The second in a series of regular updates of the signals for asset classes from our own EnCor Wealth Management Asset Allocation model, created by Mark Robinson, suggests moderate positioning in equities, both international and Czech and a preference for domestic bonds.

The model favours a diverse distribution of weightings across asset classes through the year end period.

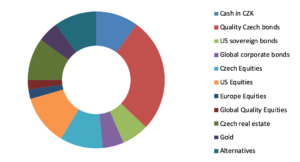

Allocation for a typical moderate-risk client into Q4 2019*

Source: EnCor Wealth Management proprietary asset allocation model. See disclosures at the bottom of this text. * Weights as of 31 October.

The weightings in equities in our model, summing to 27%, are higher than seen in recent quarters. Most of the larger position in fixed income assets is seen in Czech bonds, taking into account also the potential for strength in the Czech koruna. The model utilizes historic and recent leading indicator data to set positions in various assets compared to an initial benchmark split 50%/50% between equities and bonds, for clients with a moderate tolerance of risk and seeing the world in Czech koruna terms. The model reduces its cash position but retains weightings in gold, real estate and Alternatives, such as Private Equity.

Our moderately higher allocation to riskier equities and corporate bonds for this quarter is set in the context of signals of general caution from the model since the first half of 2018. Fears over a global economic slowdown, evident in some of the leading indicators the model tracks, have dominated for much of that period. So why the increase in risk now? Several of the leading indicators relating to monetary conditions globally appear to have stopped deteriorating.

The flow of short term liquidity (support) in the two largest economies in the world, the US and China, has increased in the last two months. This and policy interest rates being cut by the US Federal Reserve and many Central Banks in Emerging Market countries (even in the face of some inflation pressures) are being interpreted as combating the slowdown. All these policy moves appear to be in reaction to marked evidence of weaker global trade flows.

That slippage in trade flows is certainly captured by our model and feeds into why the allocations remain on the cautious side of the benchmarks. Global trade volumes fell in September 2019, by -1.3% month-on-month and -1.1% year-on-year, according to recent data released by the CPB World Trade Monitor. Until the trade picture, centred in Asia, improves, the world economy is likely to stay in the doldrums.

Optimism that a resolution to or at least a climb-down in the intensity of the US-China trade “war” is seen as logical by financial market participants and is helping riskier assets to perform right now. But we note first that trade is only one element of what looks like a wider conflict over technology IP and secondly that bilateral flows between the two countries amounts to only c.5% of global trade. This story does not look finished.

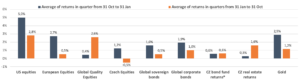

Asset class holdings returns in quarter from 31-Oct-31-Jan vs. quarterly returns in rest of year, 2009-19 (%, CZK terms)

Source: EnCor Wealth Management data, * the historic return of the EnCor FIS Fund

A final observation on the increase in allocation to riskier assets is that classes such as US equities (up 5% on average in the last 10 years) have out-performed typically in the 31 October-31 January period versus their quarterly returns in the rest of the year (2.8% for the US, for example) in the past. Why is this happening? Optimism over the New Year bringing faster economic growth? Companies guiding for higher profits in the next year? Rebalancing between bonds and equities? The “Santa Claus rally?” We don’t exactly know. It happens but with no guarantees! Our model is designed to capture out-performance and thus acknowledges this pattern.

Our Q4 2019 allocation allows clients first to participate in the somewhat likely moderate rally in equities and other riskier assets over these coming months; secondly, by maintaining weightings in cash and gold protect against downside risk and thirdly, avoid much exposure to sharp changes of opinion in international bond markets, which could see capital losses if bond yields suddenly rise, through holding the largest position in Czech bonds.

Disclaimer: This article does not constitute an investment advice, or a recommendation to buy or sell a specific security. Please contact us at welcome@encorwealth.com if you would like to consult on your individual situation.

Autor: Mark Robinson