EnCor Navigator: allocation of assets in Q4 2022

Portfolios still wrapped in caution but attempting some bottom-fishing

Since the last update blog of our quarterly asset allocation (Q2 2021) our portfolios have been positioned extremely cautiously: the global inflation storm raging since then has duly taken its toll on most liquid asset classes and markets. Our proprietary EnCor Asset Management Asset Allocation model, created by Mark Robinson, remains very conservative in its outlook but deems now as the time to commit some of our ample cash positions to international equities, US 10Y government bonds and gold.

Our model in Q3 2022 was positioned at its most conservative ever. Cash and Czech bond weightings in our Low Risk mandates exceeded 90%, while also topping 70% and 50% in Mid and High Risk portfolios. With all the volatility in equities and international assets, sheltering in CZK cash (yielding over 6%+) and safer CZ bonds (yielding 7%-8%) made a lot of sense. It still does and those safer returns in CZK terms are still available. But our allocation is looking much more like it did in Q2 2022.

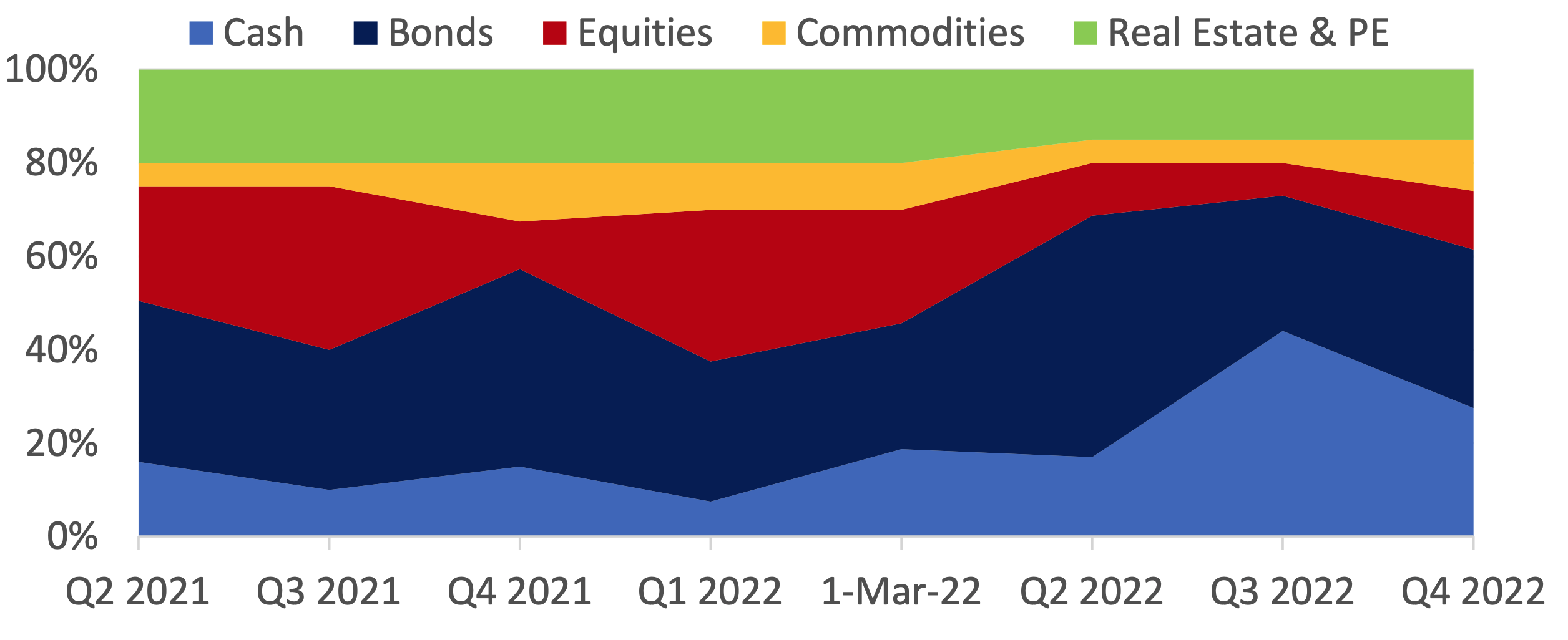

Broad asset class allocation history for our typical moderate risk client, Q2 2021 to Q4 2022

Source: EnCor Wealth Management proprietary asset allocation model.

You can see we adopted our cautious positioning for the first time in recent times in November 2021, which coincided with the topping out of the US NASDAQ and the beginning of the acceleration in the sell-off of US and European government bonds. All of these asset classes and others have suffered consistently since, with short periods of stabilisation in February (before Russia’s Ukraine invasion and our emergency intra-quarter reallocation on 1 March), mid-June to mid-August and in the last few weeks.

The sell-off in international bonds in particular is seen as one of the worst seen on record. This did not occur in tandem with falling equities in the most recent bear markets (2000-03 and 2008-09). In these previous episodes, bonds rallied and protected the balances of diversified multi-asset investors. But hiding places for investors globally in 2022 have been thin on the ground. Oil, gold and some other commodities have provided a hedge during some periods this year but it is plain old cash, especially in CZK that has provided proper shelter from horrible performance from our benchmark components. This has enabled our Low and Moderate Risk clients to make solidly positive year-to-date returns.

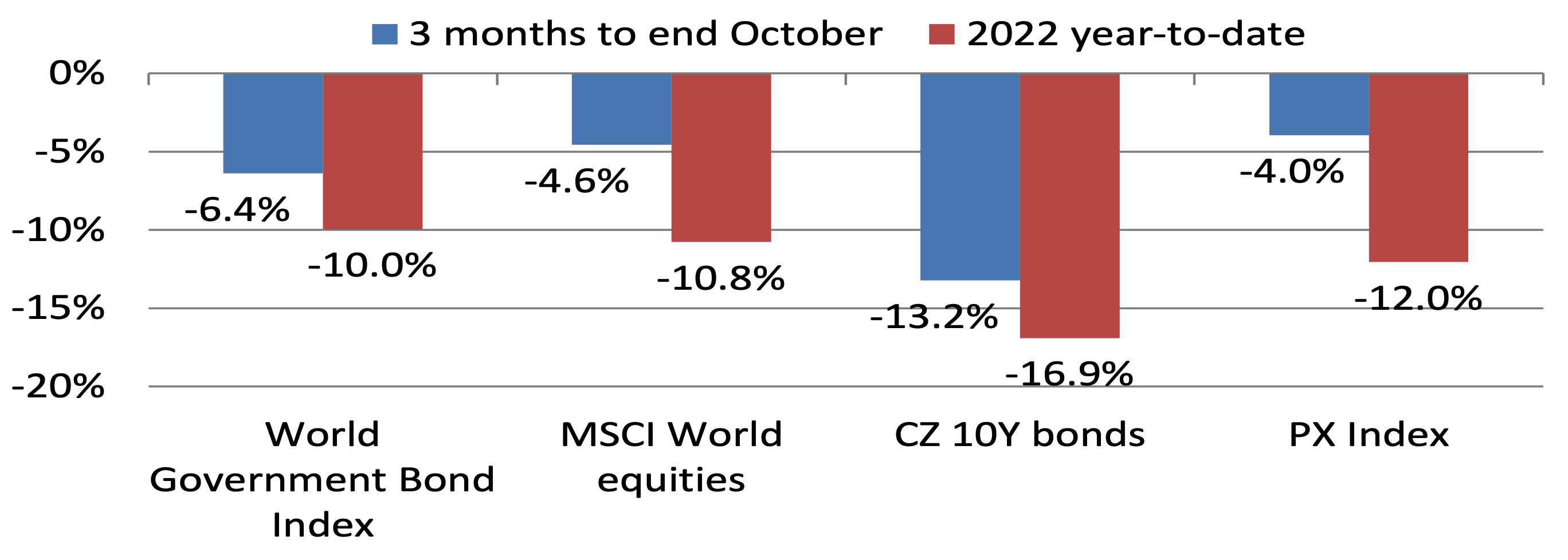

Performance of our benchmark components in CZK terms in 2022

Source: investing.com, Bloomberg, EnCor Wealth Management

The themes that have dominated this bear market in most assets remain in place, namely a reduction and reversal of Central Bank stimulus/money supply growth, rising inflation and interest rates and slowing economic growth. Of these, it is the probability of very slow economic growth or recession in most economies (including the US, Germany and CZ) in 2023 which is likely to be the dominant risk going forward. Many of the 44 leading indicators embedded in our model point to this outcome. Slowing economies implies erosion of earnings in equities and credit and a likely softening of the very high current inflation readings. The “good news” from the latter will probably result in performance from government bonds and gold rather than equities, simply because of the high level of ownership of shares and the aforementioned threat of margin and profit shrinkage.

Proper bear markets require patient investing and thus our allocations for Q4 2022 reflect some desire to “bottom-fish” in equities and government bonds. But by no means are we thinking that this bear market comes to an end soon. It may well be another 6-18 months before the global economic cycle turns upwards again. Thus, riskier assets are likely to struggle for now. And thus we remain committed to careful husbanding of our clients’ assets.

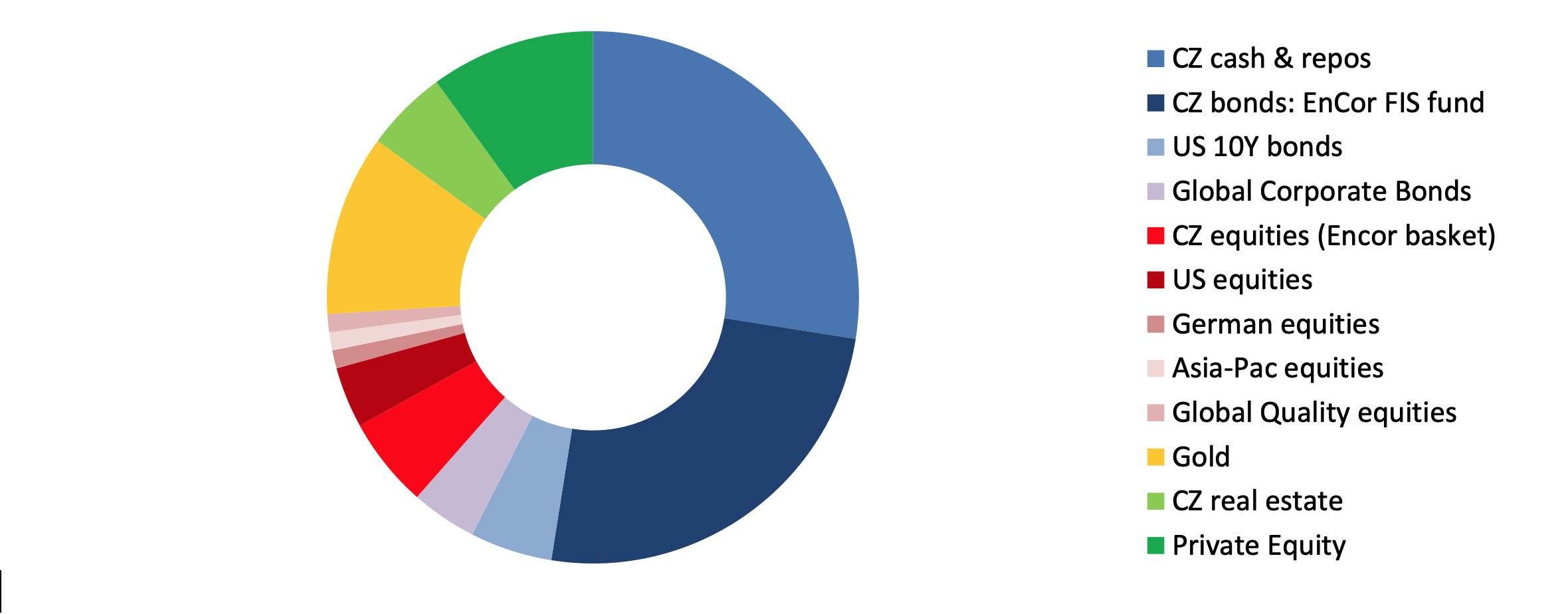

Allocation for a typical moderate risk client into Q4 2022*

Source: EnCor Wealth Management proprietary asset allocation model.

See disclosures at the bottom of this text. * Weights as of 31 October.

Disclaimer: This article does not constitute an investment advice, or a recommendation to buy or sell a specific security. Please contact us at welcome@encorwealth.com if you would like to consult on your individual situation.

Author: Mark Robinson