More than shuffling the deck of cards: asset selection does matter

The second-quarter 2021 update of the signals for asset classes of our proprietary EnCor Wealth Management Asset Allocation model, created by Mark Robinson, maintains below-average allocations to assets perceived as more risky. Equities overall appear to have priced in much of the global economy’s anticipated post COVID-19 recovery phase while investors in all asset classes are presently assessing or reacting to the increase in inflation readings seen around the world.

Our model maintains its overall Q1 tilt away from “riskier” assets, equities and commodities but rotates positions away from Q1’s best performers towards relative laggards. Our proprietary model follows some 44 leading indicators and amongst these, the downshift in both the positive surprises and the levels of growth in activity data in the key G10 countries and also the slowing of money supply and liquidity indicators in these same G10 countries explain the sustaining of our overall caution for the coming quarter.

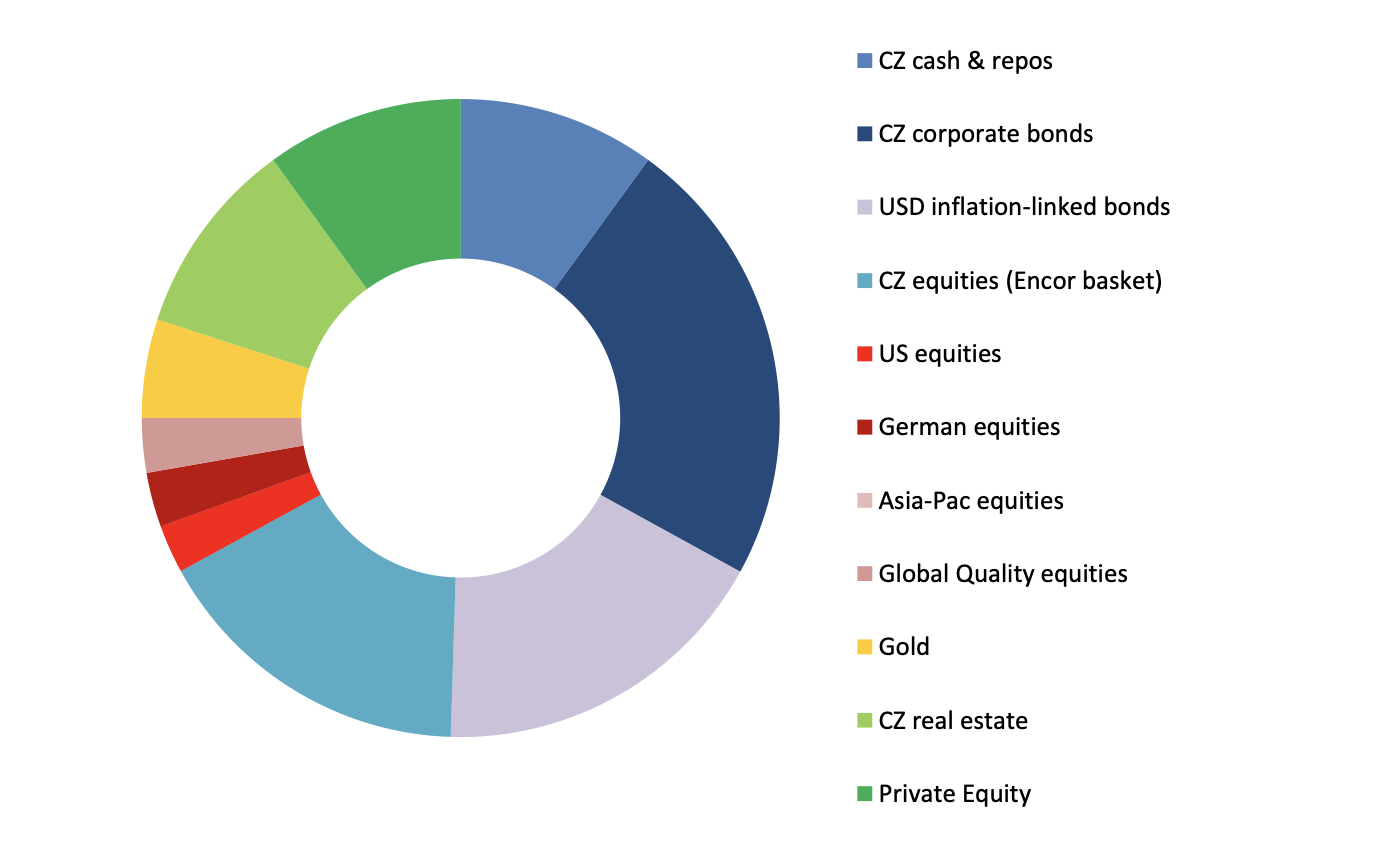

Allocation for a typical moderate risk client into Q2 2021*

Source: EnCor Wealth Management proprietary asset allocation model.

See disclosures at the bottom of this text.* Weights as of 30 April.

This portfolio mix maintains some ability to capture further upside in share prices whilst ensuring that a below-average level of portfolio risk is taken, as some equity and credit markets (particularly in the US) do look vulnerable to a correction in coming months. This risk management stance worked in the February-April period.

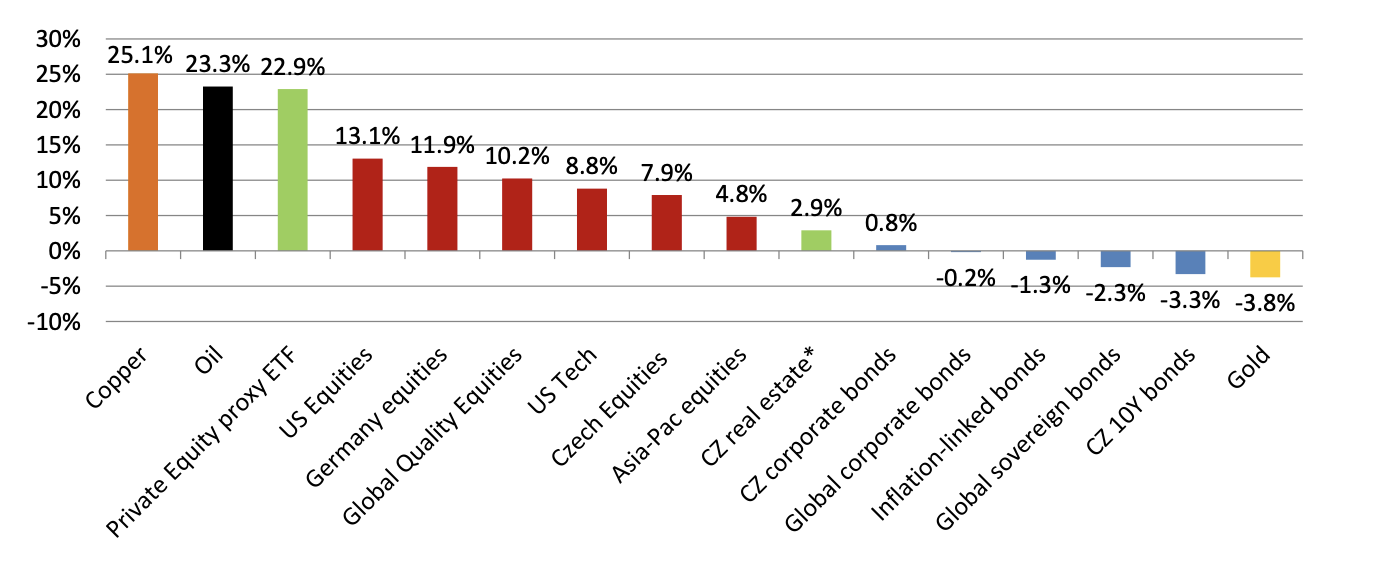

Our above-average allocation in Q1 to cash and bonds (whose returns are shown via the blue bars in the below CZK-terms asset class performance chart) and below average allocation to equities (red bars) does appear incorrect at first glance. Equities did indeed rally throughout Q1. Our allocation model and strategies still managed better-than-benchmark performances, though, through the selection of asset classes within the two groups.

Performance of asset classes, from 31 January to 30 April (in CZK terms)

Source: investing.com, Bloomberg, Hypotecni Banka, EnCor Wealth Management

* Hypotecni Banka Index for apartments/family homes 31 Dec to 31 March

In equities, our positioning was more in the out-performing German, “global quality” and US equities last quarter. US Tech and Czech equities lagged. Similarly in bonds, we concentrated client money in Czech repos, Czech corporate and global inflation-linked bonds (offering some protection against higher CPI readings) rather than classic Czech or global government bonds. These allocations all aided performance. We maintained positions in Private Equity, where our proxy ETF jumped 23% in the quarter. For our higher-risk clients, large positions in copper (25% up) and oil (23% higher) also paid off well.

For this coming quarter, Q2, our equity allocation rotates back towards Czech shares and, marginally, German shares. Momentum in leading indicators such as the German IFO Expectations subcomponent and Czech M1 money supply help to explain this positioning. In addition, a build-up of leading risk indicators in Emerging Markets, linked in part to higher inflation data, also favours (for now) exposure to the home Czech bourse over, for example, the Asia-Pacific region. Czech equities, with high dividend yields and a somewhat predictable outlook, are seen as relatively safe compared to many other Emerging Markets. In the bond space, we maintain our Czech repo and corporate bond allocation preferences and we increase slightly our exposure to the inflation-linked (or “inflation-protected”) international bonds and continue to avoid ordinary, “classical”, government bonds due to inflation fears.

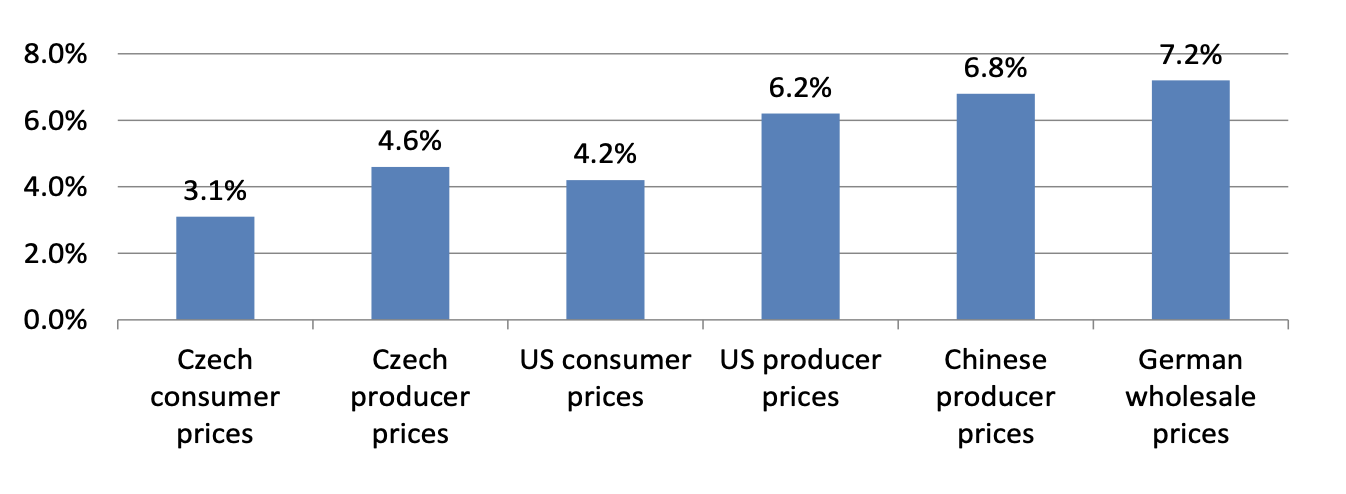

The tension in markets over the coming months will be around the topic of inflation. Almost all commentators do acknowledge the effect of the COVID-19 pandemic shutdown in Spring 2020 on annual inflation figures being printed now. And it is clear that the debate between those who interpret this inflation as “transitory” (or temporary) and those who see the most recent data as the start of a sustained trend is unresolvable until after the summer. We commented on the causes of this inflation in our Q1 Navigator but what is interesting about April’s data displayed below is the jump in Chinese and German producer (or factory gate) prices. These countries are the largest manufacturing exporters in the world economy, so these price hikes are coming down the pipe to consumers in major countries in coming quarters.

Selected year-on-year inflation readings from around the world, April 2021 (%)

Source: investing.com

In addition, what is also apparent is that prices are rising even from a measurement base taken at the end of 2020. The Czech inflation index from December to April moved from 100 to 101.3, equivalent to 3.7% annual inflation. Clearly, these price rises belong to 2021 and are nothing to do with the 2020 shutdown.

We are positioned for markets to further recognise the inflation threat, via our allocations to inflation-linked bonds, our gold weighting and no positions in classic government or international corporate bonds whose prices drop if yields rise in reaction to inflation readings. In addition, the high weighting of banks within Czech equities should be of benefit if commentators and investors predict more than the 2 to 3 interest rate rises now expected from the Czech National Bank in 2021. Banks are perceived to be able to expand their margins if interest rates go up. Those expectations of interest rate hikes point towards further strength in the Czech koruna in the near term. Our zero weighting in US Tech shares also aligns with the inflation threat: the predicted profits of many Tech companies are far into the future and thus have to be “discounted back” to the present using bond yields. If bond yields rise, those future profits are less valuable now.

Our reshuffled Q2 2021 allocation again aims to navigate investors through perhaps rougher market conditions, with low overall portfolio risk taken.

Disclaimer: This article does not constitute an investment advice, or a recommendation to buy or sell a specific security. Please contact us at welcome@encorwealth.com if you would like to consult on your individual situation.

Author: Mark Robinson