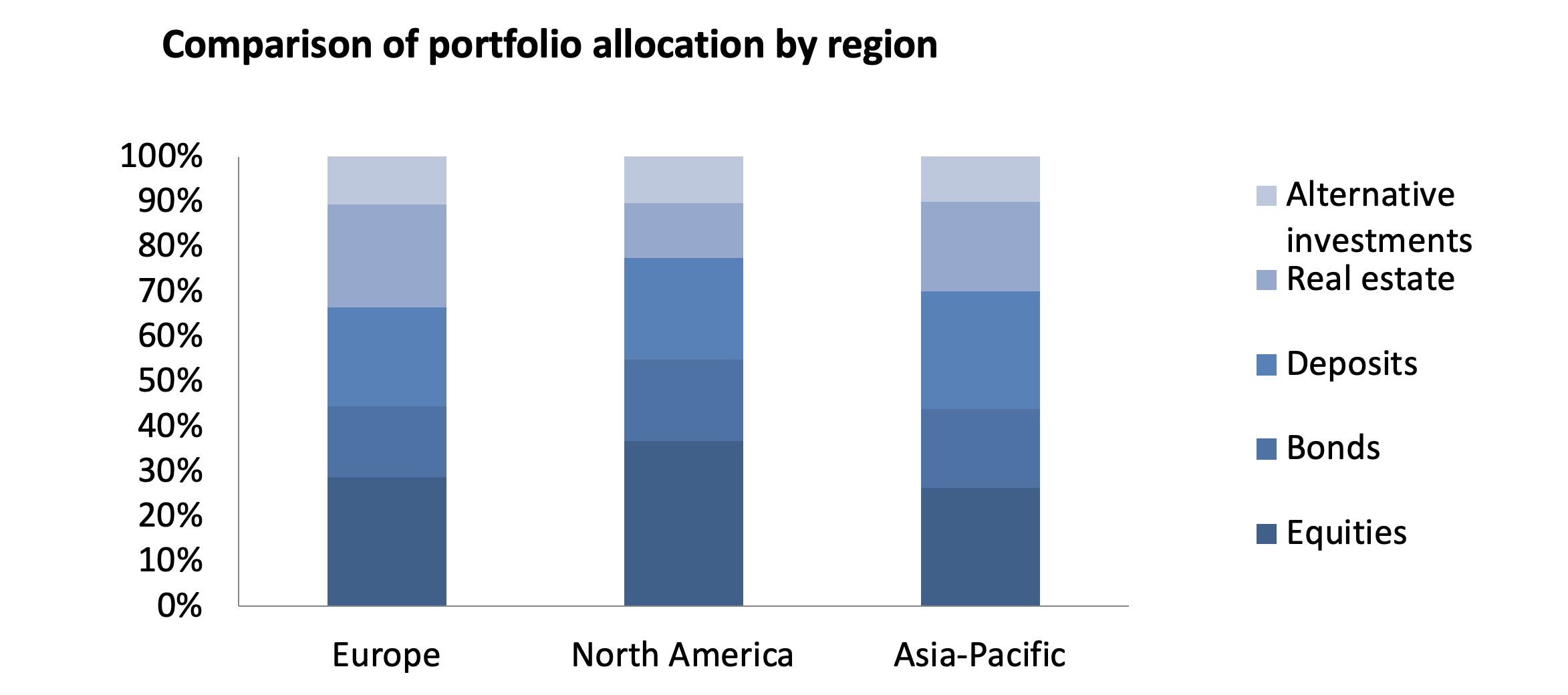

A recent study, www.worldwealthreport.com, compares the average portfolio allocation by asset class of high net-worth individuals in Europe, North America and the Asia-Pacific region.

The largest allocation across all regions, according to the study, is in equities, especially in North America, with 36.8%. In Europe, real estate ranks second with 22.9%, while this sector in the North American region is rather a minor component at around 12%, almost the level of alternative investments. A relatively large exposure, in all regions above 20%, is in cash and deposits. Cash is even the second-largest component of the average portfolio In Asia, the 26.2% allocation is at the level of the 26.4% investment in shares.

At EnCor, we use our own prediction model for asset allocation, which we update on a quarterly basis. From a long-term perspective, our model portfolios, probably not surprisingly, are most similar to the European model. The current allocation, though, is changing dynamically and, for example, we earmarked a significantly smaller exposure to equities in the past quarter and a higher exposure to deposits and bonds. What would a comparison with your portfolio look like?