“Goldilocks” for now

As in the famous “Goldilocks” fairy tale, investors in recent months have seen inflation tracking down to moderate levels both in G10 countries and in the Czech Republic as perfect for risk-taking. That inflation is “not-too-hot, not-too-cold” has sent equity markets to all-time highs in the US, in Europe and also in Japan. In this environment, our proprietary EnCor Asset Management Asset Allocation model, created by Mark Robinson, adopts a balanced outlook. Returns in safer koruna cash and bonds are still high but falling. Allocations to a spread of USD-denominated bond and equity asset classes are increased this quarter.

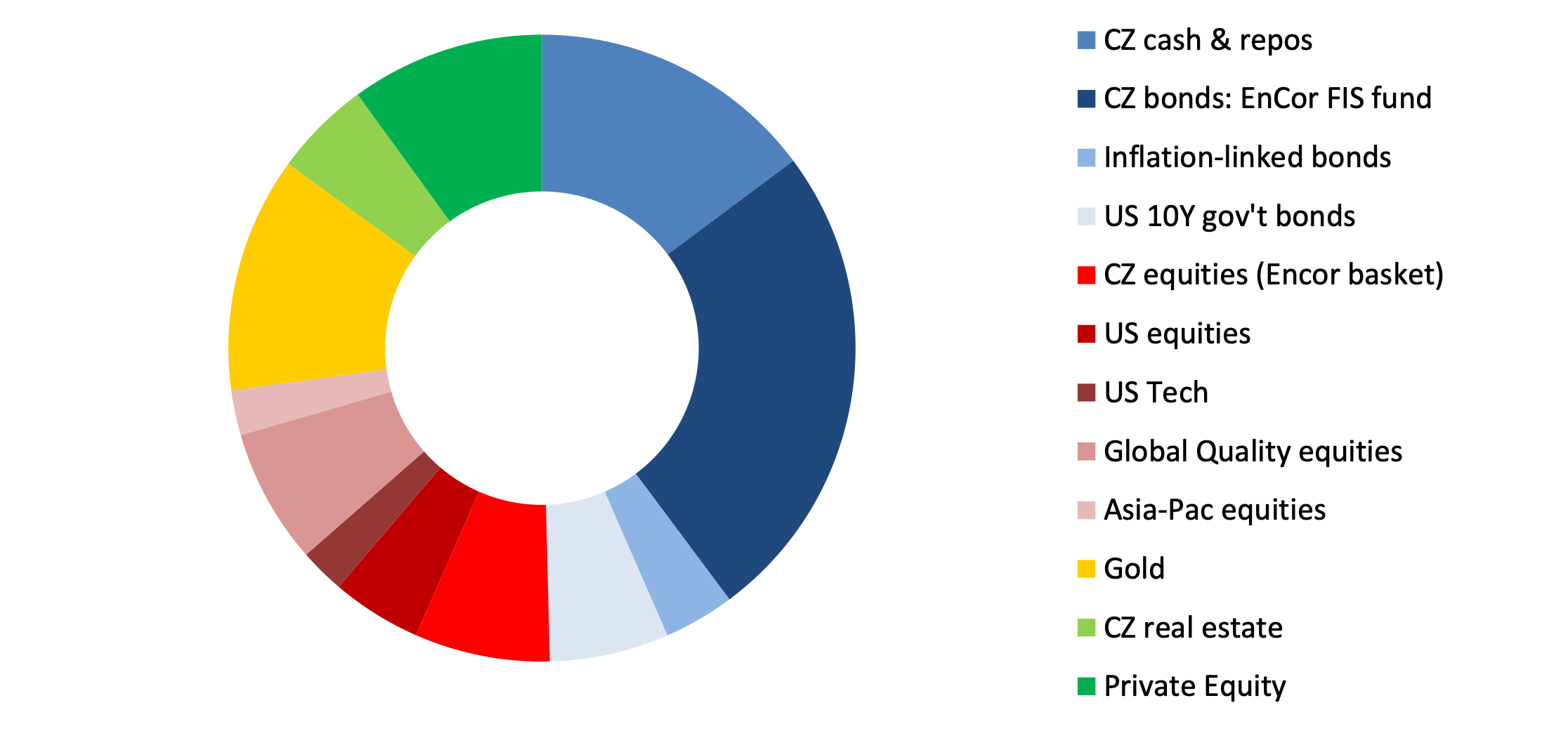

Allocation for a typical moderate risk client into Q1 2024*

Source: EnCor Wealth Management proprietary asset allocation model.

See disclosures at the bottom of this text. * Weights as of end January.

For this quarter, our asset allocation model reduces overall exposure to CZK-denominated assets to 52% in Q1 2024, down from 65% in Q4 for a typical moderate risk client. Cash yields in the Czech Republic are now well below 6%, as the CNB has embarked on its rate-cutting cycle. This reduces the koruna “risk-free rate of investing” or the “cost of capital” in our model, rendering the likely returns from other asset classes more attractive by comparison. Accordingly, our strategy advocates to invest in a blend of USD-denominated equities and bonds this quarter. Thus, we add in our client portfolios to positions in the dominant US market, specifically also to US Tech stocks and to global “high-quality” companies, (those with high returns on invested capital) and also Asia-Pacific shares. Our model sells down positions in strongly-performing German equities and UK Small Cap stocks. Our strategy also re-enters international bonds, with exposure both to benchmark 10-year Treasuries, yielding over 4% in USD presently and a position in inflation-linked bonds, which allows some protection against any revival in inflationary pressures.

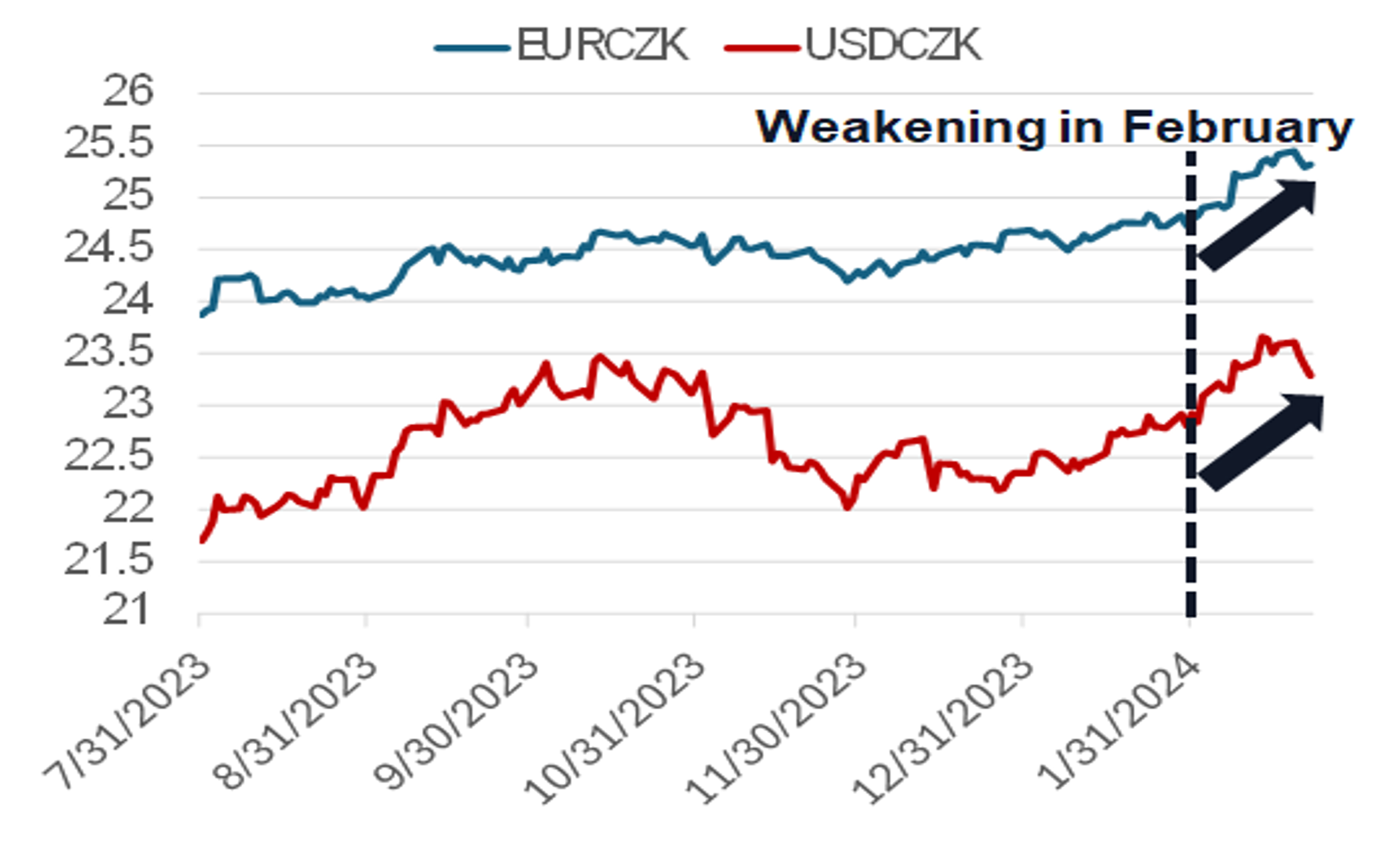

At the time of writing, in late February, the koruna has already weakened some -2% versus the USD and the EUR. Investors are pricing in the reality of lower interest rates and very insipid Czech GDP growth. The currency’s move has delivered positive returns on international assets for koruna-denominated investors.

CZK exchange rate vs. EUR and USD

Source: investing.com, EnCor Wealth Management

How much lower the koruna will go is a question to assess, given the potential for imported inflation that the weaker currency would bring. Members of the CNB’s Monetary Policy Committee are alert to this risk and have sought, after cutting policy rates, to emphasise that future monetary easing might have to be slower than markets expect. This should keep returns from Czech corporate bonds elevated in the 6%-8% range for now. Our model advocates a full weighting there.

Globally, 2023’s resilience of the US economy, with real GDP expanding at a 3.3% annual rate in Q4, surprised many commentators. Adding in inflation of around 3%-4% means nominal growth of around 6%-7%, which is a reasonably solid base, for now, for earnings growth. The US economy is slowing, thus presenting a risk but part of the “Goldilocks” scenario for markets certainly for H1 2024 is that the incumbent Democrats have no interest in seeing recessionary conditions unfold ahead of the Presidential election in November 2024. Thus, the Administration continues to run a huge fiscal deficit (perhaps -5-6% of GDP), priming growth and inflation. Equities are therefore likely to “grind higher” for now and dollar government bond yields will likely sustain over 4%. US investors expecting interest rate cuts may be disappointed in H1 2024. Our model’s allocation to gold will increasingly come into play in coming months as investors start to grapple with the question of US (and other G10 countries’) budget deficits, fiscal stability and inflationary effects. Gold will also act as a hedge in the event that the US economy does falter and/or if the current fragile geo-political situation worsens.

So, for this quarter, our overall “barbell strategy” remains in place. We retain solid CZK cash and bond positions but increase allocations to USD bonds, equities and hold gold. Markets remain in a “Goldilocks” phase and some positive returns are probable in the near term.

Disclaimer: This article does not constitute an investment advice, or a recommendation to buy or sell a specific security. Please contact us at welcome@encorwealth.com if you would like to consult on your individual situation.

Author: Mark Robinson