“Barbell strategy” for portfolios continues in Q3

The resilience of the US economy and the positive performance of US equities in 2023 has continued to surprise many commentators and investors. US equities were the largest riskier weighting in our clients’ portfolios in Q2. The steady and predictable performance of CZK-denominated repos and lower-risk Czech corporate bonds delivered again solid overall returns in Q2 2023. Our proprietary EnCor Asset Management Asset Allocation model, created by Mark Robinson, retains in Q3 our “barbell strategy” of holding both riskier equities and lower-risk CZK cash and bonds.

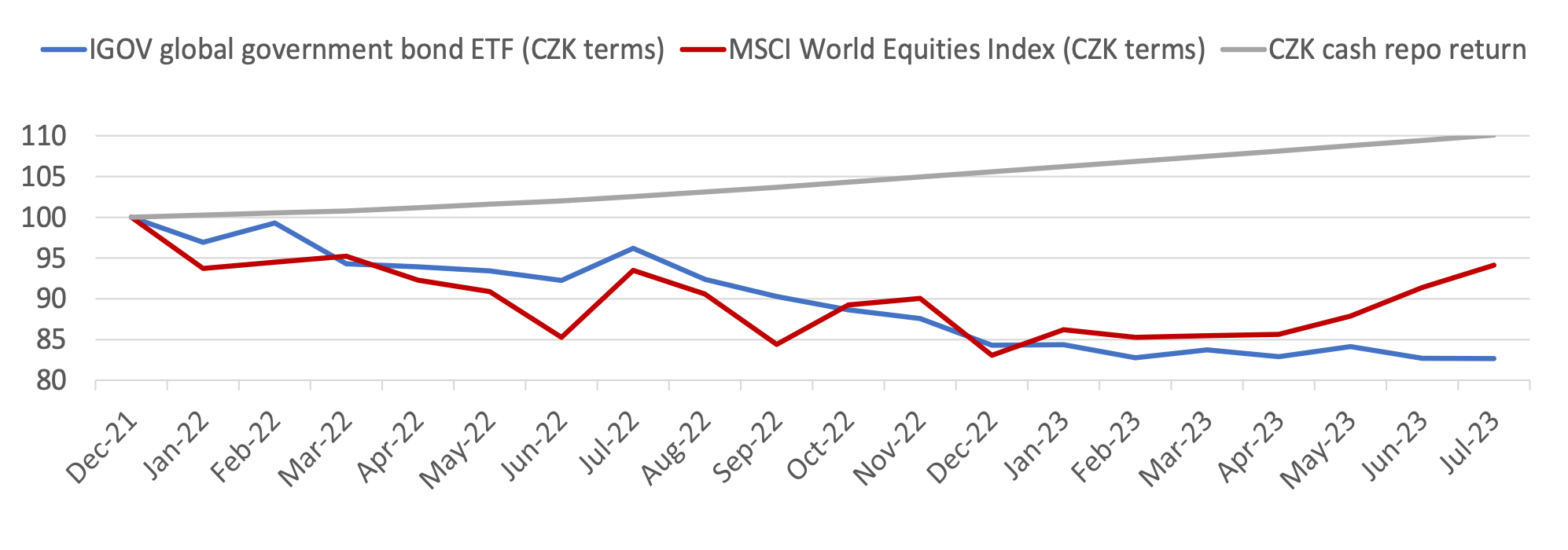

Performance of global government bonds, global equities and cash repos (2022-23, CZK terms)

Source: investing.com, StockQ.org, EnCor Wealth Management

We witnessed marked sell-offs in both global equities and global bonds in 2022. Our over-arching strategy of maintaining very high weights in both CZK cash repos and Czech koruna-denominated bonds saw us through that difficult last calendar year. Our proprietary model increased positions in equities in both January and April 2023 and these shifts paid off: global equities have made up half the ground lost in 2022. Global bonds, where our exposure was and is generally minimal, subsided further this year.

For this quarter, our asset allocation model trims the overall position in equities in favour of CZK-denominated cash and repos. The latter still yield over 6%+ per annum while safer CZ bonds are still offering 8%-9% annual returns. We continue to avoid international bonds, as inflation risks in the global economy are still very apparent. Higher exposure to CZK-denominated assets, rising to 59% in Q3 from 49% in Q2 for a typical moderate risk client, also reduces risk for our clients.

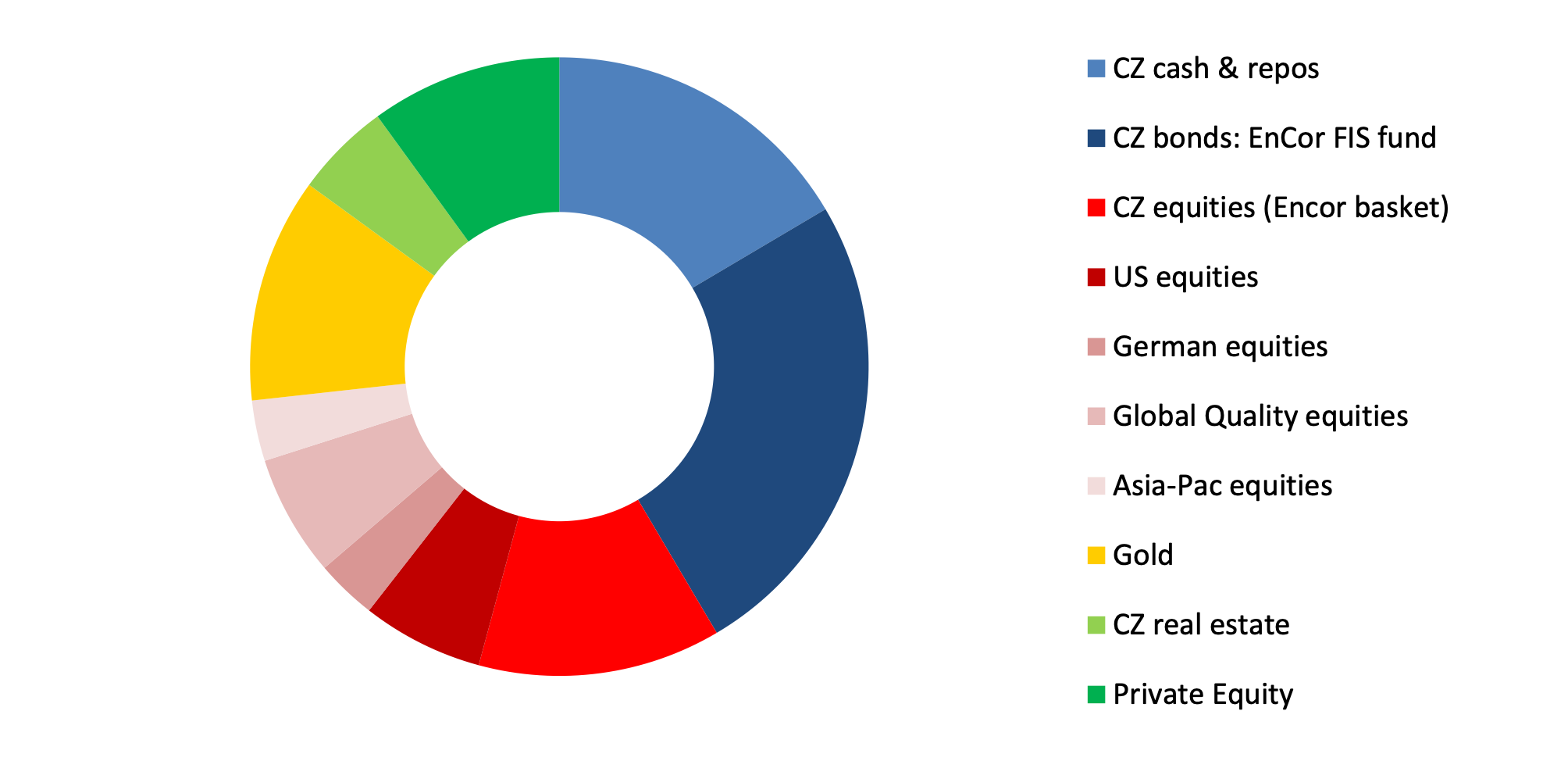

Allocation for a typical moderate risk client into Q3 2023*

Source: EnCor Wealth Management proprietary asset allocation model.

See disclosures at the bottom of this text. * Weights as of 31 July.

Our Q3 model reverses Q2’s swing within equity weightings by increasing exposure to the Czech market, at the expense of US shares (including the top-performing Tech stocks), the shares of global “high-quality” companies and the UK Small Cap stock arena. Why cut US equities now? We have felt for some time that the US economy is likely to fall into a mild recession in early 2024 and now in Q3 2023 we are one quarter closer to that time. Our model is thus picking up stronger signals that such a downturn is more likely.

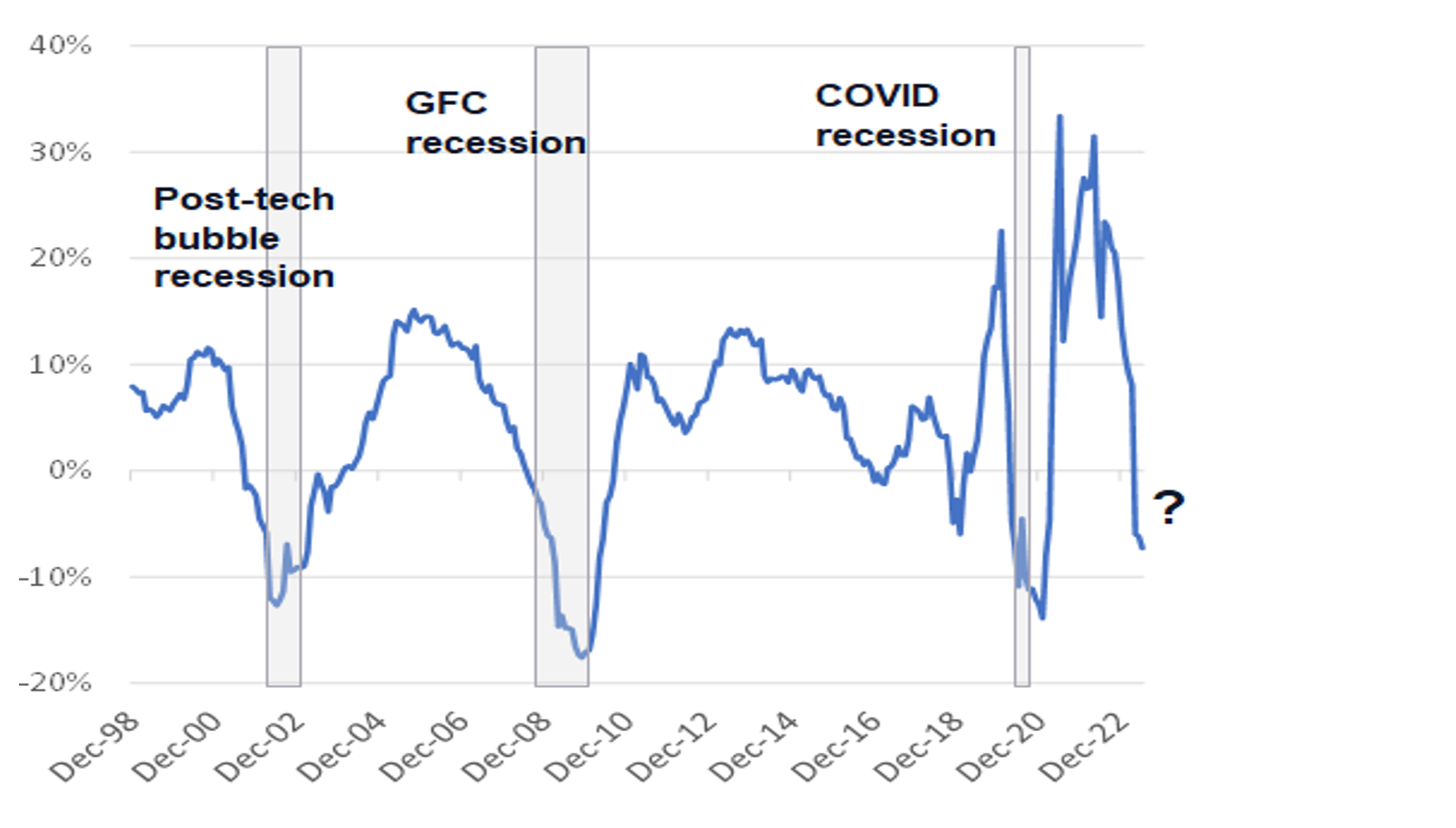

US government tax receipts (12-month moving average % change)

Source: US Treasury, EnCor Wealth Management calculations

An example is that the US government’s collection of tax receipts is falling rapidly. When this indicator stays below zero growth for any period of time more than 3 months in the last 2 decades, a recession in the US has occurred. Other indicators such as a lower amount of revolving debt borrowed by consumers and the shrinking volume of freight transported around the US point in the same direction. We remain of the view that the present low rate of unemployment and the legacy of the big fiscal stimulus in the US economy will make any recession quite mild.

So, for this quarter, our overall “barbell strategy” remains in place. But our model is reducing risk through increasing CZK cash positions and rotating into Czech equities while reducing international shares. The model also chooses to increase the position in gold moderately and, for clients who tolerate a higher level of risk in general, exposure to silver. Reducing and diversifying risk looks sensible in the main as, in addition to a potential US recession, inflation remains a problem for the world economy, the Russia-Ukraine war rages on and financial strains are becoming gradually more apparent in China.

Disclaimer: This article does not constitute an investment advice, or a recommendation to buy or sell a specific security. Please contact us at welcome@encorwealth.com if you would like to consult on your individual situation.

Author: Mark Robinson