Inflation’s slow comeback

Commentators and investors who have “missed out” on gold and Equities in many places rising to all-time highs in recent months have struggled with the idea that the world economy is actually growing (and “inflating”) somewhat faster than many envisaged when 2024 started. Fortunately for us, our proprietary EnCor Asset Management Asset Allocation model, created by Mark Robinson, captured some of this momentum by maintaining full weights in various Equity assets and in precious metals during the first half of 2024. As a result, we delivered a record Q1 for clients and followed it up with continued firm performance in Q2. Our moderate-risk mandates rose around 7.1% in CZK terms in H1 2024, while our new “Rustovy OPF” (“Growth Open-Ended Fund”) which has a “Dynamic” focus returned B-Class unit-holders 8.7% year-to-date in CZK net-of-fees up to the end of July.

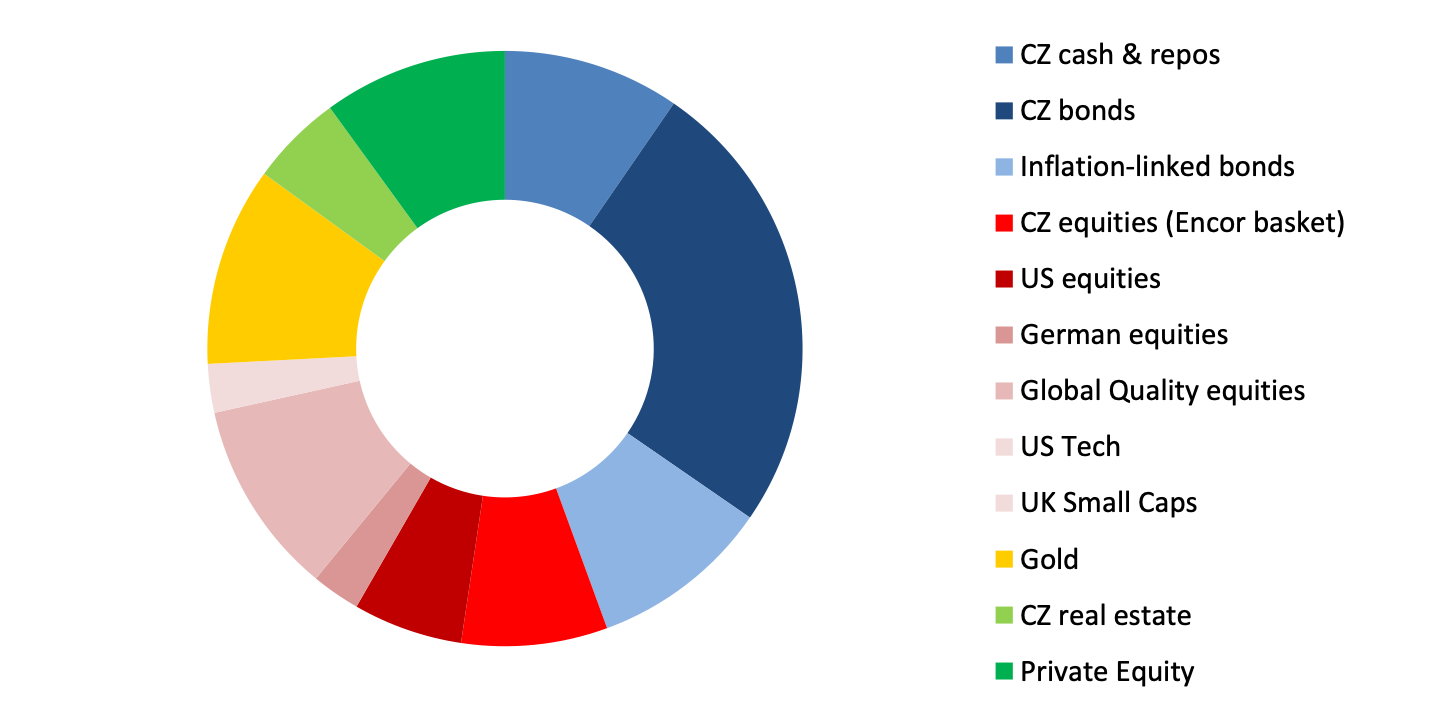

Allocation for a typical moderate risk client into Q3 2024*

Source: EnCor Wealth Management proprietary asset allocation model.

See disclosures at the bottom of this text. * Weights as of end July.

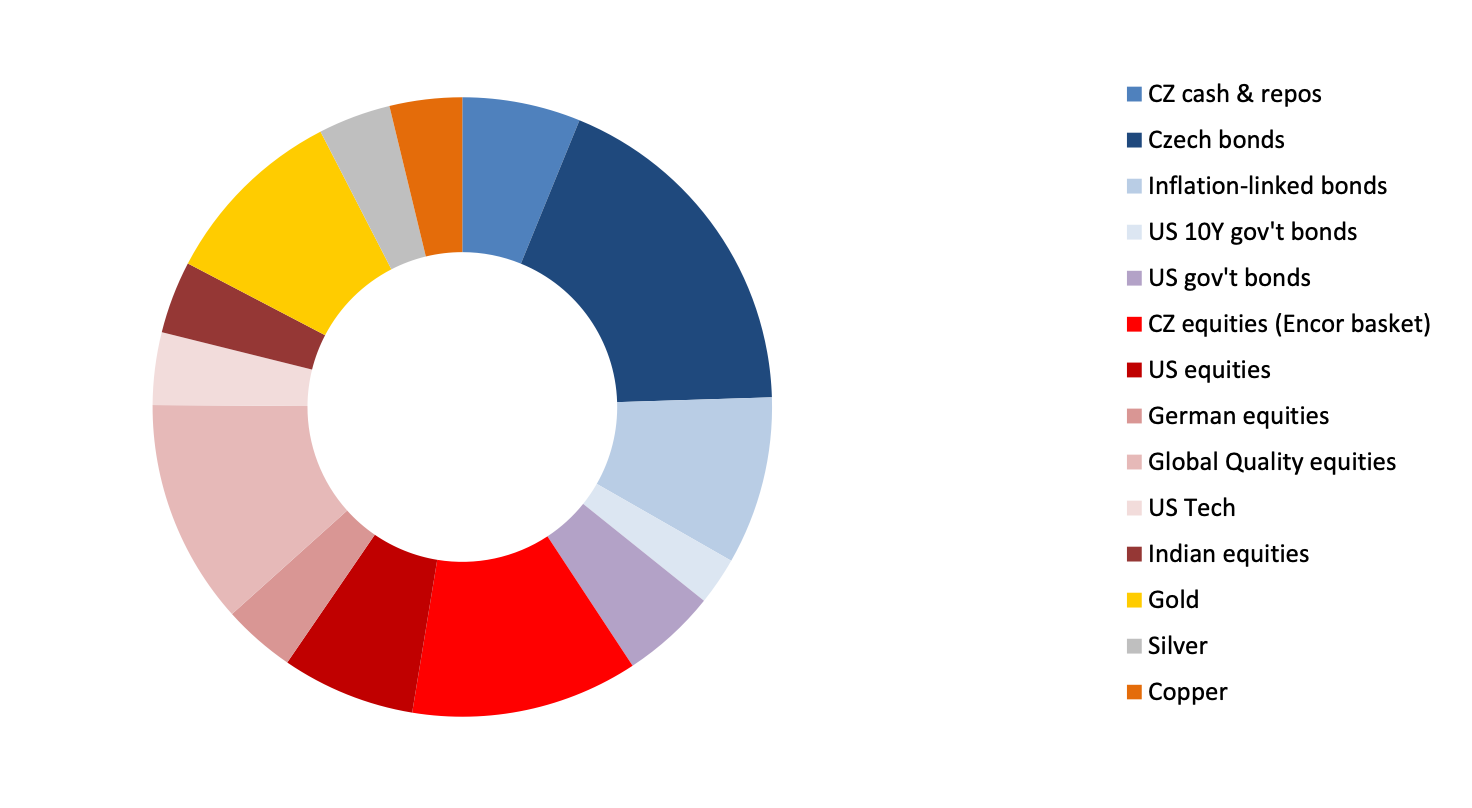

Allocation for Q3 of our “Rustovy” Dynamic OPF – Q3 2024*

Source: EnCor Wealth Management proprietary asset allocation model.

See disclosures at the bottom of this text. * Weights as of end July.

So what’s next? For this third quarter, our asset allocation model reduces overall exposure to Equities marginally, thus booking some profits. The money goes back into precious metals (more gold and silver) and rotating into inflation-linked bonds within Fixed Income. These moves and the retention of weightings in “Global Quality”, German Equities and in India and copper for our “Rustovy” unit-holders are market “hedges” on higher inflation readings coming out in H2 2024.

Inflation rates have fallen significantly since the large spike in general consumer prices globally in 2022. Food and energy prices in particular have helped bring headline consumer price inflation (“CPI”) levels back, in many cases around the world to the 2%-3.5% range, just above Central Bank targets (generally set at 2%). But a mixture of factors, including moderately more expensive energy, economies with low unemployment rates and some governments, especially the GDP-heavyweight US Biden-Harris Administration, are still spending much more than they gather in taxes. This is inflationary. And if the make-up of the US Congress after November is so inclined, this process may continue.

Part of the symptom of a higher trend inflation rate is strong GDP growth. And this links into our model’s almost full positioning in Equities. But at the same time we are not “overweight” in shares. Our positions in Bonds overall and Gold are also full. And after all, cash returns in koruna still amount to around 4% annualised.

As we have seen in August and now into September, markets are going through some choppy weeks. A broader correction in “risky assets” might or might not develop. US election uncertainty, war & geopolitics and some tension in markets over the likely speed of US Federal Reserve interest rate cuts plus the added factor of the Bank of Japan embarking on interest rate rises after decades at zero-bound rates can all affect market sentiment. A more balanced approach looks appropriate, especially after such strong returns so far in 2024.

Disclaimer: This article does not constitute an investment advice, or a recommendation to buy or sell a specific security. Please contact us at welcome@encorwealth.com if you would like to consult on your individual situation.

Author: Mark Robinson