The COVID-19 storm begins to dissipate

The fourth-quarter update of the signals for asset classes of our proprietary EnCor Wealth Management Asset Allocation model, created by Mark Robinson, suggests above-average allocations to assets perceived as more risky, even in the face of the latest flare-ups in COVID-19 in Europe and the US. A new global economic cycle appears to be in the process of being established and ample supply of money should see major economies through the latest COVID-19 storm.

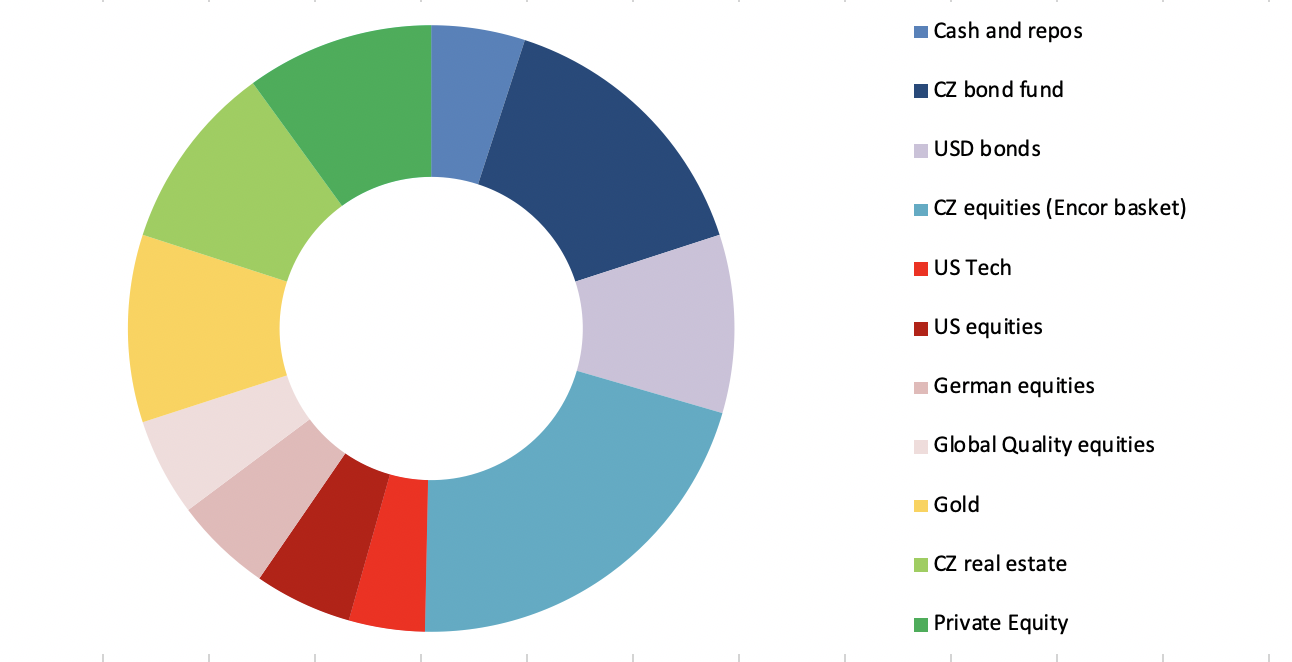

Our model tilts towards “riskier” assets, equities and commodities, to the greatest extent observed in the last 4 years. Allocations to bonds and, particularly, cash are lowered.

• A wide range of leading indicators, including credit market, currency risk, global output sentiment and equity market sentiment have all flipped positive in the last few months

• Several specific leading indicators tracking the key Asia-Pacific region also have positive momentum. This region tends to lead the world economy into and, importantly, out of conventional recession phases

• The supply of money in financial systems is very high, presently, aiding stability and reduction of risk in credit markets. COVID-19 disruptions over the winter would most likely lead to further money supply growth and/or government fiscal interventions

• A combination of tight supply chains, currency depreciations, the money supply growth and promising COVID-19 vaccine news boosting consumption spending appear to suggest that higher inflation, or a “reflation phase”, will occur

Allocation for a typical moderate risk client into Q4 2020*

Source: EnCor Wealth Management proprietary asset allocation model.

See disclosures at the bottom of this text.* Weights as of 31 October.

Asset classes saw a mixed performance in the end-July to end-October 2020 period. “Mega-tech” stocks again led the way, again taking US stock market indices’ valuations to levels unseen since the “dot.com” bubble years of 1999-2001. The US S&P 500 Index rose 5% in CZK terms. Credit markets also performed solidly, backed by the weight of money globally seeking any yield available. Most other assets fell in value in USD (and also CZK) terms, including gold, European equities and Czech equities.

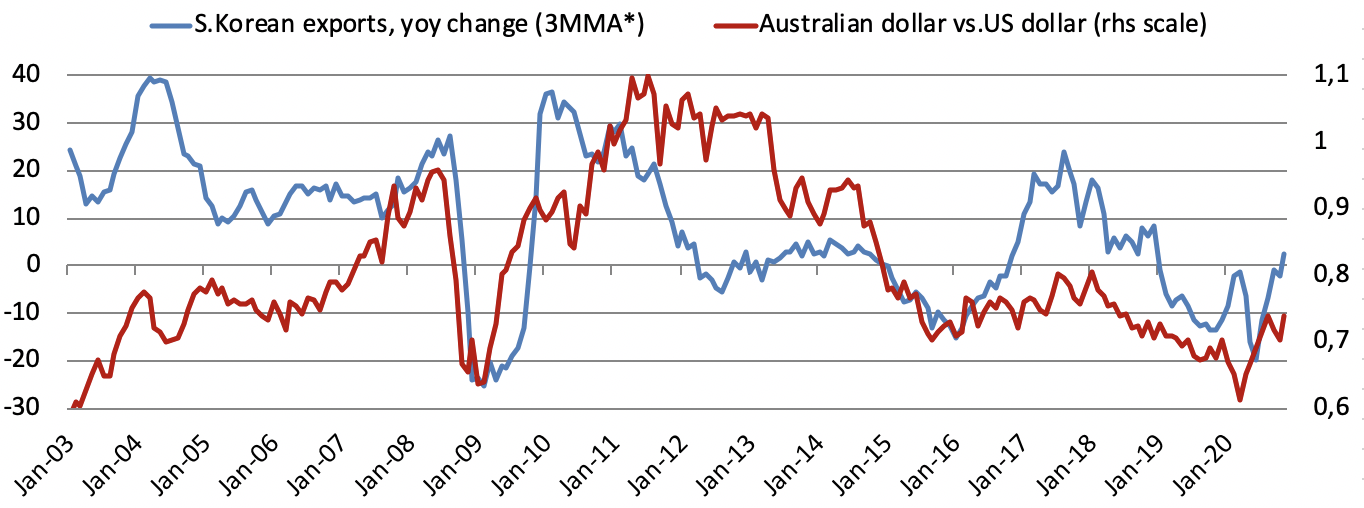

The solidity of key Asian economies through the COVID-19 pandemic (including China) is the key to understanding why a new economic cycle is now being shaped. Asia’s populations mean that the region contains more consumers than G10 countries and, additionally, intra-regional trade is an insulating factor, as COVID-19 rages elsewhere around the world. Signals of this new cycle (used in our model) include export growth from South Korea and the rise in the value of the Australian dollar vs. the US dollar, both recovering rapidly from 2019-20 lows.

South Korean export growth (3-month moving average year-on-year change) and the Australian dollar/US dollar cross rate (rhs scale)

Source: Bloomberg

* three-month moving average of annual change recorded monthly

Interest rates in the key Asian economies were cut in the spring of 2020 and the potential spending power of consumers is thus high. Investment into “riskier assets” (equities and residential real estate) by local investors in East Asia as the interest rate cuts flood money into the financial systems is a typically related occurrence. This phenomenon appears to be present also in the Czech Republic, with very high levels of money supply meaning both a continued rise in house prices in 2020 and the very recent initial public offering activity and generally better sentiment on the Prague Stock Exchange. Our largest allocation to any asset class this quarter is to Czech equities.

Aside from a complete (as in March-April 2020) COVID-19-triggered lockdown of economies around the world, the key risk to our allocation strategy for this quarter is that valuations of some equity asset classes are too stretched. This applies certainly to US equities and thus our model recommends to spread out the investments into equities and commodities into different categories. Our portfolios retain smaller weighting in Czech bonds and cash, to protect against equity markets falling. The weighting in gold protects against both inflation and instability in currency markets.

Our Q4 2020 allocation prepares for a world beyond COVID-19 and the birth of a new global economic cycle.

Disclaimer: This article does not constitute an investment advice, or a recommendation to buy or sell a specific security. Please contact us at welcome@encorwealth.com if you would like to consult on your individual situation.

Author: Mark Robinson