Spring is the season for dividends in the Czech equity market. The major companies listed on the Prague Stock Exchange (“PSE”) declare and pay dividends between mid-April and around the end of July. All but two of the market’s nine major constituents have finalized and paid out their 2018 dividends to shareholders so far in 2019. Those exceptions are CEZ and O2 Czech Republic.

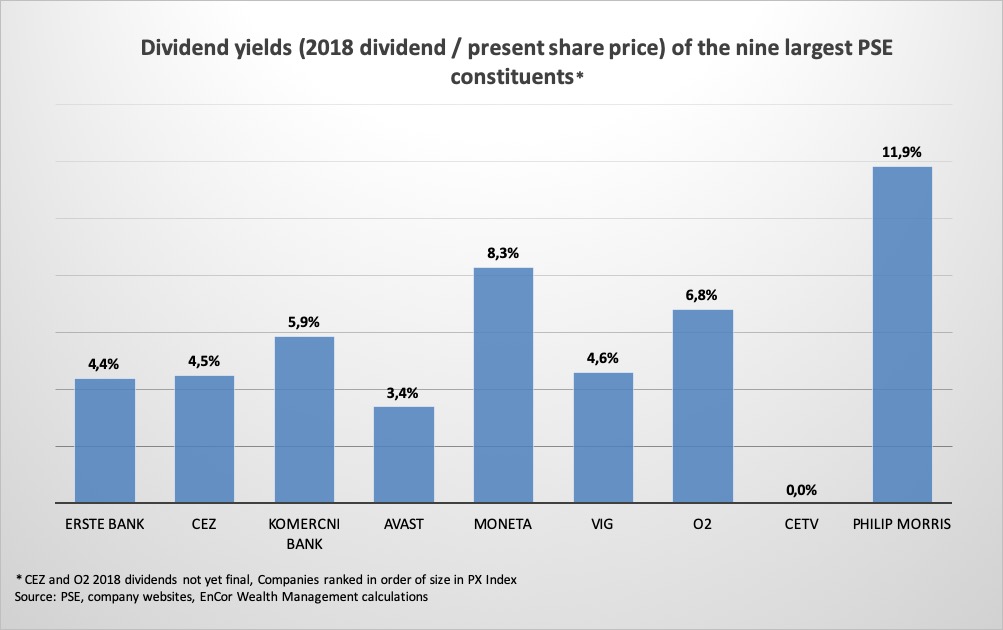

Dividends matter in the Czech equity market, certainly compared to most European bourses and also versus most Emerging Market countries. Czech-listed companies have, by and large, a long track record of electing to pay out decent proportions of their profits to shareholders each year. Taking the top-nine PX Index constituents, representing 96% of the market’s capitalization, the weighted average dividend yield is 5.2%. A dividend yield is the ratio of the dividend per share divided by the share price. This calculation using yesterday’s share price gives an approximation of the annual income return (gross of tax) that an investor is expecting if they had held these shares in recent months.

Only one constituent, CETV, is not presently paying out any of its profits to investors. All of the rest are doing so and the dividend yields, as defined above, range from 3.4% in the case of Avast to 11.5% at Philip Morris. The weighted average of these ratios is, as stated, 5.2%. These returns compare favourably to the Czech National Bank policy interest rate (2.0%), government bond yields (also around 2.0%) and bank savings rates (around 0.5%-1%).

What is the risk? Like any annual harvest, the next year might bring feast or famine. There is no guarantee that these companies will pay out an identical dividend in a year’s time. There is no obligation to do so on the part of the companies. But commentators and investors form opinions, with the help of market participants, on the future size of dividends via assessing the future profitability of a business. The share price, on any given day, is the sum of those opinions.

Not only is there the risk of the companies making less profits and/or paying less dividends but the share prices themselves fluctuate. In order to capture a dividend, one must own a share. And in doing so, the investor takes on the risk of investing in that company and industry. For example, the recent talk from Prime Minister Babis about extra taxation to be potentially applied to the banking sector saw the share prices of Erste Bank, Komerčni Bank and Moneta Money Bank fall. Such “volatility” can take away all of the gains made through being paid dividends as income.

Buy in the summer? In most years, Czech companies have been reliable dividend payers and the mix of businesses on the stock exchange is seen by European and Global Emerging Market investors as relatively safe compared to other places. So, when the companies pay out their dividends and share prices are marked down by the dividend amount, the expectation of similar income in the next springtime can offer an entry opportunity to investors now.

Source: PSE, company websites, EnCor Wealth Management calculations