The first in a series of regular updates of the signals for asset classes from our own EnCor Wealth Management Asset Allocation model, created by Mark Robinson, suggests cautious positioning in equities, both international and Czech and moderate weightings in bonds.

The model favours high weightings in cash and gold, running from the end of July into the autumn months.

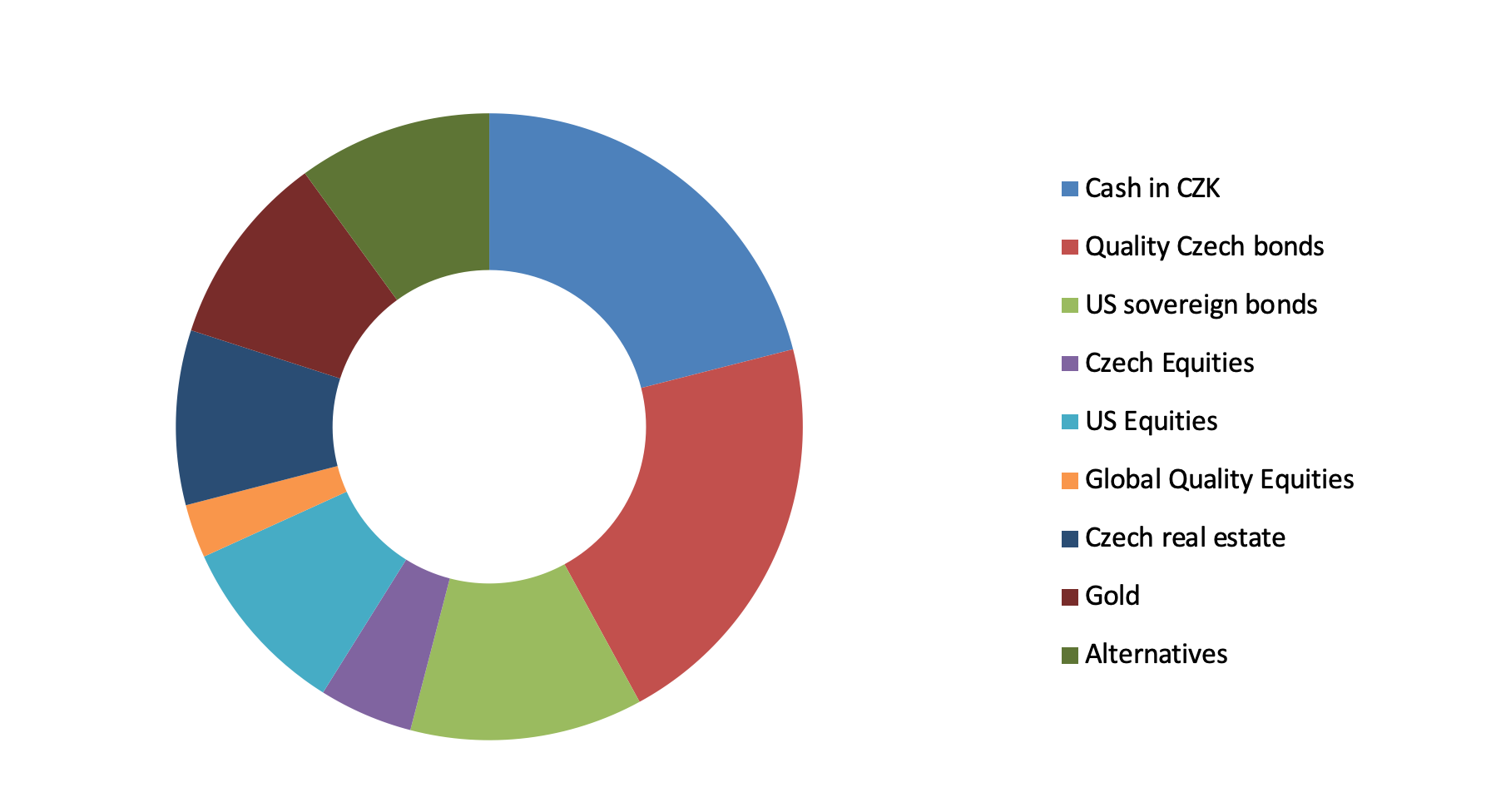

Allocation for a typical moderate-risk client into Q3 2019*

* Weights as of 31 July. Zero allocation to global corporate bonds and to European equities.

Source: EnCor Wealth Management proprietary asset allocation model. See disclosures at the bottom of this text.

The weightings in cash and gold are even higher compared with rising allocations to these asset classes in recent quarters. Our model utilizes historic and recent leading indicator data to set positions in various assets compared to an initial benchmark split 50%/50% between equities and bonds, for clients with a moderate tolerance of risk. The total of the model’s recommended weights in listed Czech and international equities sums to just 17% presently, with the allocation to quality Czech and US sovereign bonds combined sitting at 33%. The model sits with nothing right now in corporate bonds and European equities but retains weightings in real estate and Alternatives, such as Private Equity.

The model has leaned towards being cautious since the first half of 2018, with weightings in cash and gold generally building up. Why the even higher allocations now? Peering into the engine of the model, the signal from several indicators pointing to slower economic growth are combining with those suggesting lower inflation and some uncertainty about the future trajectory of the world economy (perhaps due to geopolitical risks or the level of debt).

These signals are perhaps provoking Central Banks to discuss and/or implement policies of monetary easing, by lowering interest rates. As interest rates are already generally low, financial markets appear to believe that further “Quantitative Easing” or, put most simply, electronic “money creation” by the Central Banks is very likely. Certainly, the latter looks likely in the Eurozone, where the ECB’s policy rate sits at -0.4%. To be clear what this number means: banks pay the ECB an annualized 0.4% to hold their money safe. Not the other way round.

This urge to “keep money safe” has seen bond prices rally and yields tumble. The state of the market is such that the Bloomberg Barclays Global Aggregate Negative-yielding Debt market value sits at over USD 16 trillion presently. An estimated 27% of all higher-quality (“Investment Grade”) listed debt in the global economy has a negative yield. 10% of all global corporate bonds have a negative yield. Via such bonds, investors are paying the Swiss government today 1.06% per year to keep their money for 10 years. They are paying the German government 0.69%, per year.

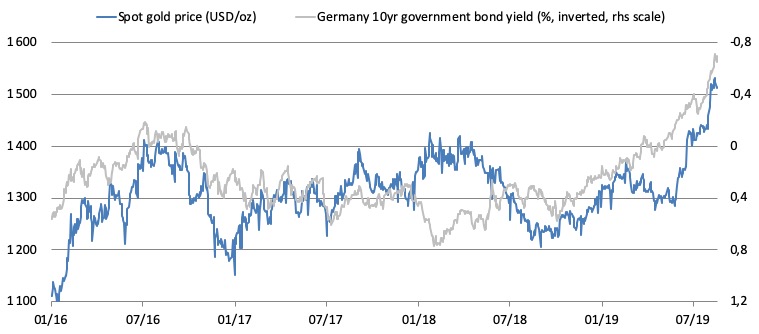

Gold price in US dollars per ounce versus German 10-year government bond yield (%)

Source: investing.com, EnCor Wealth Management

So, for now, investors in bonds are increasingly in the position of paying interest to those who borrow from them, not receiving interest. In this situation, allocations to real estate (yielding nothing if you live in it or rent if you do not), cash (yielding not very much, depending on where it is) and gold (yielding nothing) make a lot of sense. And the gold price has reacted by going up.

Our Q3 2019 allocation is designed to shelter clients first from fears of recession, which would hurt equities, secondly from sharp changes of opinion in bond markets, which could see capital losses if bond yields suddenly rise and thirdly avoiding paying interest to bond issuers, whoever they are.

Disclaimer: This article does not constitute an investment advice, or a recommendation to buy or sell a specific security. Please contact us at welcome@encorwealth.comif you would like to consult your individual situation.