Disruption ongoing

Our step to de-risk our portfolios at the end of January proved prescient, as US assets, especially equities, sold off through most of the last 3 months. The signal for Q2 from our proprietary asset allocation model doubled down on our cautious positioning, reducing equities further and raising cash and very short-term bond positions. The first 100 days or so of the second-term Trump Presidency has posed both structural and cyclical challenges for investors. Asset markets are likely to consolidate at best for the remainder of Q2, while remaining vulnerable to renewed downside momentum if unexpected policy shifts occur, liquidity conditions worsen or key macroeconomic data deteriorate.

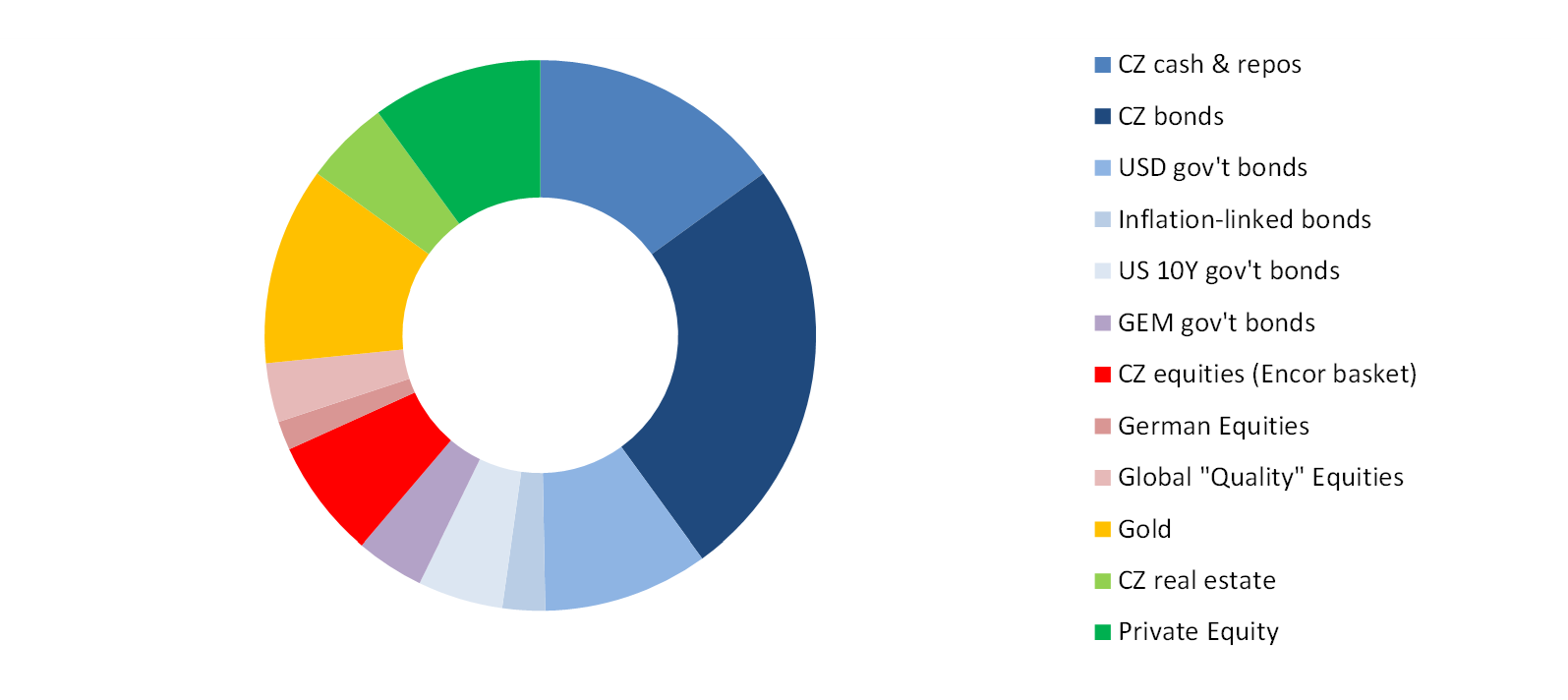

Allocation for a typical moderate risk client into Q2 2025*

Source: EnCor Wealth Management proprietary asset allocation model.

Source: EnCor Wealth Management proprietary asset allocation model.

See disclosures at the bottom of this text. * Weights as of end April.

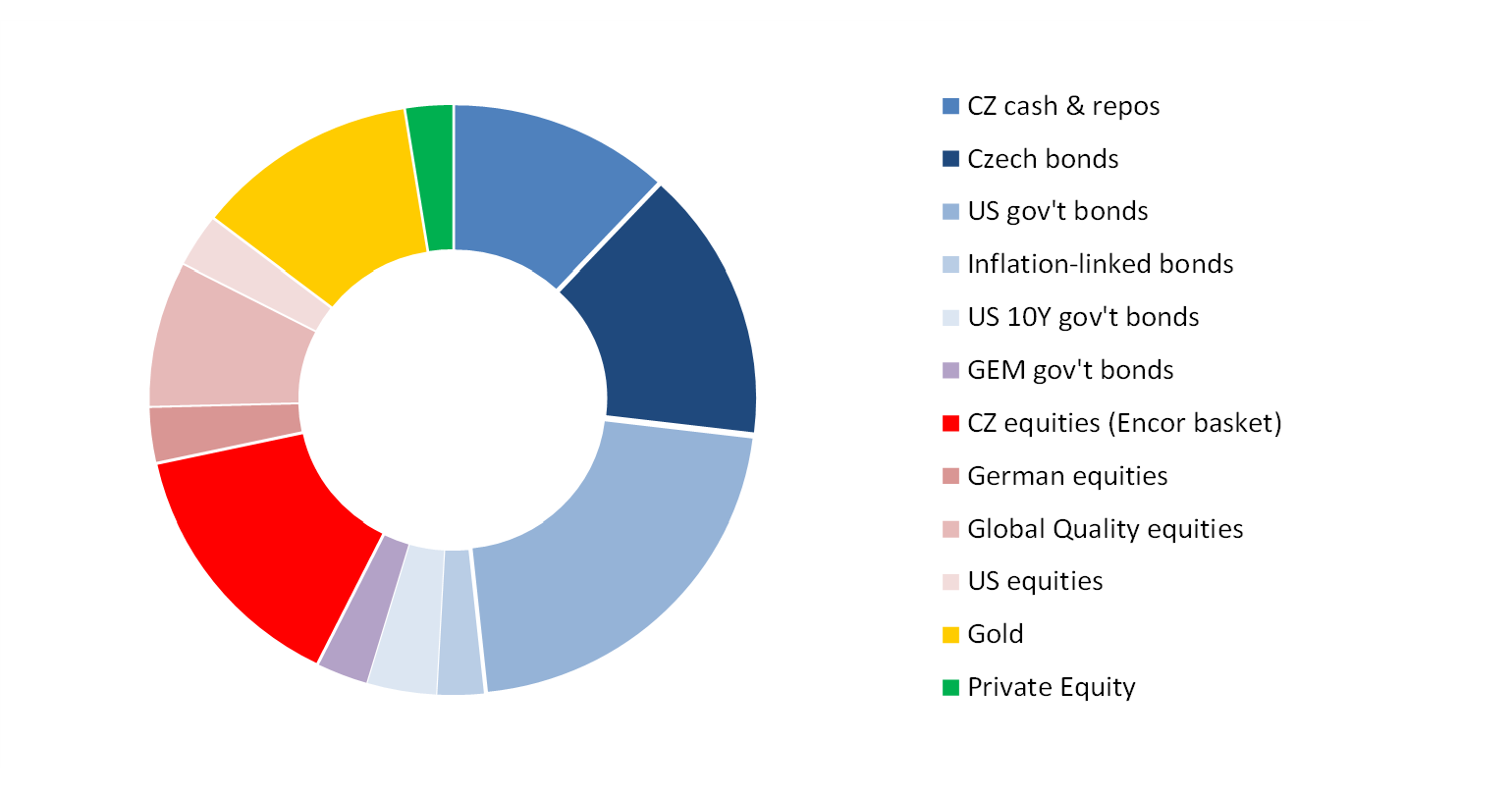

Allocation of our “Rustovy” Dynamic OPF – Q2 2025*

Source: EnCor Wealth Management proprietary asset allocation model.

See disclosures at the bottom of this text. * Weights as of end April.

Liquidity, sentiment and growth signals from the Q2 update of our model show a clear deterioration already over the past 3 months. For Q2, we removed around a third of our positions in equities in our mandates and funds, selling most of our rump US positions and taking profit from Czech shares. We raised cash weights, held both in Koruna and in very short-term (maximum 6-month maturity) US Treasury Bills. Risky asset markets sold off heavily in March and the first half of April, as investors realized the intent of the Trump Administration to rebalance the US economy. This process involves reducing American consumption of imports, thereby shrinking the trade deficit at the same time as cutting government spending, which was (partially) feeding that consumption. If the US government follows through fully with this rebalancing, the global economy will face profound changes.

But for the moment, the Trump Administration has “blinked”. They have backed down, for now, on the more extreme impositions of tariffs announced on the President’s “Liberation Day” (2 April). Equity markets have recovered since their lows in the middle of April, with government bond and currency markets stabilizing. The rally in risky assets has taken some European bourses, including Germany’s DAX Index and the Czech PX-TR, to fresh all-time highs at the time of writing in the middle of May. US shares have largely made up their USD-terms losses year-to-date. But longer-dated US Treasury bonds (-5% in CZK terms) and equities (-9%) are still down year-to-date in 2025 due to the substantial fall in the US dollar versus the Euro and Koruna. Currency markets are already pricing in tariff disruptions.

Markets tend to discount ahead of events actually happening and it is true that a cheaper dollar does some of the job of rebalancing the US trade deficit, making exports cheaper and imports more expensive. President Trump touts the inward investment deals he has agreed with Middle Eastern partners and some US and global corporates as evidence that the economy can be renewed and rebalanced. Yes, it can but it will take 2-10 years to execute. 10% import tariffs look like the minimum levels to be imposed for the medium term. “Permanent tariff deals” remain to be struck with many major partners, apparently all before mid-July. In the meantime, making imports more expensive and removing “stimulating” government spending is likely to curb US consumption and/or reduce the profits of US companies in the import-consumption chain. So, an economic and/or an earnings growth slowdown looks very likely. Perhaps also accompanied by inflation of US consumption goods prices, which might be counterbalanced by cheaper energy input costs.

It will take time for US and foreign companies feeding the vast US consumption machine to adjust to a changed reality. If it is indeed permanent, which we don’t know yet. For investors, this introduces profound uncertainty over the path of earnings growth for all involved companies worldwide. Uncertainty very often brings violent asset price movements, which we have seen already during 2025. When this occurs, the “required return” for investing rises, to price in uncertainty. In addition, valid concerns over the US and Japanese fiscal balances are pushing up longer-term bond yields. This mechanism also pushes up the “required return”/cost of capital for companies and consumers, which should cause high valuations (especially in US equities) to decompress. It also causes “mark-to-market” losses for longer-term bondholders and questions to be asked in credit markets where there are only low levels of risk premiums built in.

Thus, given this environment, our asset allocation for Q2 is cautious. Our portfolios retain a full position in gold, which rose 6% in CZK terms since the end of January, bolstering our clients’ performance. Most of our remaining weights in equities are in German, “high-quality” dividend-paying global companies and defensive Czech shares. Investors worldwide are likely to need a lot of convincing that President Trump has discarded his “disrupter” hat before markets truly calm down.

Disclaimer: This article does not constitute an investment advice, or a recommendation to buy or sell a specific security. Please contact us at welcome@encorwealth.com if you would like to consult on your individual situation.

Author: Mark Robinson