Cutting risky assets into stronger markets

US and global equities spent most of 2023 in a rally phase, though performance was extremely concentrated among the “magnificent 7” giant US Tech stocks. This narrowing of the participants in the US’s rally is often a precursor of more difficult times ahead. As we approach the 2023 year end, our proprietary EnCor Asset Management Asset Allocation model, created by Mark Robinson, cuts positions in equities, favouring lower-risk CZK cash and bonds and increased positions in precious metals.

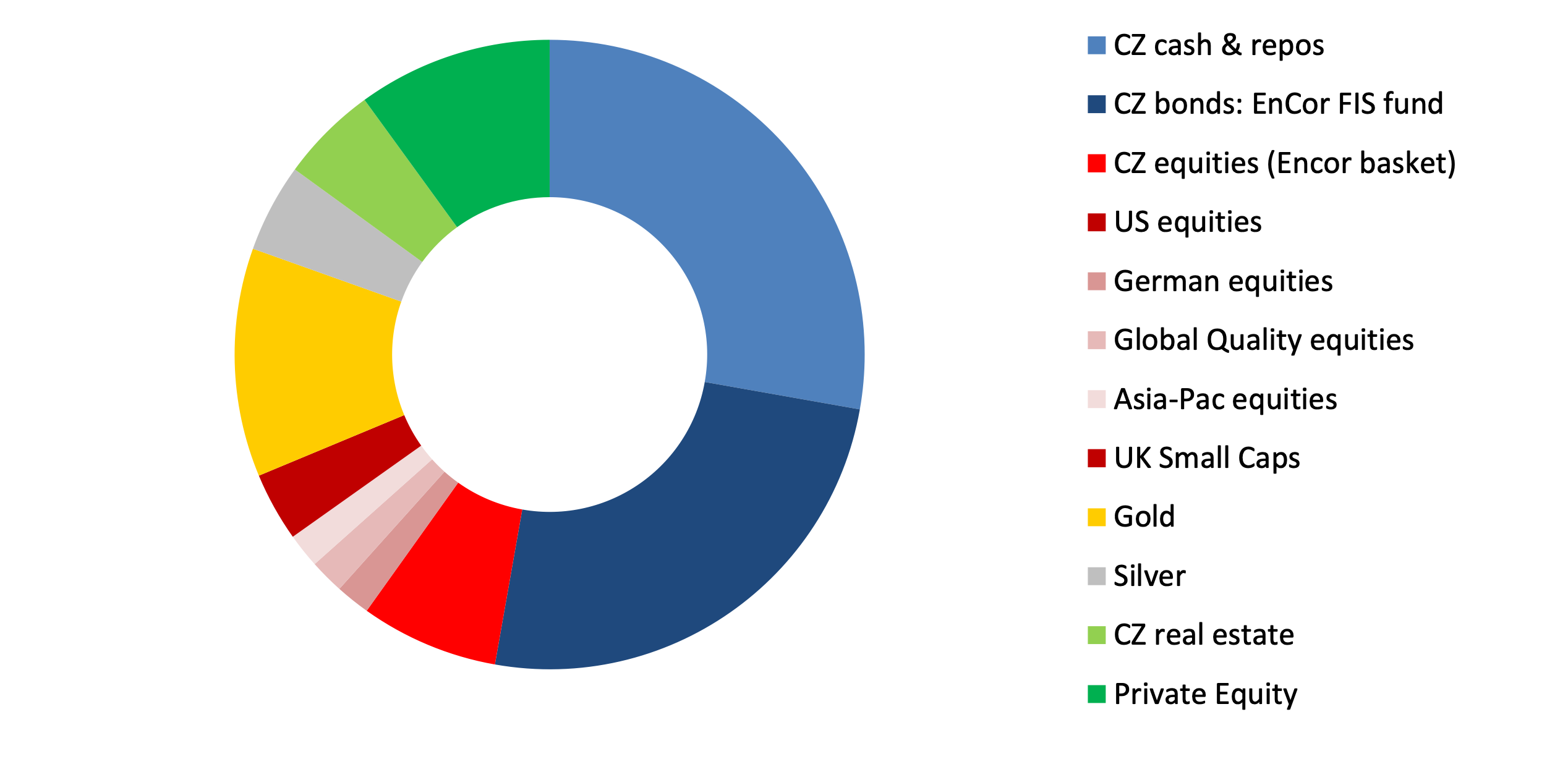

Allocation for a typical moderate risk client into Q4 2023*

Source: EnCor Wealth Management proprietary asset allocation model.

See disclosures at the bottom of this text. * Weights as of 31 October.

For this quarter, our asset allocation model trims the overall position in equities through selling positions in the dominant US market, global “high-quality” companies, (those with high returns on invested capital) and also Czech shares. Weightings in CZK-denominated cash and repos are increased. The latter still yield over 6%+ per annum while safer CZ bonds are still offering 7.5%-9% annual returns. We continue to avoid international bonds, as major economy government budget spending and inflation risks are still very apparent. US dollar weakness is apparent and is likely to continue, reducing koruna-terms returns from these assets. Our model raises overall exposure to CZK-denominated assets again, up to 65% in Q4 from 49% and 59% in Q2 and Q3, for a typical moderate risk client. Our model thus seeks, for the short-term, to reduce price volatility risk by holding assets with certain or near-certain returns in koruna terms.

A major trigger of the downward shift in our weightings in equities is the deterioration in leading indicators of economic growth. While certain economies, such as Germany and the Czech Republic have flirted with recession, with prints of zero or negative real GDP growth during 2023, the resilience of the US economy, with real GDP expanding at close to a 5% annual rate in Q3, surprised many commentators. Our model suggests this is “in the price” of US equities and that forward-looking data is pointing to a much more subdued picture in 2024. A recession is distinctly possible in the world’s largest economy next year.

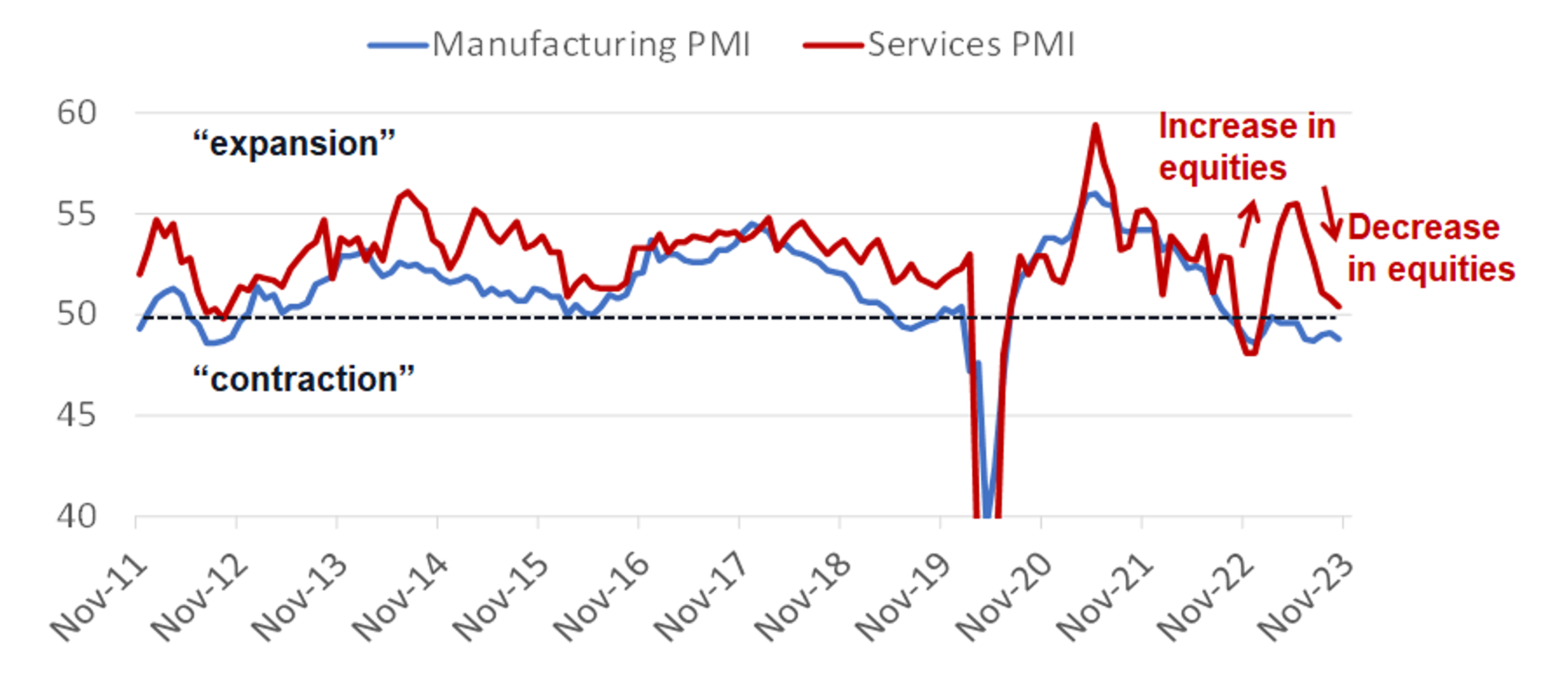

JP Morgan Global Manufacturing and Services PMI indices*

Source: IHS Markit, investing.com, EnCor Wealth Management * monthly data, 50 level = “neutral”

Two of the key leading indicators that our allocation model tracks are among those that are signaling us to reduce equity weightings and pointing towards weak GDP growth in key markets in 2024. Every month in both Developed and Emerging Market economies, information services provider IHS Markit and investment bank JP Morgan collect and collate purchasing manager indices (“PMIs”), asking company managers about prospects for their businesses. These indices are published at the beginning of every month, with 50 as a neutral level. Globally, the Manufacturing PMI Index is consolidating just below 50 but it is the sharp deterioration of the Services PMI that is partly triggering our more cautious positioning in equities. Other leading indicators, such as the US government’s collection of tax receipts are also falling rapidly. If a recession in the US comes in 2024, it is likely to be quite mild.

So, for this quarter, the emphasis is on preservation of returns through larger positions in CZ cash and bonds. The model also chooses to increase the position in precious metals with gold and silver featuring in both our moderate and high-risk strategies. Precious metals tend to be uncorrelated with other assets, provide protection against economic slowdowns, historically were inflation hedges and have always been seen as protection against the “debasement,” or increase in the supply, of paper “fiat” currencies. Gold also appears to be very under-owned by many conventional equity-bond and multi-asset funds despite trading very close to all-time highs presently.

Disclaimer: This article does not constitute an investment advice, or a recommendation to buy or sell a specific security. Please contact us at welcome@encorwealth.com if you would like to consult on your individual situation.

Author: Mark Robinson