Tilting towards safer havens in the COVID-19 tempest

The second-quarter update of the signals for asset classes of our proprietary EnCor Wealth Management Asset Allocation model, created by Mark Robinson, suggests dominance of less risky assets in navigating the current economic crisis.

The model tilts towards high quality bonds, cash and gold, with only domestic CZ equities taking a larger share of riskier assets.

- Developed market equities are substantially expensive in relation to their expected earnings and may correct their prices again going forward

- Leading central banks resort to printing money and buying corporate bonds in order to kickstart the economy that has been troubled with the coronavirus pandemic

- Sovereign fixed income yields of G10 countries were driven nearer to zero, making them rather unappealing class for investors

- Global tensions may play vital role especially in the second half of the 2020

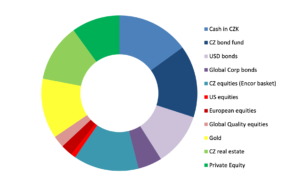

Allocation for a typical moderate-risk client into Q2 2020

Source: EnCor Wealth Management proprietary asset allocation model. See disclosures at the bottom of this text. * Weights as of 30 April.

The COVID-19 crisis struck markets and economies, causing a tempest in asset prices and leading indicators: the model responded with an allocation of 46% to money market and fixed income instruments, while retaining a favourable tilt into alternative asset classes. Allocations in the model to equities decreased from Q1 in the light of record market valuations that open up space for a potential additional market correction in the near term.

While developed countries’ equity markets continue to rally after reaching their bottom (so far) in the second half of March, the overall economic picture has deteriorated for quite some time now. As corporate earnings track economic conditions, this effectively translates into developed market equities trading at record-high valuations in relation to their expected future corporate earnings. This earnings drag is especially likely if we assume that the recovery in activity from the COVID-19 tempest will be slow in many consumer sectors. The model therefore favours local Czech equities for their blue-chip nature combined with a historically-stable dividend pay-out. Czech shares have fallen notably already.

Developed country government bond markets have rallied significantly through the COVID-19 storm: the leading Central Banks, with the objective of allowing huge fiscal spending to aid economies, carried out substantial monetary policy rate cuts, “quantitative easing” (the printing of electronic money) and further liquidity injections, effectively increasing the prices of government bonds of stable countries through direct purchases. This rally on bond markets has driven yields to very low levels, meaning that the U.S. government bonds yield much less than they used to in the pre-COVID-19 world. We see it as likely that the COVID-19 crisis has marked an end of seeing G10 government bonds in portfolios of investors seeking any decent return potential.

In corporate credit markets, the US Federal Reserve and other Central Banks have recently (re)commenced purchasing various types of both higher-quality “investment grade” and lower-quality “high yield” bond issues in order to prevent a series of likely bankruptcies. This action supports the companies that would not typically survive such a crisis but, of course, has led to these bond prices rising. The real level of defaults is, given the current developments, at abnormally low levels as such capital injections help companies with unhealthy balance sheets to survive. This can be termed “zombie capitalism” and we have seen such developments over the last 30 years in the Japanese economy. Slower long-term economic growth is a likely consequence.

The US Federal Reserve also managed to (thus far) halt a strengthening of the US dollar that would hurt mainly Emerging Market countries that would otherwise be falling short of funding: global debt has increased. Global debt looms as a huge new storm cloud: how will levels be maintained? We may face either a period of lower growth, as debt levels are reset lower, or higher inflation, as higher prices eat away at the debt value over time (“reflation”).

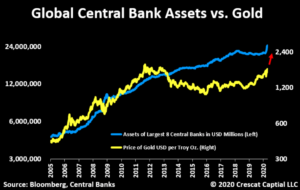

In either scenario, the recent monetary actions of Central Banks, as well as the global economic tempest, have both paved the way for favourable returns on precious metals holdings. Gold, fundamentally undervalued in relation to the global money printing of the last decade or so, has rallied substantially year-to-date, while our model still sees a rather sizeable upside potential. Either in the “reflation” scenario or in a global economy with low inflation (or deflation) caused by weak demand and too much supply from “zombie companies”, gold may prove to be a valuable hedge in investors` portfolios.

The coming U.S. elections may provoke more storm clouds: we may face yet another round of a trade war setting, with COVID-19 as a likely lightning rod of blame. China currently has a diplomatic dispute with Australia, the latter pushing for an investigation of the origin of the virus. Tensions between China and Taiwan and more recently again with Hong Kong are simmering. Regional tensions and de-globalisation look likely to play a role in the changing post-COVID world.

Attractive Gold price in Relation to Money Supply Provides Potential Price Upside

Source: Crescat Capital, Central Banks, Bloomberg

Our Q2 2020 allocation first and foremost protects clients from possible large drawdowns, should markets correct from historically high valuations, while the cash on hand may be later invested in a much more favourable market climate. The speed of any economic recovery and whether an environment of higher inflation (“reflation”) or low or negative inflation (“deflation”) dominates is, as yet, unknown. The weighting in gold in particular provides, for now, a hedge on both these outcomes.

Disclaimer: This article does not constitute an investment advice, or a recommendation to buy or sell a specific security. Please contact us at welcome@encorwealth.com if you would like to consult on your individual situation.

Author: Michael Holec and Mark Robinson