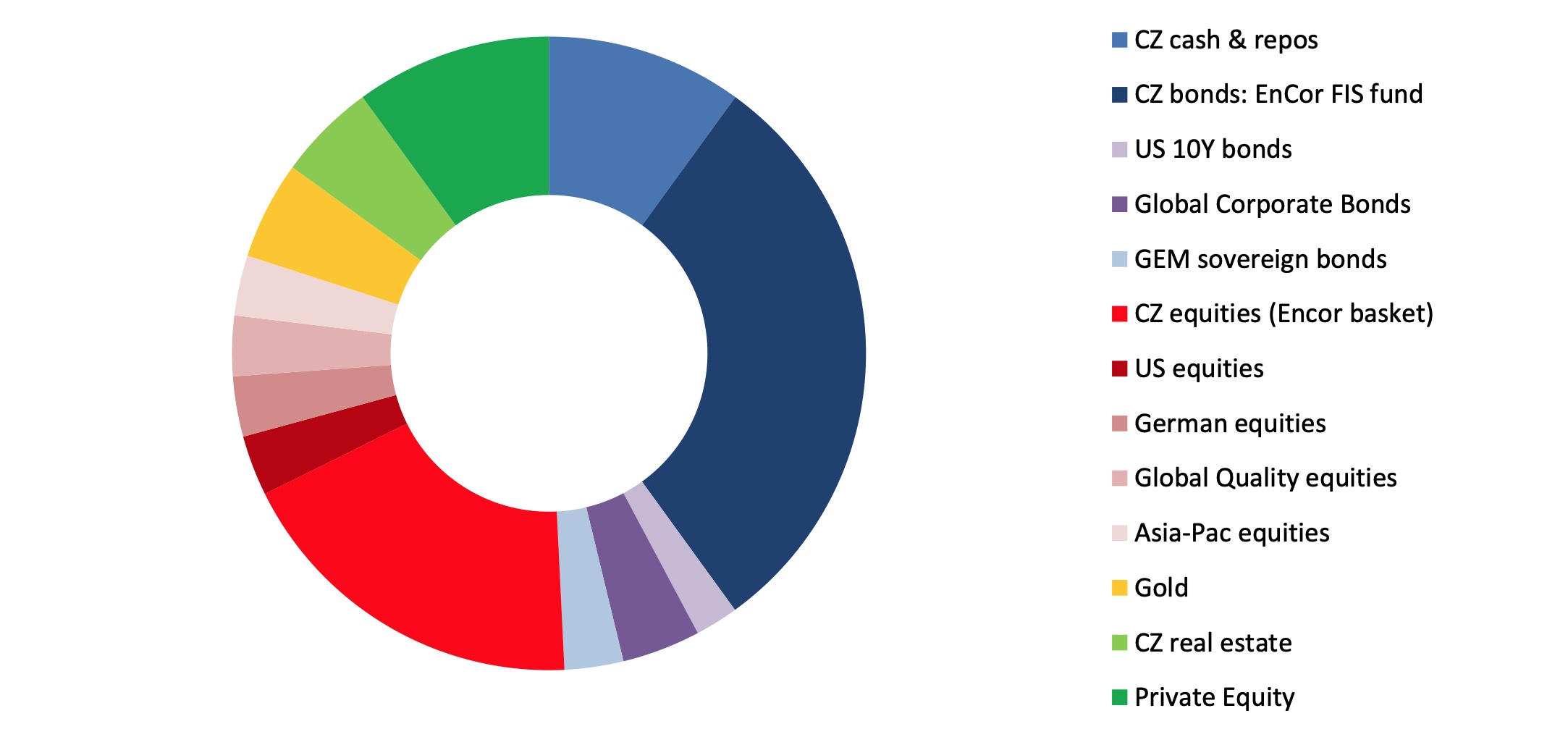

Our asset allocation model elects again in Q1 2023 to continue to reduce the high cash positions with which we sheltered from the market turbulences last year. Czech koruna cash, repo and bond weightings made up a combined 90% and 70% of our low and moderate risk strategies at the height of the storms in Q3 2022 but now drop in Q1 to 60% and 40% (see the latter in the chart below) respectively. These proportions are still significant and make sense, as CZK cash (yielding over 6%+) and safer CZ bonds (yielding 8%-9%) offer high returns with zero or very moderate risk being taken.

Allocation for a typical moderate risk client into Q1 2023*

Source: EnCor Wealth Management proprietary asset allocation model.

See disclosures at the bottom of this text. * Weights as of 31 January.

Compared to the violent movement of yields (up) and prices (down) in 2022, bond markets have so far in 2023 performed in a more benign way. The concurrent calming of credit markets has set fair conditions for stock bourses and it is these signals that have pushed up the weightings of equities in our model to almost a neutral position in Q1 for the first time since 2021. Higher-than-expected inflation readings, with associated interest rate rises, are the main risk to this positioning but the debate over the extent of the period of high inflation is more about H2 2023-2024 than it is about H1 2023’s data. Markets thus have a “lull” in the 2020s inflation storm, where lower equity valuations can be exploited. This is, in the opinion of our model, more apparent in German/European equities, Asia-Pacific markets, the shares of global “high-quality” (strong returns on equity, high dividend payout) companies and Czech shares than in the expensive US stock market. Our allocation excludes a weighting to US Tech companies for the fourth consecutive quarter.

The large weight in Czech shares points to a continued preference for assets denominated in CZK. Indeed, the reduction in CZK cash & repo levels is matched by the jump into CZK equity and bond exposures, meaning that the proportions in CZK are running at a high but flat 63% for our moderate risk clients, with just 37% allocated to assets denominated in foreign currencies.

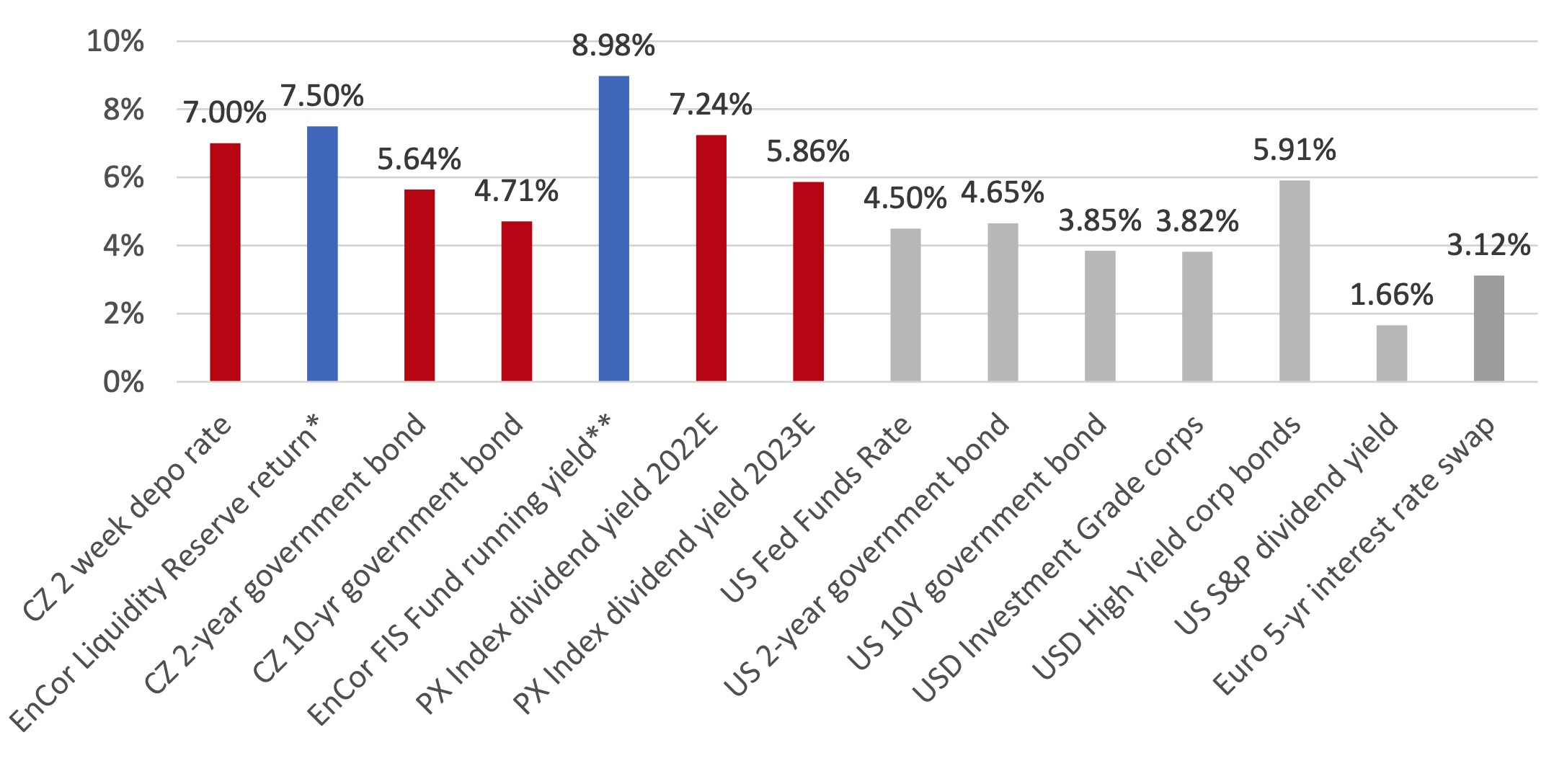

Current yields of CZK and major USD and EUR asset classes (%)

Source: investing.com, Bloomberg, Prague Stock Exchange, EnCor Wealth Management. Dated as of 16.02.2023

* Latest offer for product, 16.02.2023, net of fees. ** end December yield to maturity of the fund

The CZK strengthened nearly 12% against the USD in our Q4 allocation quarter (to end January), drowning out US equities and all international bond asset classes which had negative CZK-terms returns in that three-month period. This Koruna strength has continued to date in February and as the above chart shows, the attractiveness of the yields on assets denominated in CZK is clear compared to international peers. US equities (the S&P 500 Index) yield just 1.7%, compared to over 7% for the PX Index constituents for 2022E and a still high 5.8% in 2023E. Cash yields 250bps (2.5%) more, looking simply at the Central Bank policy rates (7% versus 4.5%). CZ government bonds have a premium of 80-100 basis points, depending on the maturity. CZ corporate bonds, as represented by our conservative EnCor FIS Fund, yields close to 9%, compared to 4%-6% for key US corporate bond universes.

So for now, we are happy with higher-yielding assets in CZK, including equities. This is accompanied this quarter with a moderately more risky stance internationally as we await more inflation data. The world economy is growing slowly and the US economy in particular may face a recession in Q4 2023 or in 2024. We thus recommend to invest patiently and we remain committed to careful husbanding of our clients’ assets.

Disclaimer: This article does not constitute an investment advice, or a recommendation to buy or sell a specific security. Please contact us at welcome@encorwealth.com if you would like to consult on your individual situation.

Author: Mark Robinson