Rougher inflation conditions as the valuation anchor slips?

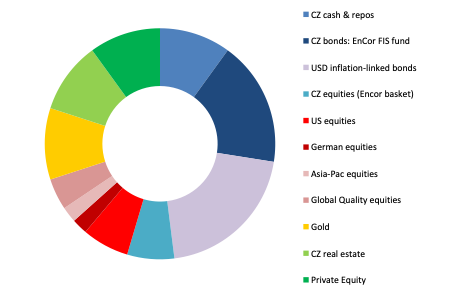

The first-quarter 2021 update of the signals for asset classes of our proprietary EnCor Wealth Management Asset Allocation model, created by Mark Robinson, reverts to below-average allocations to assets perceived as more risky. A slowing of the economic recovery momentum in consumption and the services sectors in the G10 countries is likely to signal a topping of the performance of expensive equity and credit markets for now.

Our model tilts away from “riskier” assets, equities and commodities, reversing the signal from last quarter. Allocations to bonds and, particularly, cash are increased. Factors behind this shift include the following indicators from our proprietary model:

• A deterioration in global services purchasing manager sentiment, US retail sales and a fall in the G10 economies’ economic surprise indices. Commentators in general did not foresee the latest COVID-19-driven restrictions on activity, especially in high-contact services. Services make up the majority of activity and employment in economies such as the US and the UK

• For Czech and German equities especially, a stalling of upward momentum of the German IFO Expectations sub-component and Czech M1 money supply growth. Temporary VAT cuts boosted the German economy in Q4 2020 and this advantage is now in the past

• Emerging Markets risk indicators are rising and the US dollar appears to have stopped depreciating versus its currency peers for now. This suggests currency markets may see a more “risk-off” phase in coming weeks and into the early Spring months

Allocation for a typical moderate risk client into Q1 2021*

Source: EnCor Wealth Management proprietary asset allocation model.

See disclosures at the bottom of this text.* Weights as of 31 January.

The tilting of our asset allocation towards selling down positions in equities coincides well with both the strong performance of shares and industrial commodities in the past quarter and the present expensive valuation of some equity markets. Czech equities performed very well in the 31 October-31 January quarter, rising 19%. This was well ahead of the US and German stock markets, both up 4% in CZK terms. Asia-Pacific equities registered a strong CZK-terms gain of 11%, reflecting the relative absence of COVID-19, the status of the region as the world’s manufacturing hub and, as we discussed last quarter, good evidence that the region is witnessing the birth of a new global economic cycle. Our Private Equity-proxy ETF also gained 11%. The poor performers in the quarter were those asset classes that had done well previously in 2020: US Tech stocks (-9% in CZK terms), gold (-6%), global corporate bonds (-7%) and global USD-denominated government bonds (also -7%).

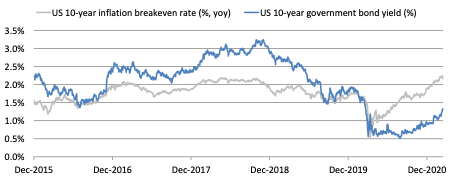

That poor performance of international (and Czech) government bonds looks set to continue in the short run and is indeed another reason why riskier assets might struggle to perform in the near term. These bond markets are selling off and long-run bond yields (such as the US 10-year yield in blue on the chart) are rising because investors foresee inflation in 2021. Supply chain shortages, food price rises, approaching year-on-year comparison effects, de-globalisation and especially commodity price rises are all contributing factors. But it is the huge fiscal stimulus (government spending) and associated very strong money supply growth in the G10 countries that are the predominant cause of inflation expectations and there is little sign of these forces abating, with unemployment high and COVID-19 disruptions still present.

US 10-year bond yields and rate of annual inflation expected by the bond market

Source: EnCor Wealth Management

If long-run bond yields rise, then the “valuation anchor” for very expensive equities and credit markets starts to loosen. If credit yields sit still when government bond yields rise, then the “spread” between the two arenas shrinks. Is that sustainable when those credit yields are amongst the lowest on record? Similarly for equities, long-term bond yields are a “risk-free rate” of investing, used to discount future cash or dividend flows back to the present time. If that “risk-free rate” is rising, then it automatically reduces the present value of cash flows that are far into the future. And that includes the cash flows of much of the Tech sector and all companies not presently making a profit. Anyone who has been following the equity markets in 2021 knows that rampant speculation has occurred in many companies not making a profit. And they know that measures of “volatility”, or the expected future likely violence of movement of equity markets, are still elevated versus history.

We do not expect all stock markets to suffer from the effects of inflation and our model allocations reflect this, raising Asia-Pacific equities in particular, maintaining some exposures elsewhere and keeping weights in industrial commodities for our high risk clients. We thus believe that, via these holdings, our portfolios are hedged against “missing out” on further performance by equities in the near run. In addition, our US dollar government bond exposure recommendation remains 100% into inflation-linked bonds, offering protection against rising consumer price inflation (“CPI”) readings.

Our Q1 2021 allocation aims to navigate investors through perhaps rougher market conditions, with inflation fears rising and high valuations meaning riskier assets are vulnerable to a correction.

Disclaimer: This article does not constitute an investment advice, or a recommendation to buy or sell a specific security. Please contact us at welcome@encorwealth.com if you would like to consult on your individual situation.

Author: Mark Robinson