In the eye of the COVID-19 storm?

The third-quarter update of the signals for asset classes of our proprietary EnCor Wealth Management Asset Allocation model, created by Mark Robinson, suggests allocations to less risky assets, even in the face of record highs for US equity indices. The dislocation between the record highs in riskier assets and the depth of the current recession, suggests we are in “the eye of the storm”.

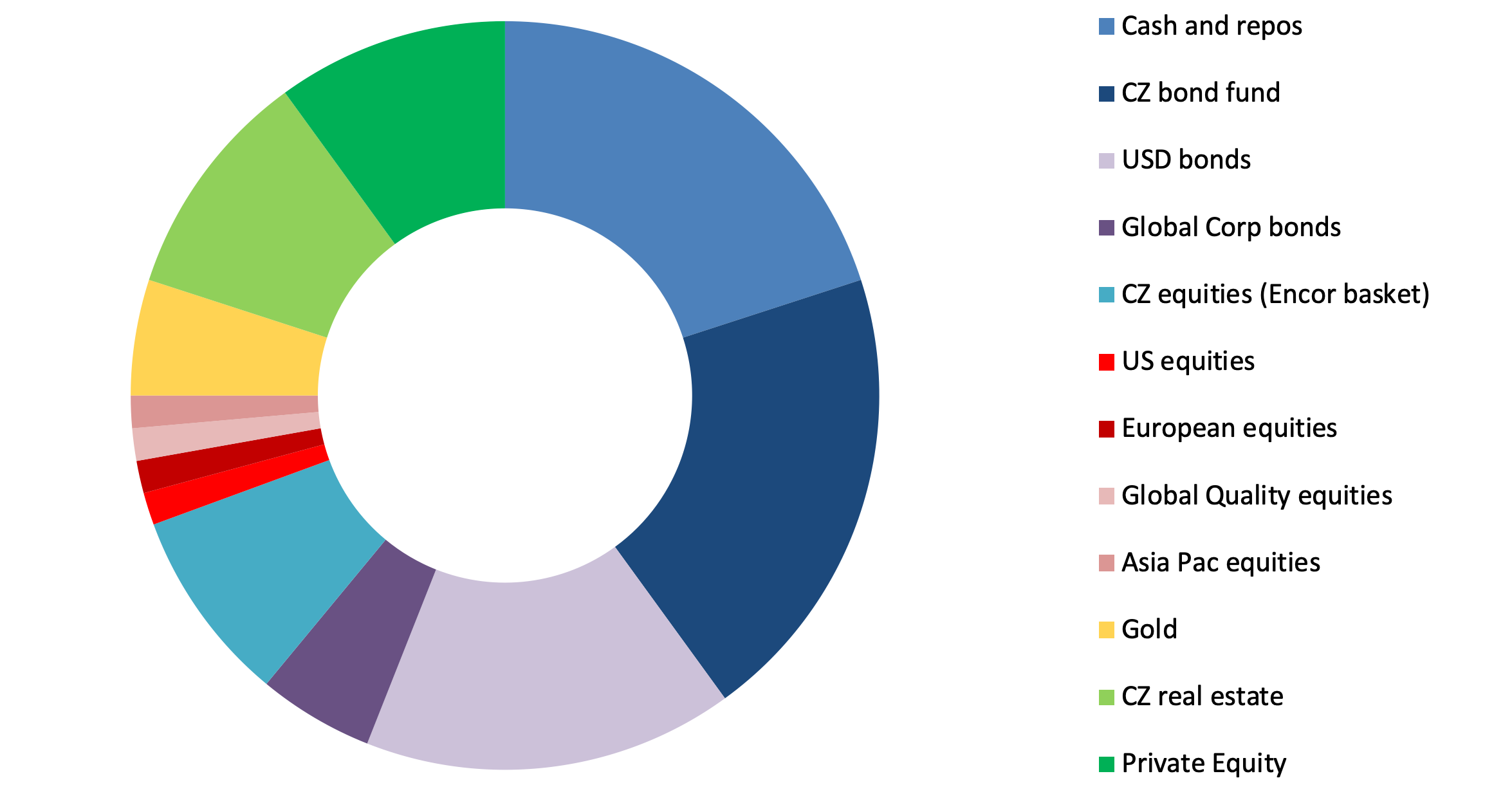

Our model tilts towards high quality bonds and cash, with small allocations to riskier assets.

· Real-time activity indicators in economies across the world appear to have plateaued in July and August, at levels well below those seen before the onset of COVID-19

· Key trade momentum indicators suggest the likelihood of negative returns for equities in coming months

· Central Bank support for credit and government bond markets remains in place, meaning likely small positive returns for these assets in the coming quarter

· Allocation to gold is reduced, booking substantial profits but a position is retained and counteracts inflation risk

Allocation for a typical moderate risk client into Q3 2020*

Source: EnCor Wealth Management proprietary asset allocation model.

See disclosures at the bottom of this text.* Weights as of 31 July.

All riskier asset prices rallied in Q2 2020, led by the “mega-tech” stocks, which took the US stock market indices valuation levels not seen since the “dot.com” bubble years of 1999-2001. Credit markets, backed by G10 Central Banks, followed in the wake of equities. Commodities even outshone equities, with oil and copper prices reflating considerably from the end of April. Confidence in a faster “V-shaped” recovery from the COVID-19 economic shock and the unprecedented levels of liquidity in the global financial system drove all these asset classes higher.

With US and global stock indices at or very close to record highs, further ascent now looks difficult. From these levels, a negative return from equities looks very likely, especially when assessing real economy data, such as the trade flow into the world’s largest economies. The year-on-year change of the sum of Chinese and US imports on a 3-month moving average basis (yellow line in the below chart) is not likely to turn around or bottom until well into 2021, even assuming no further disruptions. History suggests that the white line, the year-on-year return on global equities will dip into negative territory as well. Fresh COVID-19 waves will make the coming dips worse.

Performance of global stocks (year-on-year change) and US & China imports (3-month moving average year-on-year change, rhs scale)

Source: Bloomberg

The same liquidity appears to be eroding confidence in bond investments and driving the gold price up. Gold has outpaced the tech-heavy US equity NASDAQ Index in 2020, making this very long-run store of real value the best-performing asset year to date. The government bonds of G10 countries barely returned anything to investors in Q2 2020. Over USD 15trn of government debt globally is negative-yielding and much of the rest (in the USA) yields between 0%-1.2% per annum with maturities of up to 30 years.

The creation of money (chiefly dollars, yen, Euros and British pounds) by the Central Banks in Q2 financed the unprecedented G10 government spending programmes to support furloughed and unemployed citizens through COVID-19. Consumers were thus handed money, adding to global debt, without many of them producing output (goods & services). This huge injection of spending power has increased money supply markedly and with the supply of goods held back by COVID-19 effects, inflation readings have begun to come in higher than commentator forecasts. If this trend persists and economic growth does not continue to rebound, we may have “stagnation” with “inflation” present, a condition known as “stagflation”.

Stagflation is not a healthy state for the global economy but it might well be a harbinger of the next phase of the COVID-19 storm. Expectations of inflation are continuing to increase. In a normal situation when inflation is rising, bond yields would rise as well, losing clients’ money. We thus in our client portfolios hold dollar bond exposure in inflation-linked bonds to protect our clients’ money. In the Czech bond universe, our EnCor Fixed Income Strategy Fund seeks to beat inflation. Small holdings of gold and equities hedge against this “stagflation” too.

Our Q3 2020 allocation first and foremost protects clients from possible large drawdowns, should markets correct from historically high valuations, while the cash on hand may be later invested in a much more favourable market climate. Allocations to gold and inflation-linked government bonds and our EnCor Fixed Income Strategy aim to protect against a “stagflation” scenario.

Disclaimer: This article does not constitute an investment advice, or a recommendation to buy or sell a specific security. Please contact us at welcome@encorwealth.com if you would like to consult on your individual situation.

Author: Mark Robinson