Resilient growth dictates positioning in Q2

Financial markets around the world are in a much calmer situation than global news headlines might suggest: for Q2 2023 we see continued stabilization following on from the difficult year 2022. Investors are pricing in the presence of inflation but also the resilience of economic growth. Our proprietary EnCor Asset Management Asset Allocation model, created by Mark Robinson, again adds in Q2 2023 to the moderate increase in risk positions we implemented in Q4 and Q1 by cutting bond weightings and adding to international equities and gold.

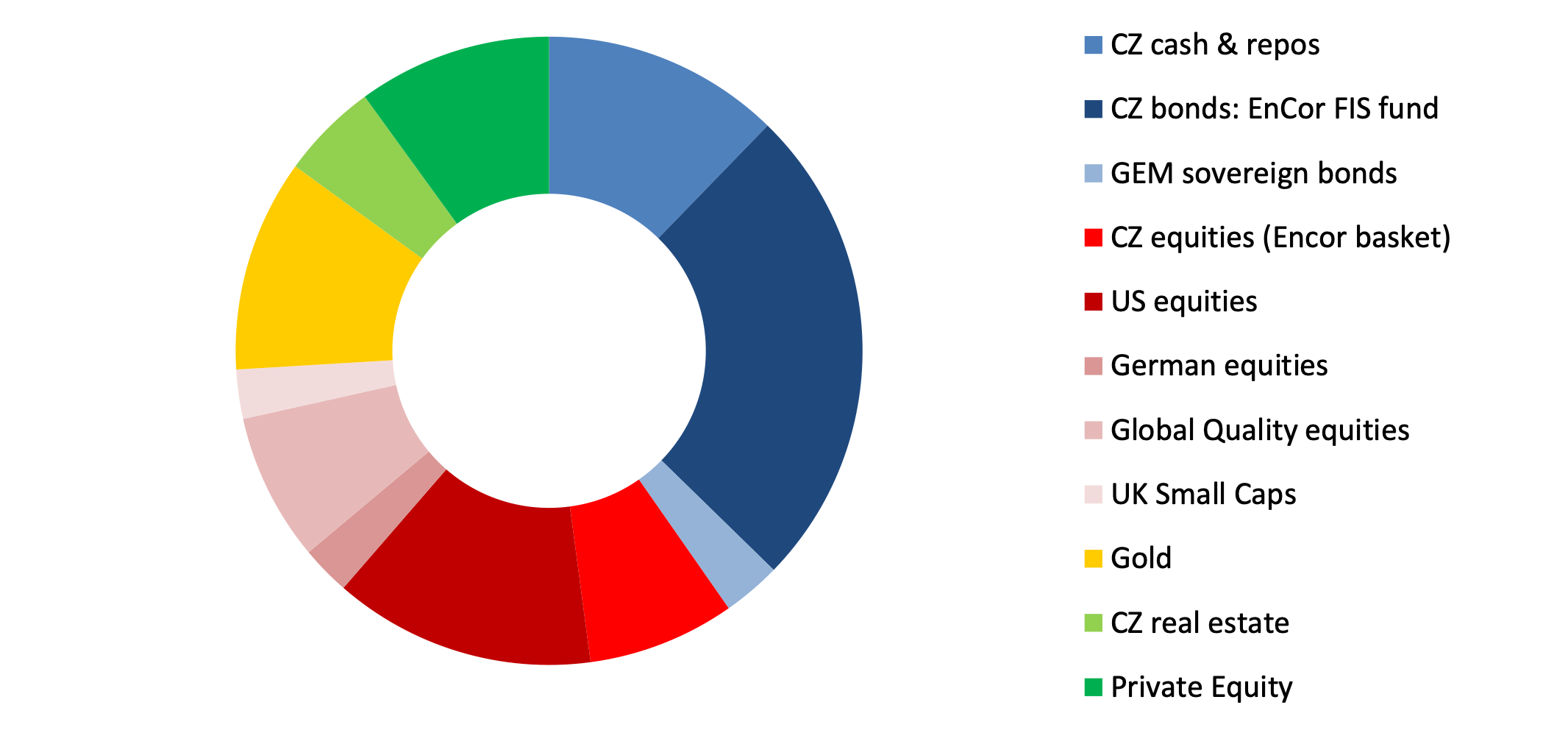

Our asset allocation model shifts this quarter towards assets that reflect the global high-inflation environment but also that GDP growth is surprising on the upside. After recent koruna strength, our model also signals to reduce Czech koruna equity and fixed income positions: the total proportion in koruna has dipped to 49%, down from 63% in Q1, for a typical moderate risk client. Most of that exposure remains in CZK cash (yielding over 6%+ per annum) and safer CZ bonds (yielding 8%-9% per annum) offer high returns with zero or very moderate risk being taken.

Allocation for a typical moderate risk client into Q2 2023*

Source: EnCor Wealth Management proprietary asset allocation model.

See disclosures at the bottom of this text. * Weights as of 30 April.

The most significant upshift in our model weightings is towards international equities, in particular German/European equities, US shares, the shares of global “high-quality” (strong returns on equity, high dividend payout) companies and the UK Small Cap stock arena. Czech equities rallied strongly in Q4 and Q1 but the new model favours selling down our large Q1 weight and rotating into riskier international universe. Summing these shifts leaves our portfolio with the highest weight in equities relative to bonds and cash since the first half of 2021.

What is apparent from the various leading indicators that drive our asset allocation model is the resilience of the world economy in the face of higher inflation and interest rates.

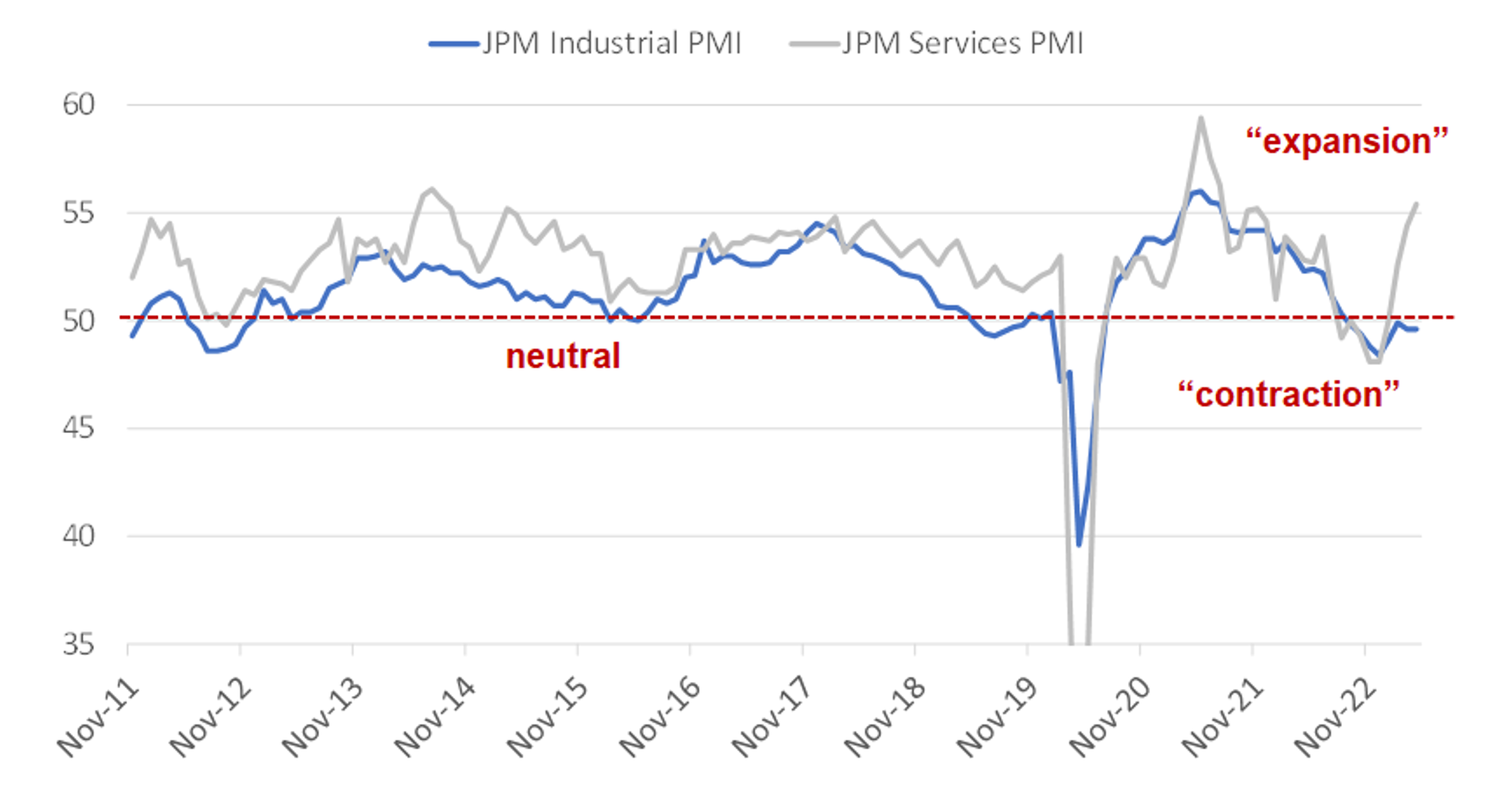

JP Morgan Global Manufacturing and Global Services Purchasing Manager Indices (2011-2023)

Source: investing.com, EnCor Wealth Management. Data as of 3 May 2023

Economic sentiment, especially in the Services arena, is very healthy. The series of composite leading indicators formed by JP Morgan, the monthly Industrial and Services Purchasing Manager Indices, are among the factors we use to determine our weightings each quarter. The global Services component, a combination of indicators from OECD countries and some Emerging Markets, has spiked considerably in the past few months. This indicator is now significantly above the 50 “neutral” level, having dipped into “contractionary” territory in H2 2022 as the food/energy inflation crisis bit. Services are a larger proportion of the larger OECD economies when compared to manufacturing. What we believe is behind this jump in sentiment is spending power still reappearing after the COVID disruptions. And enough financial reserves amongst consumers to absorb higher prices (inflation), for now. And also the falling away of the food and energy price pressures.

This flowering of consumer demand for services is probably “late season”, certainly in the US, where indications are that a recession still lies ahead of us. But that is looking more like an early 2024 story, unless events such as the government debt ceiling or a collapse in the US dollar, importing inflation, bring it forward. Markets are “climbing a wall of fear” with the US debt ceiling negotiations presently. Elsewhere, consumers, especially in Europe and China, are looking to spend on services. This will work beyond our asset allocation horizon of the next 3 months as long as the European and Asian export manufacturing engines do not sputter. Global Manufacturing PMI is hovering around the contractionary level, according to the JP Morgan data series and will need to be watched closely looking into H2 2023.

So, for this quarter, our model is opting for a combination of conservative koruna high-yielding cash and fixed income positions with more risk budget taken on in international equities. Markets have faced rising interest rates from the major Central Banks for a year now but it looks like the period of these intense rises is coming to an end. A “pause” in Central Bank activity while GDP growth is resilient will probably lead to inflation expectations increasing again. Consumers spending will push prices up. If that is the case, then gold and equities are probably better places to be than bonds for now.

Disclaimer: This article does not constitute an investment advice, or a recommendation to buy or sell a specific security. Please contact us at welcome@encorwealth.com if you would like to consult on your individual situation.

Author: Mark Robinson