Trump redux – 9 November 2024

One of the busiest weeks for markets in recent memory has just closed. Interest rate cuts by 3 Central Banks, including the US Fed and the CNB, accompanied Beijing’s announcement of large financial support for China’s regional governments and news of the likely fall of the German government with elections probable within months. But it was the return of Donald Trump to the White House, along with an almost-certain Republican “Red sweep” of both Houses of the US Congress that gripped the imagination of markets. The former President defied conventional polling (again), to easily secure a second term in office. US equity investors cheered, sending the market to another all-time high, commodity markets paused for thought, while US bonds sold off.

Large weightings in Equities and especially precious metals helped our portfolios during calendar Q3’s rising markets and through October. Our moderate-risk mandates rose around 10.6%-12.3% in CZK terms in the first 9 months of 2024, while our new “Rustovy OPF” (“Growth Open-Ended Fund”) which has a “Dynamic” focus, returned B-Class unit-holders 11.9% year-to-date in CZK net-of-fees up to the end of October. The quarterly updating of our proprietary EnCor Asset Management Asset Allocation model, created by Mark Robinson, suggests to increase further the Equities weight in Q4, while trimming commodities and cutting exposure to international bonds.

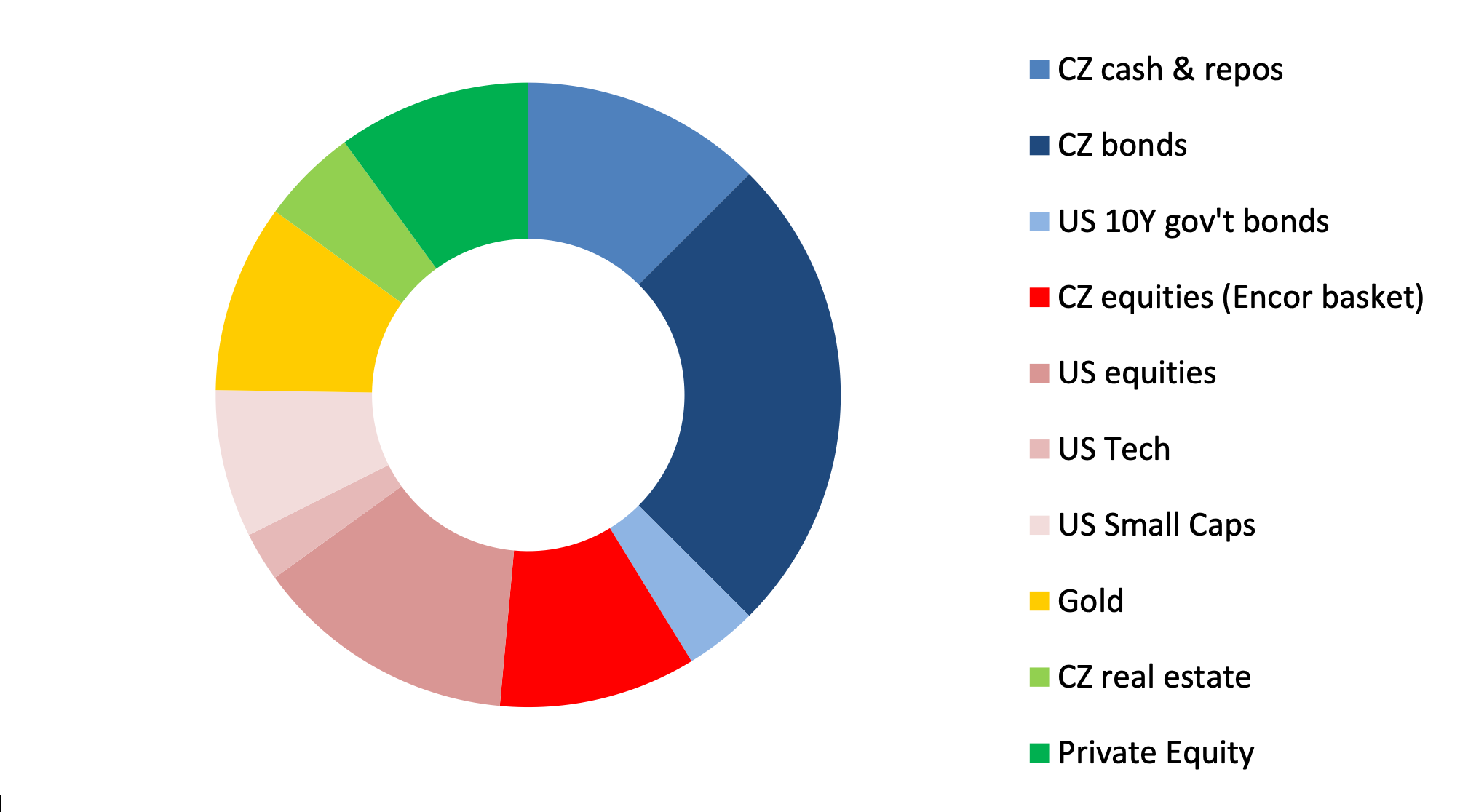

Allocation for a typical moderate risk client into Q4 2024*

Source: EnCor Wealth Management proprietary asset allocation model.

See disclosures at the bottom of this text. * Weights as of beginning of November.

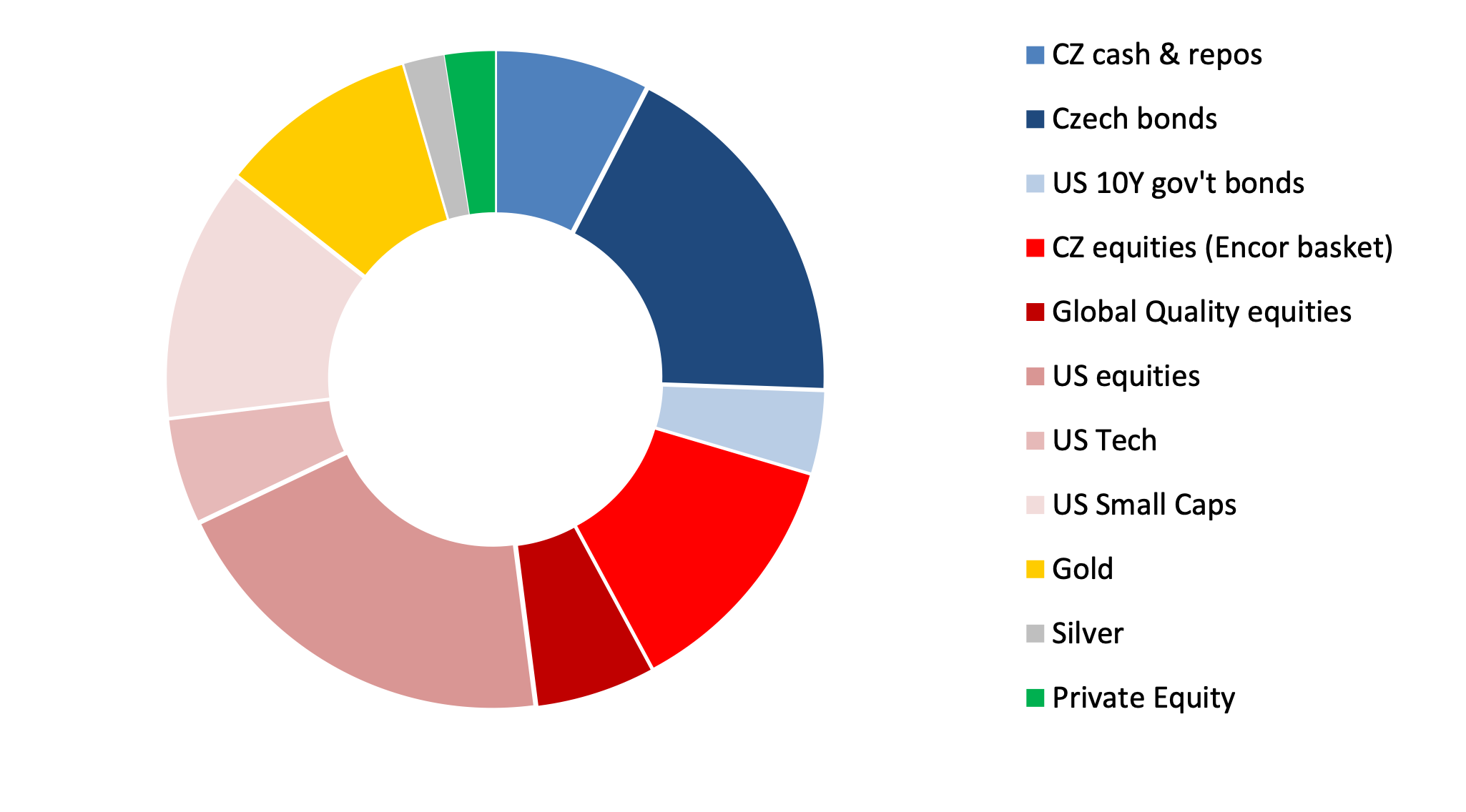

Allocation for Q4 2024 of our “Rustovy” Dynamic OPF*

Source: EnCor Wealth Management proprietary asset allocation model.

See disclosures at the bottom of this text. * Weights as of beginning of November.

Our allocations imply a clear step towards a higher weighting in US markets, assigning around 70% of the total Equities pie to the world’s largest bourse. That proportion matches the current weight of the US in the MSCI World Index, the most widely-followed equity benchmark globally. Our model selects to spread this via investing in US Small Cap stocks, remaining exposed to the US Tech sector, both via very diversified ETFs and by taking a larger position in an ETF tracking the ubiquitous US S&P 500 Index. We retain weightings in Czech equities and in high dividend-paying Global “Quality” stocks in our Dynamic mandates.

Behind this re-weighting towards the US are signals that economic growth and liquidity in the world’s largest economy remain healthy. A “pro-business” Trump Presidency is likely to seek continuation of the US’s very low-tax regime and very high fiscal deficits that have primed economic growth in the last 2 years. The recent rate cuts by the US Federal Reserve (-75 basis points in 2 months) are likely to support economic activity into 2025. While many will worry about the resurgence of inflation due to the possible imposition by the US of tariffs on imports, especially from China, the possible deportation from America of (illegal) workers and that wide fiscal deficit, these concerns are not going to crystallize into reality before the President Trump’s second Inauguration on 20 January 2025.

The natural “hedge” in our portfolios to the above positioning in the US market and its accompanying risks are the remaining weightings in Czech koruna cash, Czech bonds and in precious metals, especially gold. These solid building blocks together make up nearly half of our Balanced (moderate-risk) mandates and close to 40% of our Dynamic portfolios, including the EnCor Rustovy OPF. Large allocations to Czech bonds and cash suppress portfolio currency volatility while gold offers investors a hedge on potential weakness in the US dollar, to policy-making in the BRICS countries, to geopolitical risk, to continued Central Bank-buying of precious metal reserves and to worries over “currency debasement” via inflation.

Our portfolios remain relatively balanced, overall, as a result of these allocations. International bonds, where our exposure is limited, do look somewhat fully-priced in Europe, after a strong rally in 2024 and under pressure in the US, as investors absorb those potential medium-term inflation risks of the Trump Administration’s likely set of policies. Weightings in industrial commodities are now zero, while those in Asian and European equities are also zero or very limited in our Dynamic mandates. This overall balanced approach looks appropriate, especially after such strong returns so far in 2024.

Disclaimer: This article does not constitute an investment advice, or a recommendation to buy or sell a specific security. Please contact us at welcome@encorwealth.com if you would like to consult on your individual situation.

Author: Mark Robinson